Pound to New Zealand Dollar Week Ahead: Building the Recovery as Tech Stocks Sweat

- Written by: Gary Howes

Image © Adobe Images

The New Zealand Dollar is under pressure amidst a selloff in U.S. technology stocks, raising the prospect of a strong recovery in the Pound to New Zealand Dollar exchange rate (GBPNZD) in the coming days.

GBPNZD looks set for a second sizeable daily advance as it emerges from an early-2025 selloff.

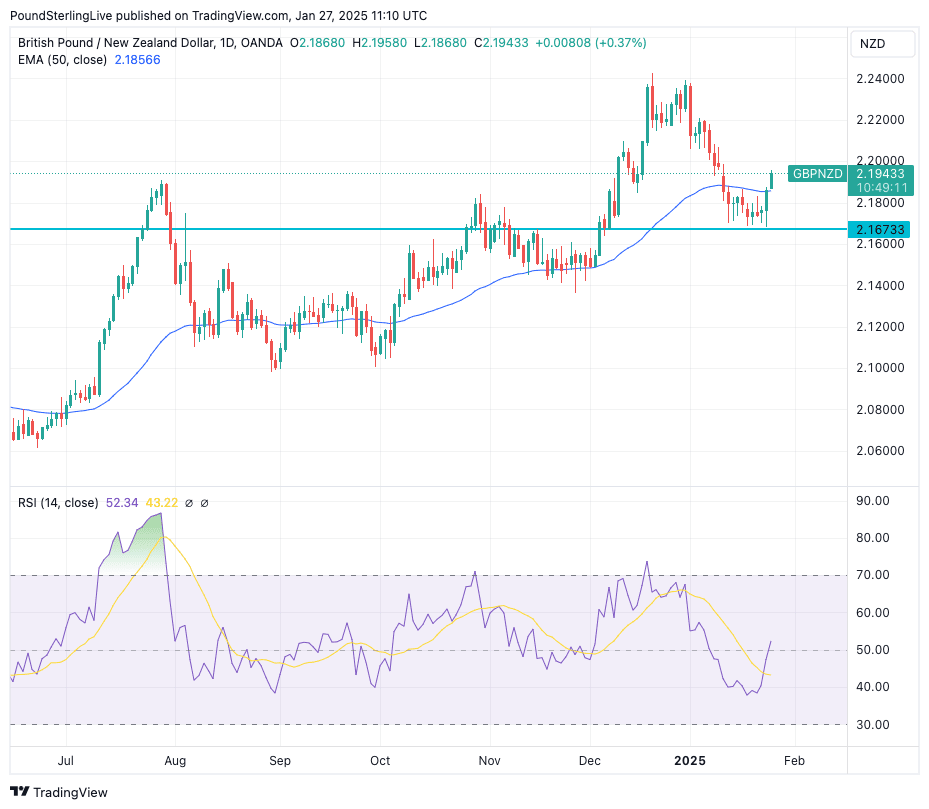

Evolving price action suggests the fall from December's high of 2.24 to January's low at 2.1673 should be viewed as a pullback within an ongoing uptrend.

The recovery takes GBPNZD back above the nine-day, 21-day and 50-day exponential moving averages while the Relative Strength Index (lower panel) turns higher, all signalling a shift in momentum from the downside to the upside.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The low at 2.1673 looks to be the interim floor from which the rebound is building, and gains to 2.20 look to be the first objective in the week ahead, with 2.2065 being the next target attainable in the five-day time span.

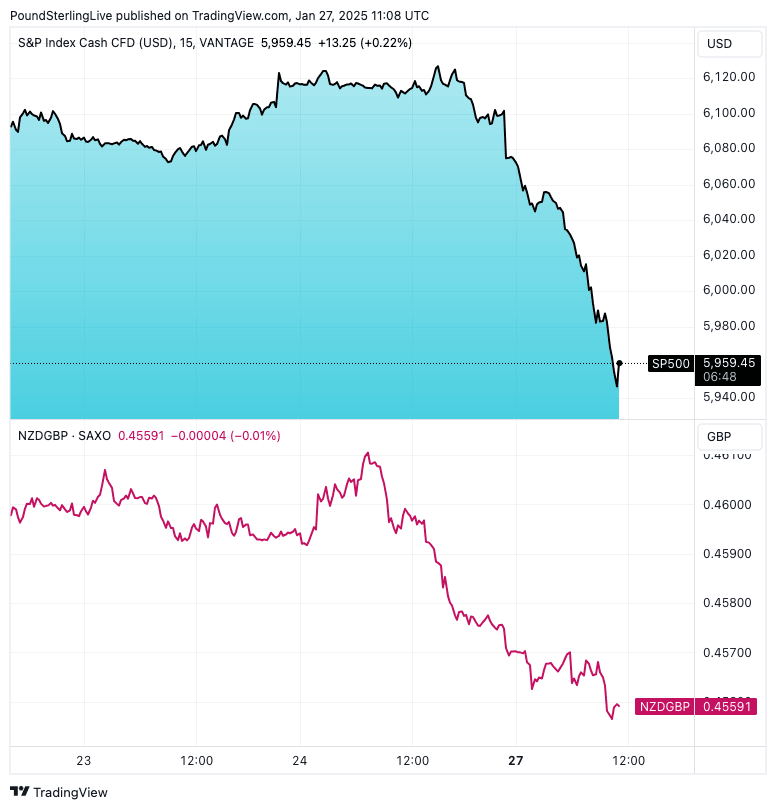

GBPNZD's turnaround has global developments to reference. At the start of the new week, the New Zealand dollar was under pressure due to a selloff in global equity markets and signs that the AI bubble in the U.S. equity market was deflating.

As we can see in the below chart, NZDGBP holds a positive correlation with the S&P 500 index at present, confirming broader global investor sentiment matters for the risk-sensitive Kiwi Dollar:

There are concerns that China might just have burst the AI bubble with the release of Deepseek R1, a competitor to ChatGPT and similar models from other big-name tech firms.

That China has delivered this tool so quickly and at seemingly minimal relative cost blows a hole in the AI model. Can OpenAI justify such high valuations, can the tech sector deliver exponential earnings growth expectations when it is clear competition abounds?

"The AI world is abuzz with the Chinese DeepSeek LLM model that apparently costs much less to build than OpenAI’s ChatGPT, performs better than the OpenAI o1 model and is cheaper for users to run. That is at least what the DeepSeek team is saying. Here are four thoughts on this," says Bilal Hafeez at Macro Hive.

🎯 GBP/NZD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Recall the tech sector is trading at sky-high multiples, leaving them highly sensitive to any fundamental developments that would challenge these valutions.

If the hot air is let out of U.S. stocks then those currencies that have a high correlation with investor sentiment would be expected to suffer. This is where NZD looks vulnerable: should equities lose altitude, then GBPNZD can recover further.

DeepSeek was only founded in 2023 and has rapidly developed advanced AI models that rival those of established U.S. tech giants.

"DeepSeek unveiled a free, open-source large-language model in late December that it says took only two months and less than $6 million to build, using reduced-capability chips from Nvidia called H800s. DeepSeek’s app is now one of the most downloaded app on Apple’s App Store, and Bloomberg searches for “DeepSeek” have surged, reflecting heightened global interest and investor focus," explains Charu Chanana, Chief Investment Strategist at Saxo.