Why an August Rate Cut Still is Still Likely

- Written by: Gary Howes

Image © Adobe Images

Although this month's inflation and wage data are likely too strong for the Bank of England to cut interest rates on August 01, we could still be in for a surprise.

This is because two members of the Monetary Policy Committee (MPC) are already voting for rate cuts, and others will only need a little convincing to join them. In this camp, we would include the highly influential Governor Andrew Bailey, who started sounding sympathetic to rate cuts

In June, the odds of an August rate cut rose after the Bank of England kept rates steady but said the decision to hold interest rates unchanged was "finely balanced" for three of the MPC members who voted to hold.

So what straws can those who want a rate cut clutch onto?

Headline services inflation is too strong (5.7%) and will push inflation up again in the coming months, thanks to elevated wage settlements (5.7%). The Bank has repeatedly said it wants to see wages and service inflation come down before considering a rate cut.

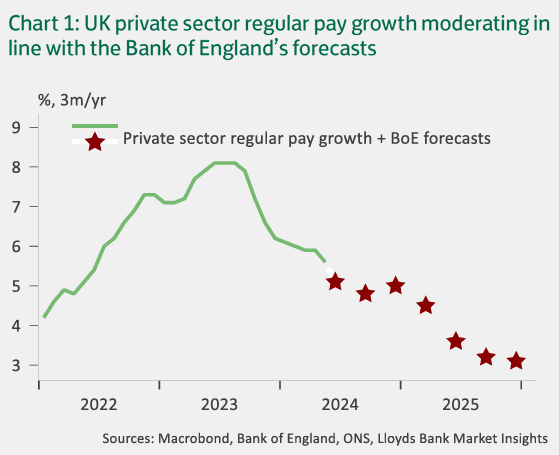

Image: Lloyds Bank.

Yet, the fall in wages from 6.0% in April to 5.7% in May was in line with expectations. And wages look set to fall further to 5.1% in the second quarter, which would meet the Bank of England's own target.

Economist Ashley Webb at Capital Economics says wages should fall to 5.1% in Q2 if regular private sector pay rises by 0.6% m/m or less in June.

The Bank's 'dovish' MPC members could lean on this expectation and argue it can cut interest rates in August without risking pushing up inflation.

Image: Lloyds Bank.

"What's more, the 1.0% y/y rise in GDP in the three months to May relative to a 0.0% y/y change in total hours worked suggests the strength of the recent rebound in activity may be less of an inflation worry for the Bank," says Webb.

Viraj Patel, an analyst at Vanda Research, has been a long-time GBP bear and has been warning of imminent interest rate cuts for some months now. He says an August rate cut is still likely because unofficial payrolls data for June shows the softest wage growth since Covid (from 6% to 3.6%).

He adds that monthly UK jobless claims are rising and, on a three-month basis, are now increasing at the same pace as was the case in the 1990s (recession), 2008 and 2020. "Either a short-term blip for the UK labour market or the start of something more ominous," he says.

The Bank of England could well pivot its focus from its inflation mandate to the labour market (something the Federal Reserve has done recently) and argue it would be prudent to cut interest rates in August to protect jobs.

"Rate setters will breathe a sigh of relief after today’s labour market data, which leaves open the option to cut in August despite hot CPI services inflation," says Rob Wood, Chief UK Economist at Pantheon Macroeconomics. "Rate setters will be encouraged by softer private sector pay growth in May, suggesting only small upside risks to their forecast for Q2 pay growth."

Pantheon thinks an August rate cut is a very close call.

Wood says the MPC could easily dismiss yesterday’s stronger-than-expected CPI services reading as volatile, just as they did in June, note slowing wage growth, and plough on with a rate cut in August.

"But we think services inflation is just too hot for the MPC to go ahead in August, and instead expect them to wait until September to reduce interest rates," says Wood.

Gabriella Dickens, G7 economist at AXA Investment Managers, says May’s labour market release will bring some comfort to the MPC.

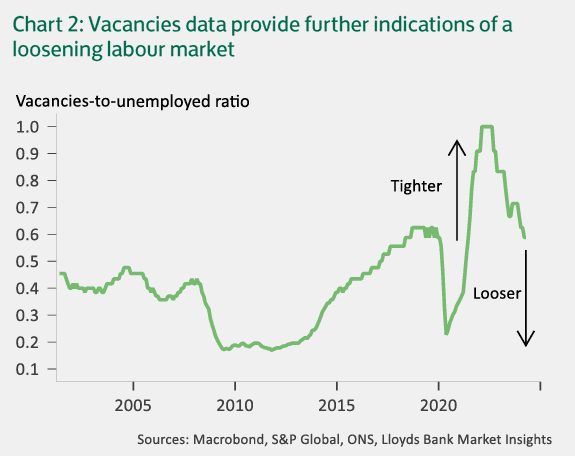

"While the unemployment rate held steady at 4.4%, that was still above the 4.3% forecast made by the MPC in May’s Monetary Policy Report," she says. "The PAYE measure of employee numbers increased by just 16,000 – or 0.1% month-on-month – in June, well below the 2023 average monthly increase 35,000. Vacancies also continued to ease."

AXA thinks pay growth is slowing more materially now that the near-10% increase in the National Living Wage has largely filtered through. "We think employment will continue to tick up over the rest of the year, given the strength of the recovery in broader activity," says Dickens.

"Today’s labour market data has arguably increased the chances of the first cut being pushed through in August, after questions were raised following the release of June’s CPI inflation data yesterday. We continue to think it will be close, but the drop in private sector wage growth alongside signs that labour market slack is continuing to develop faster than the BoE forecast in May will give the doves a stronger footing to switch their vote," she adds.