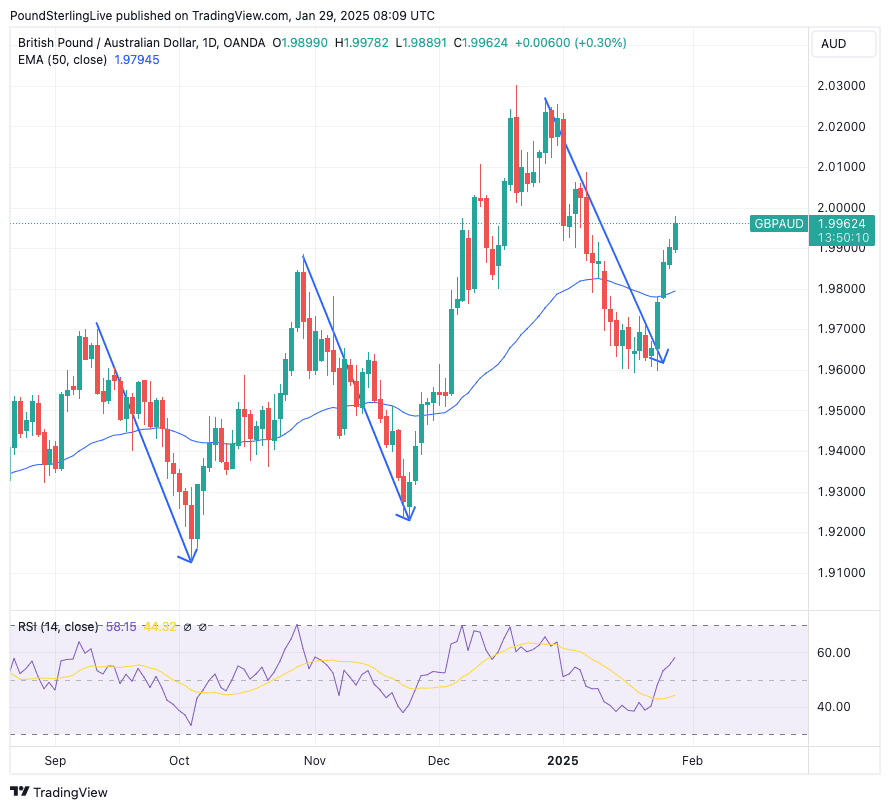

GBP/AUD Extends Gains on Aussie Inflation Undershoot

- Written by: Gary Howes

Image © Adobe Images

The Australian Dollar was softer after inflation undershot expectations and brought closer a Reserve Bank of Australia (RBA) interest rate cut.

The Pound to Australian Dollar (GBPAUD) exchange rate rose to 1.9959 following news inflation rose by 0.2% quarter-on-quarter in the final quarter of 2024, undershooting expectations for an acceleration to 0.3%.

The annual rate of inflation rose to 2.5% y/y from 2.3%, but this met expectations. However, it will be the measures of core inflation that are garnering the most attention from currency market participants.

The RBA trimmed mean measure of core inflation rose 0.5% on a quarterly basis in Q4, which was less than the 0.6% market expectation. The annual measure rose 3.2%, which was down from 3.6% and below consensus expectations of 3.3%.

"Today’s data should give the green light for the RBA to commence normalising the cash rate at the February Board meeting," says Kristina Clifton, an analyst at Commonwealth Bank of Australia.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Money market pricing shows investors have increased pricing for a February RBA rate cut, seeing a 95% chance compared to 78% prior to the inflation release.

Economists at ANZ say there are positive signs that housing disinflation will continue into 2025, reflecting the softening market.

Specifically, in December, rent inflation slowed to 0.3% m/m rather than maintaining the 0.6% m/m trend. New dwelling construction costs were largely steady, rather than rebounding from the 0.6% m/m fall in November which reflected builder discounts.

These two expenditure classes account for 14.4% of the CPI basket, which ANZ thinks will help bring underlying inflation sustainably into the target band in 2025.

🎯 GBP/AUD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

"We think this will be enough for the RBA to cut the cash rate by 25bp at its February meeting," says Catherine Birch, Senior Economist at ANZ.

Incoming data will determine the prospect of further rate cuts in 2025, but the headline from today is that the disinflation process in Australia looks to be intact.

This can allow the market to bet on further cuts, providing a headwind to the Australian Dollar in the outlook.