Bank of England Now Faces Spectre of Rising Inflation

- Written by: Gary Howes

Image © Adobe Images

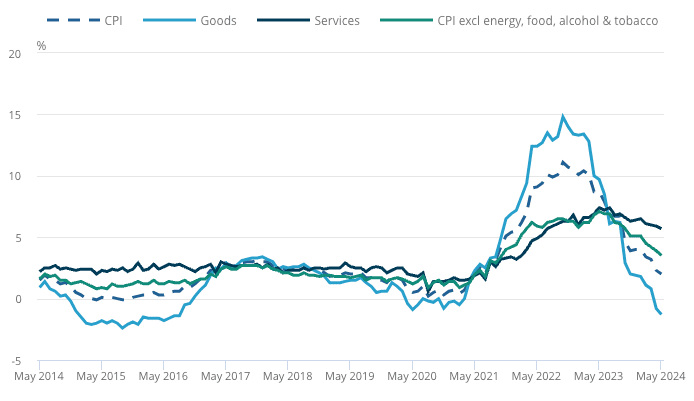

The Bank of England faces the spectre of rising inflation once more as easy wins from goods and energy prices will no longer be able to flatter stubbornly high services inflation.

Economists say this could be as good as it gets for the disinflation process until 2025, and the prospect of rising inflation in the coming months will keep the Bank of England cautious about cutting interest rates.

"We expect inflation to rise to 2.2% in July as utility prices fall less this year than in July 2023," says Rob Wood, Chief UK Economist at Pantheon Macroeconomics.

The ONS said headline UK CPI inflation remained at 2.0% y/y for a second month in June, meeting expectations. Core inflation, which excludes energy, food and alcohol, stayed at 3.5% and also met expectations.

The annual rate of services inflation remained at 5.7%, as expected. Restaurants and hotels, which are included in the services basket, made the largest upward contribution to the monthly change in headline inflation.

"This is too strong for the MPC to cut in August," says Rob Wood, Chief UK Economist at Pantheon Macroeconomics. "Stronger-than-expected services inflation kept headline CPI inflation at 2.0% in June."

"It’s the stability of services inflation at 5.7% that’s the blow," says Paul Dales, Chief UK Economist at Capital Economics. "The chances of an interest rate cut in August have diminished a bit more."

Falling energy and goods prices have helped drive headline inflation down to the Bank of England's 2.0% target. However, their downward contribution will soon fade from the annual data. This means that the Bank of England can no longer rely on supportive 'base effects' to compensate for stubborn services inflation.

The main cost pressure facing services industries is wages, which remain elevated and well above the inflation rate and is why Thursday's labour market statistics will be closely watched.

"What drove the beat in services inflation? Slightly higher rents for one," says Sanjay Raja, an economist at Deutsche Bank.

"The ONS data shows rent pressures remain high, potentially increasing wage demands. Rental and wage pressures are why we are finding more small businesses opt for a virtual office in London and a physical presence in cheaper locations," says a post-release analysis from Hoxton Mix.

The National Institute of Economic and Social Research (NIESR) predicts that inflation will start to rise from here.

"Core inflation remains elevated at 3.5%, as does services inflation at 5.7%, possibly prompting the Bank of England to remain cautious with regards to interest rate cuts. We expect inflation to rise throughout the rest of the year due to base effects, before falling back towards target in early 2025," says Monica George Michail, NIESR Associate Economist.

Even if the Bank of England cuts interest rates in August, the prospect of rising inflation should keep them strike a cautious tone and warn against expecting further rate cuts.

Pantheon Macroeconomics thinks inflation will rise to 2.2% in July as favourable base effects from previous falls wash out of the annual comparison.

"Food and non-energy goods inflation have no further to fall now," says Wood. "Ofgem will likely hike the utility price cap by 12% in October after wholesale energy costs have risen."

These components have contributed significantly to recent declines in inflation, but Pantheon Macroeconomics thinks their contribution to year-over-year CPI inflation will rise 86bp by December.

"Getting inflation sustainably back to the 2% target will require services inflation to drop closer to 3.5%, but that will take time because wage growth remains strong. We look for CPI services inflation to fall only to 4.9% at the end of 2024," says Wood.