Pound to Dollar Week Ahead Forecast: Recovery to 1.2606 Possible

- Written by: Gary Howes

Image © Adobe Images

The British Pound can extend a short-term recovery against the U.S. Dollar amidst growing confidence the worst-case universal tariff scenario is off the table. But the recovery will be tested mid-week by the Federal Reserve interest decision.

The Dollar endured its worst week in more than a year last week, allowing the recovery in the pound-to-dollar exchange rate (GBPUSD) to breach the downtrend line that defined the direction of trade since last October.

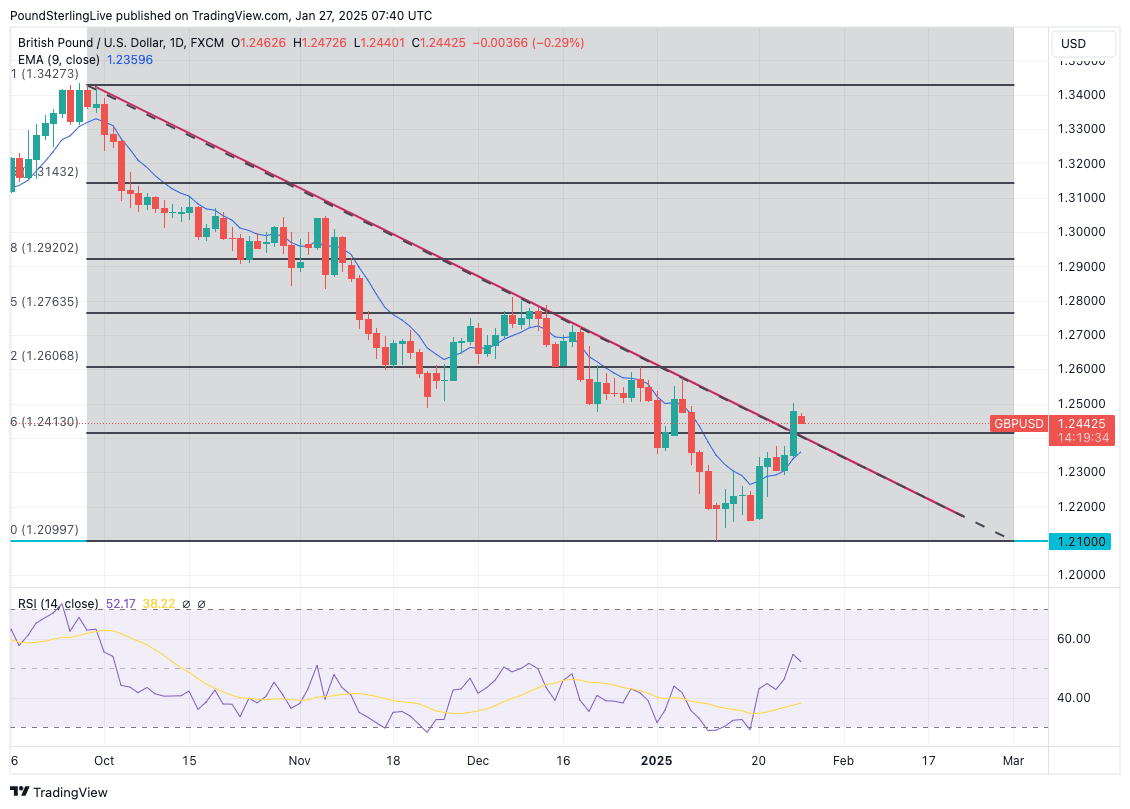

A look at the chart below shows the break above the trend line confirms an interim base at the mid-January low at 1.2099:

Above: GBPUSD at daily intervals with Fib retracement lines shown, the Oct-Jan downtrend line and the nine-day EMA.

GBPUSD has risen above the nine-day exponential moving average (EMA), which suggests upside is possible over the coming two to three days, which would keep a constructive tempo into the midweek Fed decision.

The RSI has turned up of late, confirming improved upside momentum, which leaves us scoping out a test of 1.2606, the 38.2% Fibonacci retracement of the October-January decline.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Taking a step back, there remains a good chance that we are only witnessing a pullback within the broader trend and that weakness will eventually resume.

For us to grow more confident that the selloff has been completed, a break above the 200-day EMA at 1.2717 must transpire, at which point the technical conditions of a trend turn have been fulfilled.

The underlying fundamentals that lead GBPUSD higher in the short-term is, of course, the broader pullback in the U.S. Dollar.

Markets get the sense that Donald Trump is unwilling to pursue a universal tariff, which was the all-out USD-positive policy decision that markets feared when he won in November.

Instead, Trump is using Tariffs as a potent geopolitical bargaining tool, as shown in Sunday's spat with Colombia over the refusal to accept the return of illegal migrants. Trump threatened tariffs as high as 50% on Colombian imports, and by the end of the day, Colombia had backtracked and tariffs avoided.

This is the playbook going forward. Importantly, it signals that tariffs are a bargaining tool and there is ample space for their avoidance.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

The Federal Reserve is in focus midweek as the pause button is expected to be pressed on the interest rate cutting cycle. This pause has long been expected, explaining much of the USD's strength over recent months.

The commentary around future rate hikes will matter for the Dollar, with weakness likely to emerge if Fed Chair Jerome Powell suggests there is scope to cut rates on more than one occasion this year.

One of the most interesting takeaways from Donald Trump's talk at the World Economic Forum last week was his insistence that U.S. interest rates must fall faster. This signals he will sound a more activist tone on the Fed as he wants the Trump economy to grow at a gangbuster pace.

The Fed is independent of the executive, but there is now the chance the Fed errs on the 'dovish' side when facing finely balanced decisions for fear of upsetting the uppity U.S. president.

Pound Sterling Turns a Corner

File image of Rachel Reeves. Picture by Kirsty O'Connor / Treasury.

Buy the British Pound and UK bonds; the pessimism towards the UK is overdone, says Dhaval Joshi, Chief Counterpoint Strategist at BCA Research.

"Playing the over-pessimism on the UK is to go long GBP/USD, which is also oversold based on its collapsed 65-day complexity," he says.

The call is founded on a stance that Pound Sterling looks to have finally exited the January selloff that leaves it as the worst-performing G10 currency of 2025. Declines followed a flush-out of crowded long positioning in the currency, which followed two years of outperformance.

Rising bond yields and fears of a stagnating UK economy appear to have contributed to this flush-out, as did rising market expectations for the number of Bank of England interest rate cuts in 2025.

A better-than-forecast January PMI reading, released on Friday, showed that the economy started the year with some growth, potentially easing fears that a recession was underway.

Inflation and wage growth remain elevated, ultimately limiting the GBP-negative direction of travel in interest rate expectations.

The UK economic outlook is challenging, but the gloomier reappraisal now appears 'in the price', allowing the Pound to further recover from recent lows.