Pound to Dollar Recovery to Clear FOMC Hurdle

- Written by: Gary Howes

Image © Adobe Stock

Pound Sterling can extend its rally against the U.S. Dollar if the Federal Reserve signals there is still scope to cut interest rates this year.

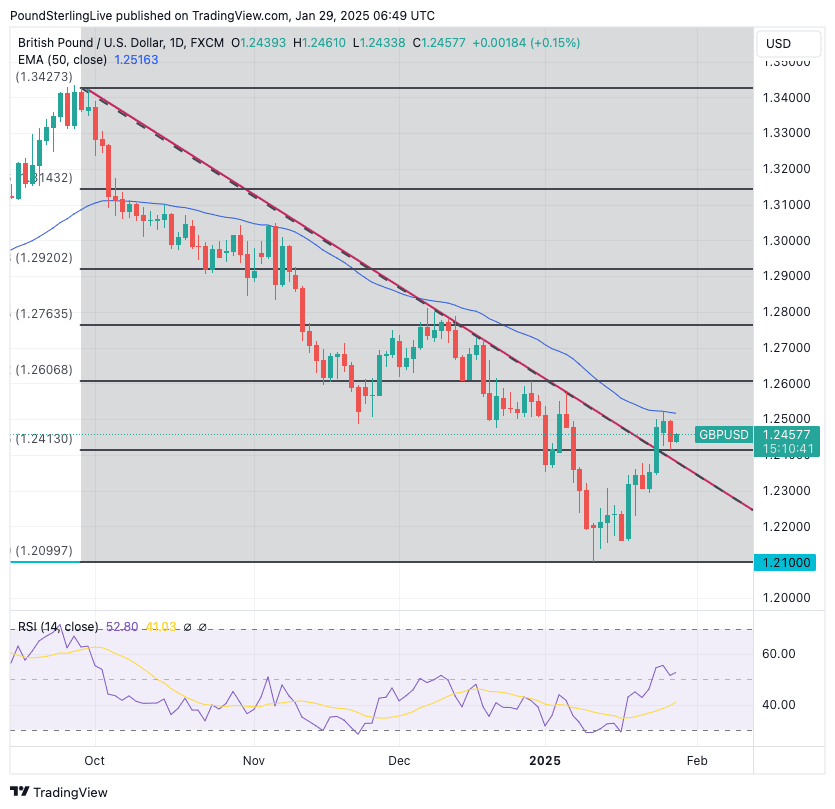

The Pound to Dollar exchange rate (GBPUSD) has been steadily recovering since mid-January as the Dollar unwinds overbought conditions and traders navigate President Donald Trump's rhetoric around trade tariffs.

GBPUSD has recovered 2.8% in value, but the rally is at risk of stalling as it rises to meet the 50-day exponential moving average (EMA), which could now form a technical barrier to the advance. Should the exchange rate break above here then the recovery would evolve into a fledgling rally.

Buyers will be encouraged by the Pound's relative resilience to fresh indications that President Donald Trump will be pursuing a blanket import tariff in the coming months, which analysts say would be an all-out positive development for the Dollar.

Following the comments made on Monday night, GBPUSD pulled back by 0.45% through the Tuesday session amidst broader USD buying but has since found some buying interest. Sellers would have expected a far deeper decline if market concerns had truly ramped up.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

This could yet happen, some specialists are warning.

"The lack of aggressive executive tariff orders during the first week of Trump's presidency has led to some 'market relief' away from the heavily positioned dollar. We, however, would view this as a local low for the dollar," says Themistoklis Fiotakis, an analyst at Barclays.

If this is a "local low," we would expect GBP/USD to cap at the 50-day EMA (currently at 1.2516) and then revert to the 2025 low of 1.2099.

As we await further Tariff commentary from Trump, the Federal Reserve will take centre stage and determine whether the recovery in the GBPUSD can grow some legs.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

The Federal Reserve will leave rates unchanged, which markets have been expecting for some time, given robust U.S. economic activity, a solid labour market and above-consensus inflation data.

The market sees just one rate cut in 2025, and the question for the Dollar is where we go from here. Are more cuts priced out, and could we even countenance rate hikes? If so, then the Dollar will break to fresh multi-month highs.

If the Fed thinks it can do more by way of cuts, then the recent pullback in USD can extend, giving the likes of GBPUSD the chance to press higher.

Above: Trump addresses the WEF, where he said he wants to see U.S. and global rates fall. Copyright: World Economic Forum/Pascal Bitz.

The Fed could point to a softening in data of late to justify keeping the flame of future rate cuts alive.

"Our macro scorecard for the US has more red than green this month in a suggestion that the US economy started to see some cooling at the close of 2024 and start of 2025," says Daniel Richards, an analyst at Emirates NBD.

"There is nothing in the data that appears indicative of a sharp slowdown in US activity, and with inflation ticking up modestly in recent prints, we expect the FOMC to remain on hold at its first rate-setting meeting of the year today. Nevertheless, we still hold to our expectation of three 25bps cuts over the year as the Fed looks to move to a less restrictive policy stance," he adds.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Trump's tariffs pose inflationary headwinds to the economy, which could encourage caution at the Fed and limit Chair Powell's 'dovish' tone at the January meeting.

Powell will be asked about President Trump's comments last week that he wants lower interest rates. These comments suggest that the president will pressure the Fed to cut rates more than it would like.

Given this, the Fed would like to ride today's meeting out without too much fanfare as it is clear there are numerous moving parts in play as the new administration gets underway.

Keeping a steady hand on the tiller might be just enough to see the two-week Dollar decline extend into February, opening the door to 1.26 in GBPUSD.