Pound to Euro Rate Week Ahead Forecast: Too Soon to Break 1.20's Spell

- Written by: Gary Howes

Picture by Simon Dawson / No 10 Downing Street.

Pound Sterling is in an uptrend against the Euro, but the near-term is likely to see more chop and churn.

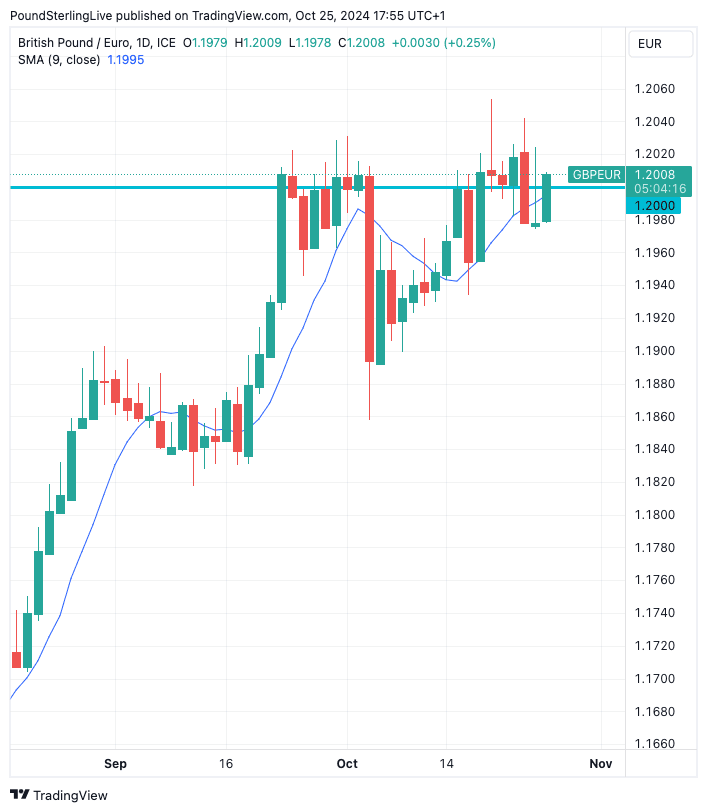

The Pound to Euro exchange rate has been gravitating around the nine-day moving average over recent days, with selling and buying interest fading whenever it strayed too far.

Interestingly, the 9-day MA is now at 1.20, which is that psychologically significant ceiling GBP bulls are struggling to crack:

We noted in our previous edition of the GBP/EUR Week Ahead Forecast that selling interest in GBP/EUR tends to be particularly acute when spot reaches the 1.2030-1.2050 region because it is at this level that retailers are able to offer 1.20 to euro buyers.

This remains the case: many a retail client would like to see 1.20 on their transaction ticket, meaning the real selling interest starts to happen when spot reaches 1.2030 through to 1.2050 to account for the spread charged by providers.

Speculators are aware of this, meaning there is a good deal of speculative selling around here, ensuring Pound Sterling strength is contained.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

We don't think the status quo will be broken in the coming five days and this merry-go-round will continue to determine near-term price action.

A particular headwind for the Pound is the prospect of nervy trading conditions ahead of Friday's U.S. jobs report and next Tuesday's U.S. presidential election.

GBP/EUR is sensitive to global investor sentiment and tends to come under pressure when stocks are selling off. Luckily for euro buyers we are in a market bull run, and this is one important factor as to why Pound-Euro has appreciated to two-year highs over recent months.

The bull run for both markets and Pound-Euro can extend into year-end, but a strong U.S. job report could prompt some volatility and a pullback sub-1.20 towards the end of the week.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

You won't be far from election speculation this week and the rising odds of a second Donald Trump presidency have been particularly punishing for most Dollar-based exchange rates, but it hasn't really impacted Pound-Euro, so we are minded to think this is not a major risk for this particular exchange rate.

That said, we think the vote will result in a market-friendly outcome regardless of the winner, which bodes for more Pound-Euro strength into year-end.

That said, the coming days should see markets behaving erratically and this kind of volatility will keep the Pound contained against the Euro.

Turning to idiosyncratic risks, the Euro could receive a boost on Wednesday with the release of preliminary October inflation data for Spain and Germany.

It was September's inflation data for these two countries that sunk the Euro when released at the start of the month, as it led to an interest rate cut at the European Central Bank two weeks later.

The market anticipates inflation to pick up slightly into year-end, which, if confirmed midweek, could cushion the Euro.

That said, any strength will be limited. On the other hand, an undershoot in the inflation figures will only add to the belief that the ECB needs to get its skates on and cut quicker, which would weigh on the Euro.

The Eurozone-wide inflation data are due the following day, although recent history has suggested the market would usually have gotten a steer from the previous day's German and Spanish releases.

Chancellor Rachel Reeves. Picture by Kirsty O'Connor / HM Treasury.

It's a big week for Pound Sterling as the UK government will announce its budget on Thursday.

We know this is likely to be a difficult budget for businesses and investors and is, therefore, a potential headwind for growth

This could weigh on the Pound, particularly if the market thinks the new tax rises will lower the UK's growth potential.

However, analysis suggests the budget will be expansionary as the Chancellor has changed the UK's fiscal rules to allow her to borrow more money in order to invest in projects that would boost the UK's growth potential.

Some estimates suggest the boost to growth could amount to 0.50% in 2025, which would require the Bank of England to be more cautious in cutting interest rates.

This would amount to a GBP-positive outcome.

Risks to the Pound would be the market not taking kindly to expectations for increased borrowing, similar to the reaction to Liz Truss' aborted mini-budget of 2022 that caused a meltdown in the Pound.

However, all analysts we follow say they have seen and heard enough to believe this is unlikely, so we think the budget is no significant downside risk to GBP.