Pound to Australian Dollar Forecast: A Perfect Prediction

- Written by: Gary Howes

Image © Adobe Stock

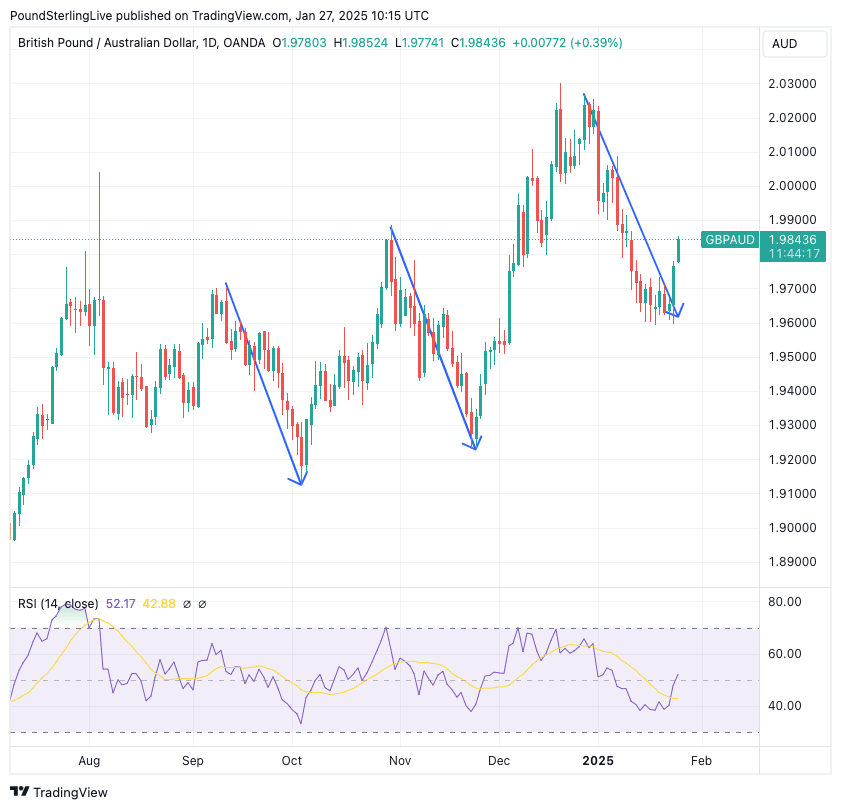

The Pound to Australian Dollar exchange rate (GBPAUD) is recovering after finding support at 1.96, as we predicted.

Pound Sterling Live has run a chart for three weeks that showed an arrow that tried to forecast how far the recent GBPAUD selloff would extend.

Here is that chart again, and as can be seen, we called the move perfectly:

The premise was simple: GBPAUD pullbacks tend to be quite deep and follow a similar pattern.

The rally in GBPAUD that took it to above 2.0 in December would need to be corrected given the overbought nature of all Pound sterling exchange rates, which was mirrored by an oversold reading across the AUD strip.

Judging that the move was finally underway in early January, we attempted to determine how far a typical pullback would extend and on what trajectory. This is not science but is based on graphical chart observations, including the rounded level of support that might emerge at 1.96.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

This support was confirmed last week and capitulation has ensued, with Monday looking to deliver a second solid consecutive daily advance.

We look for GBPAUD to edge higher over the coming days, particularly if global equity markets struggle.

U.S. futures will follow Asian markets into the red, led by a sizeable selloff in the technology-focused Nasdaq. There are concerns that China might just have burst the AI bubble with the release of Deepseek R1, a competitor to ChatGPT.

🎯 GBP/AUD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

That China has delivered this tool so quickly and at seemingly minimal relative cost blows a hole in the AI model. Can OpenAI justify such high valuations, can the tech sector deliver exponential growth expectations when it is clear competition abounds?

If the hot air is let out of U.S. stocks then those currencies that have a high correlation with investor sentiment would be expected to suffer. This is where AUD looks vulnerable: should equities lose altitude, then GBPAUD can recover further.

The Pound Rebound

Pound Sterling looks to have finally exited a broader January selloff that leaves it as the worst-performing G10 currency of 2025. Declines followed a flush-out of crowded long positioning in the currency, which followed two years of outperformance.

Rising bond yields and fears of a stagnating UK economy appear to have contributed to this flush-out, as did rising market expectations for the number of Bank of England interest rate cuts in 2025.

A better-than-forecast January PMI reading, released on Friday, showed that the economy started the year with some growth, potentially easing fears that a recession was underway.

Inflation and wage growth remain elevated, ultimately limiting the GBP-negative direction of travel in interest rate expectations.

The UK economic outlook is challenging, but the gloomier reappraisal now appears 'in the price', allowing the Pound to further recover from recent lows.