Pound Sterling Could Benefit from Growth-boosting "Historic" Budget

- Written by: Gary Howes

Chancellor Rachel Reeves. Picture by Kirsty O'Connor / HM Treasury.

The British Pound could benefit over the coming months from an expansionary budget.

Analysis from Pantheon Macroeconomics suggests the government will deliver "looser fiscal policy" in the October 30 Budget, which will boost GDP by 0.5% in 2025/26.

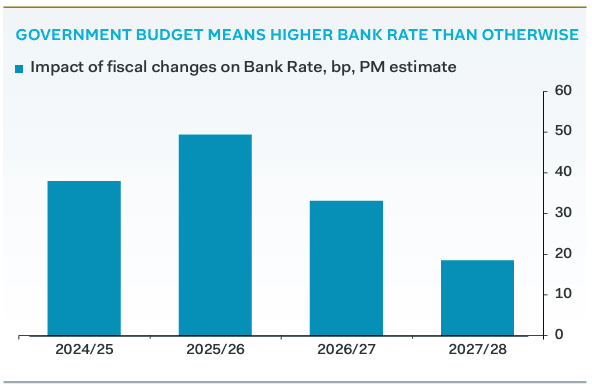

"As a result, the MPC will need to hold Bank Rate 25-to-50bp higher than it would otherwise," says Robert Wood, Chief UK Economist at Pantheon Macroeconomics.

The findings run contrary to popular expectations that the budget will be austere and will weigh on UK economic output, which is held by strategists to be a headwind to the Pound.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Pound Sterling enters the budget as one of 2024's best-performing major currencies owing to the cautious approach to interest rate cuts adopted by the Bank of England amidst better-than-expected economic data outturns in the first half of the year.

A well-received budget and a steady approach to rate cuts at the Bank can underpin Sterling's outperformance, particularly against the likes of the Euro and other European currencies.

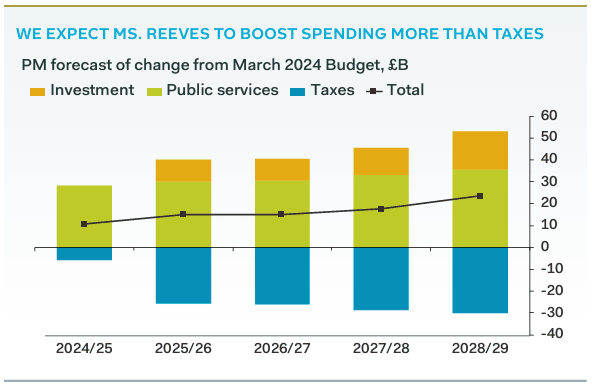

Wood explains that although the October 30 Budget will include large tax increases, expect Chancellor Rachel Reeves overall to loosen fiscal policy, boosting growth and keeping interest rates higher than they otherwise would be.

Image courtesy of Pantheon Macroeconomics.

Pantheon thinks Chancellor Reeves will raise government borrowing by an average of £17.2B per year — 0.5% of GDP to boost tight day-to-day government spending plans.

Additional expenditure will be covered by tax hikes, but the Chancellor will borrow additional amounts to fund investments.

Pantheon says that, based on the Bank of England's economic model, a 0.5% boost to growth requires the Bank to set Bank Rate some 50bp higher in 2025/26 than it would otherwise have done. Stronger growth and higher-than-expected interest rates are supportive of the Pound.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

"A historic budget," says Sanjay Raja, Senior Economist at Deutsche Bank. "Closing the near GBP 40bn fiscal hole, will require big spending and big taxation. On the spending side of the ledger, we expect the Autumn Budget to contain the largest single increase in net spending (outside the pandemic) since the OBR inception at GBP 35BN."

On the tax side of the ledger, Deutsche Bank expects the Autumn Budget to be the second largest tax raising fiscal event since 2010.

A pro-growth assessment of the budget runs counter to the current sense of apprehension that is building ahead of the October 31 budget statement that is tipped to see notable tax hikes announced.

Image courtesy of Pantheon Macroeconomics.

"The most significant risk to this bullish GBP view remains the precarious fiscal outlook here in the UK, with the 30th October Budget likely to see a rather toxic combination of significant tax hikes, and spending cuts," says Michael Brown, an analyst at Pepperstone. "This cocktail, if as drastic as media reports currently indicate, risks choking off economic growth, potentially forcing a BoE pivot."

Chancellor Reeves says the budget will attempt to plug a spending deficit of £22BN via tax rises. The Labour government has committed to not raise income tax and VAT, meaning entrepreneurs, business owners and other productive elements of the economy will bear the brunt of the hit.

If the economy slows as a result of a squeeze put on by the government, inflation rates could come down faster than previously anticipated.

Responding to low growth and inflation downgrades, the Bank of England would step up the pace it cuts interest rates.

"GBP-USD downside momentum to build on BoE’s dovish shift. UK Budget on 30 October clouds outlook but tax hikes pose a risk to growth and GBP," says Daragh Maher, Head of FX Strategy for the U.S. at HSBC.