Odds of Oct. ECB Rate Cut at 80% Following Spain, France Inflation Data

- Written by: Gary Howes

Image © Adobe Stock

A collapse in French and Spanish inflation to below the 2.0% level makes it increasingly difficult for the European Central Bank (ECB) to forgo a consecutive interest rate cut in October.

Having just cut rates in September, the view was that the ECB would wait until December before cutting again in order to assess incoming data.

But a mere two weeks since the ECB's rate cut and the incoming data is already setting the tone for the October decision.

"A clear softening in inflation pressures have moved markets to price in nearly an 80% chance of an ECB rate cut next month," says George Buckley, an economist at Nomura.

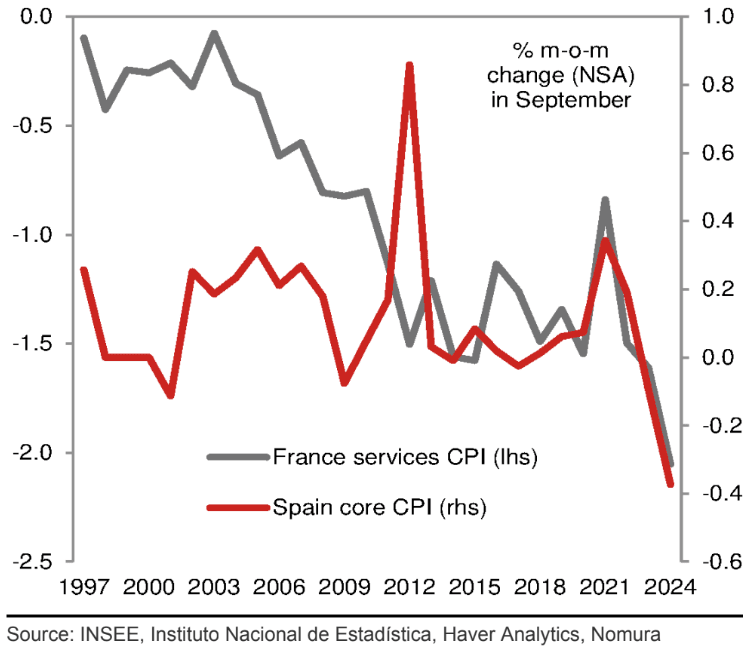

France's month-on-month inflation fell 1.2% in September said INSEE, which was below the -0.8% expected and down on August's 0.6% growth. The annual rate is comfortably below the ECB's 2.0% target at 1.5%.

Above image courtesy of Nomura.

For Spain, the m/m figure stood at -0.6% in September said the INE, which was well below the -0.1% expected and August's flat 0%. Spain's annual rate is now down to 1.5% from 2.3%.

"September’s inflation data from France and Spain all but confirm that the headline rate in the euro-zone as a whole – released next week – will show a sharp decline to below the 2% target," says Franziska Palmas, Senior Europe Economist at Capital Economics.

How can the ECB justify a slow approach to cutting rates - it verified market expectations for a cut per quarter - given the fall in inflation and signs that Germany is in particularly desperate need of stimulus?

"Certain European economies, especially the German, is in an urgent need for a more supportive monetary policy," says Ulf Andersson, an economist at DNB.

Members of the ECB's Governing Council have maintained the view that caution on cutting rates is warranted, but Buckley says the next week will be littered with speeches new speeches, which will be "critical in determining how realistic the ECB thinks a faster pace of cuts will be."

"For now we think that , on balance, the Bank is most likely to leave rates unchanged next month. But with the business surveys looking weak, the odds of a cut have risen," says Palmas.

Responding to the French and Spanish inflation numbers, Nick Andrews, Senior FX Strategist at HSBC, says slowing eurozone services CPI should allow the ECB to accelerate the pace of rate cuts.

"A 4% rally since June has lifted EUR-USD to test resistance at 1.12. Nevertheless, we prefer to fade this rally and expect EUR-USD will soon revert lower. Data this week supports our conviction," he adds.