Treasuries, Gilts Dented by FX Interventions in Poor Liquidity

- Written by: James Skinner

Image © Adobe Images

US Treasuries and Sterling Gilts fell across the curve ahead of the weekend in likely poor liquidity conditions and price action that coincided with an intraday recovery of the Chinese Renminbi from beneath the bottom of its minimum permissible trading bands and some likely intervention from Beijing.

US 2, 10 and 30-year Treasury yields spiked in early North American trade and around the European noon, leading Sterling Gilt yields to also rise sharply, with both bond markets remaining under pressure even in the wake of some softer than expected producer price index inflation figures released in the US.

The continued weakness of the Treasury market even in the wake of soft inflation, and coming alongside further weakness in local and global equity markets, prompted much comment and speculation on the sell side, while the earlier difficulties and concurrent recovery of the Renminbi went largely unnoticed.

China’s Renminbi came under intense pressure last week as Beijing and Washington traded tariff blows, likely exacerbating pressure on the broad US Dollar, which is positively correlated with the trade-weighted Chinese currency- if not pegged to it - leading numerous Renminbi pairs repeatedly pushing their daily limits.

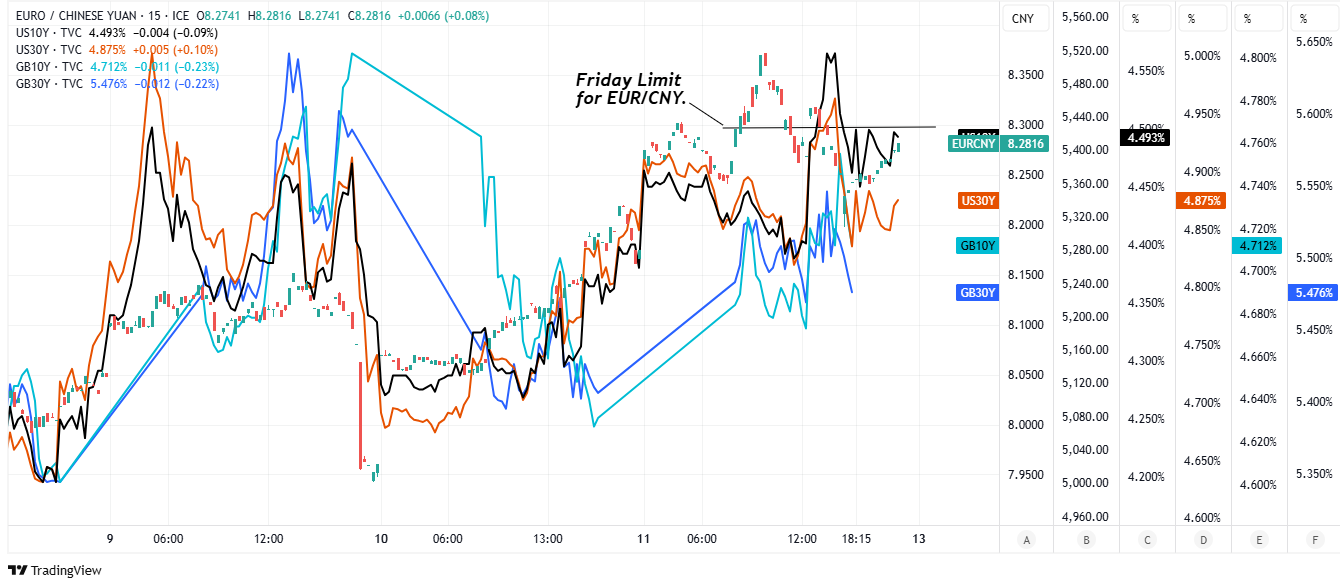

Above: EUR/CNY at 10-minute intervals with US 10 and 30-year yields, and GB 10 and 30-year yields. Click the image for more detailed inspection.

