GBP a Buy Says Citi

- Written by: Gary Howes

© BruceG1001, reproduced under CC licensing

Pound Sterling is a 'buy' against the Euro says Citibank.

Strategists at the investment bank say the pound's selloff against the euro is reaching its limits and a turnaround nears.

In a recent note, Citi's Global FX Strategy desk says it is time to "Short EURGBP".

'Shorting' is where one currency is sold against another; in this instance, the euro is sold against pound sterling.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The pound has come under significant selling pressure against the euro in 2025 as markets worry about the UK's economic growth slowdown and the government's rising debt burdens.

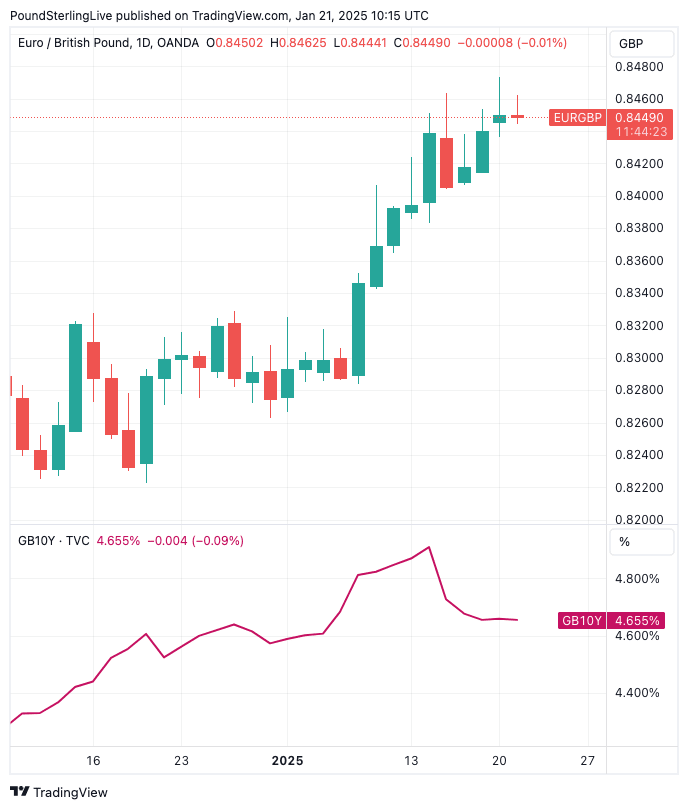

UK bond yields spiked as investor concerns grew and the currency proved another outlet for these fears: the pound to euro exchange rate (GBPEUR) has fallen nearly 3.0% since December's multi-year high at 1.2160.

EURGBP recovered from a low of 0.8223 to a 2025 high of 0.8473.

But Citi said the selloff in GBP would end when one of three conditions was met:

(1) global fixed income yields peak;

(2) a UK policy announcement to temper markets or a reversal in sentiment around fiscal concerns; or

(3) a move towards 0.8470-0.85 where risk/reward is more attractive for shorts.

"Condition three has effectively been met," says Citi, triggering the recommendation to sell EURGBP in anticipation of Sterling's recovery.

Above: EURGBP may have peaked, helped by a recent peaking in UK bond yields (lower panel).

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

In addition, last week's below-consensus inflation data from the UK and U.S. appear to have halted the rise in fixed-income yields, at least for now.

"We think risk/reward is attractive to try a tactical EURGBP short here against the 55wma with potential for a move back towards the multi-year lows around 0.8250," says Citi.

EURGBP at 0.8250 implies a GBPEUR target of 1.2121, implying that a recovery back to the top of recent ranges is possible.