Pound to Euro: Looking for Recovery Momentum to Ease

- Written by: Gary Howes

The British Pound's rise against the Euro could soon stall as markets await the European Central Bank (ECB) decision.

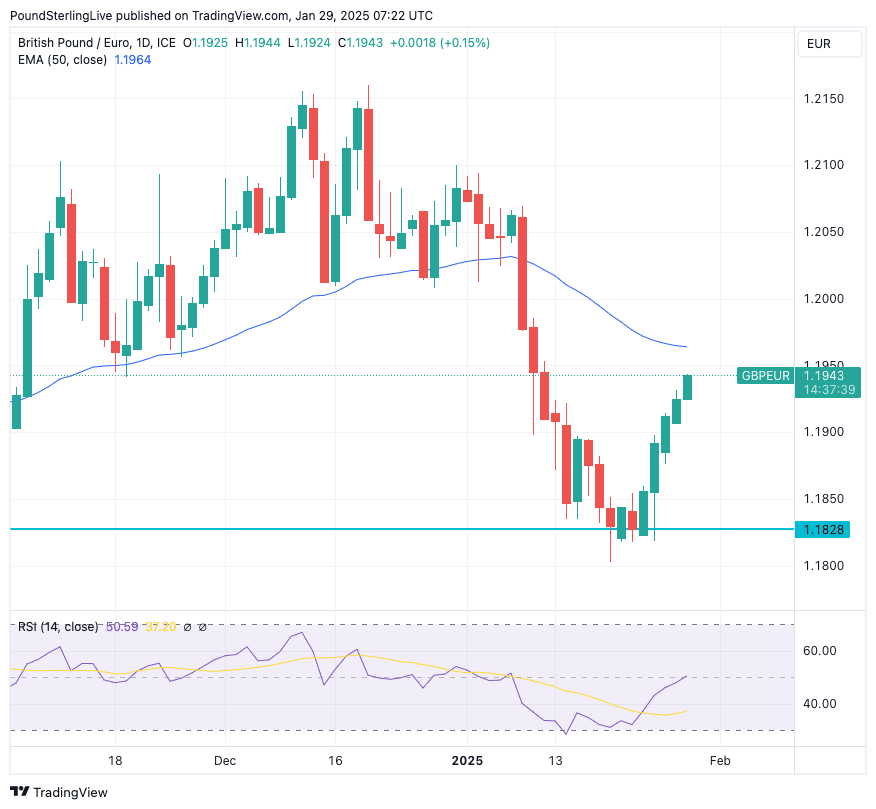

The Pound to Euro (GBPEUR) exchange rate has risen from an interim low at 1.1802 to 1.0940 in midweek trade, but we would expect the recovery to soon stabilise around current levels.

The exchange rate looks to be rising up to meet the downward trending 50 day exponential moving average (EMA), currently located at 1.1964, and we would look for some market participants to lighten their exposure near here.

Above: GBPEUR's technical charts show the rally faces an imminent pause.

Also, the Relative Strength Index (RSI) in the lower panel is rising into the neutral 50 area and could flatten out.

Gains made already this week verify our Week Ahead Forecast call that said to anticipate a rise into the ECB meeting.

We also said to then expect the rise to stall, with the ultimate weekly close dependent on the tone of the ECB.

A rate cut of 25 basis points is expected, but should the ECB prove outright 'dovish' (i.e., indicate it is minded to cut further), a rally to 1.20 in GBPEUR is likely in the next week.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

But the ECB doesn't have grounds to make such guidance as core inflation in the Eurozone is not falling as fast as would needed for the headline rate of inflation to fall to 2.0% on a sustained basis.

Also, Eurozone economic activity appears to have improved early in 2025, giving the ECB reason to maintain a cautious data-lead approach to further rate cuts while keeping its messaging broadly unchanged from the previous meeting.

This gives scope to ongoing EUR resilience that can cap GBPEUR ahead of 1.20.