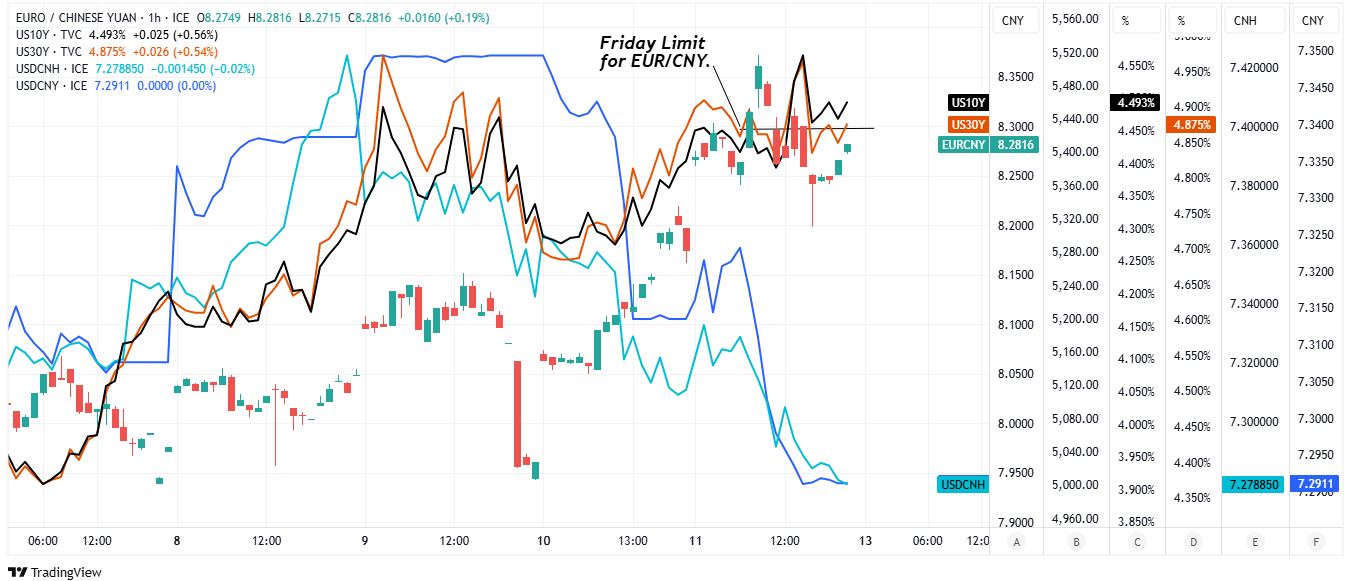

Pairs comprising a large collective part of the China Foreign Exchange Trade System Index including EUR/CNY, JPY/CNY, CHF/CNY and GBP/CNY - together worth 30.7% of the trade-weighted currency - approached the North American open and release of US producer prices data pressing their daily limits.

Some of these pairs then breached their limits after the data landed and the US Dollar came under pressure, further weighing on the Renminbi in turn, while likely necessitating sales of other currencies to rein them in.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

It was at this point that pairs like USD/CNH, EUR/CNY, JPY/CNY, CHF/CNY and GBP/CNY turned lower, while Treasury and Gilt yields spiked in a manner that was incongruous with price action in other asset classes.

The Treasury, Gilt and FX price action was similar to that seen previously, on the Wednesday of last week, ahead of and after President Donald Trump’s decision to reduce and delay the implementation of his global reciprocal tariff, which also saw a sharp increase in the levy on imports from China.

Above: EUR/CNY, USD/CNY, USD/CNY at hourly intervals with US 10 and 30-year yields. Click the image for more detailed inspection.

All of this is relevant to the Gilt market because Sterling bonds often display a high sensitivity to, and high correlation with US Treasuries, while the FX interventions are of importance because of deteriorating US-China trade relations, which may be setting the stage for a lengthy period of persistent interventions.

Persistent interventions would be troublesome if they bring about further episodes of weakness in the Treasury market, which risk leading to lasting side-effects on US markets similar to those now impacting Sterling assets, through the formation of unhelpful trading rules and assumptions among some market professionals.

Such rules and assumptions have, when combined with the Chancellor’s dogmatic adherence to a now-toxic set of self-imposed ‘fiscal rules’ - themselves being archaic relics of the European Union membership era - led HM Treasury into repeated spending cuts and economy-stifling tax increases over recent months.

What’s more, with 10 and 30-year financing and refinancing for the taxpayer rising over and above the levels seen in the September 2022 market meltdown, and to their highest levels since 1998, during recent days, the risk is now of the Chancellor and HM Treasury pursuing further self-sabotaging policies later this year.