Pound Sterling Should Welcome Reeves' Budget Boost

- Written by: Gary Howes

Above: Chancellor Rachel Reeves is interviewed by the media at the British Residence, before attending the IMF Annuals in Washington DC. Treasury. Picture by Kirsty O'Connor / Treasury.

Tax hikes have been telegraphed, but any boost to investment spending should underpin the British Pound.

The Pound looked to have initially benefited from news of a significant boost to government investment potential in next week's budget when Chancellor Rachel Reeves said Thursday that the government would change its fiscal rule.

It will now seek to borrow more than would have been allowed under the previous rule to spend on investments, which some analysts said explained a rise in UK bond yields and the Pound.

"I can confirm that we will be changing the way that we measure debt in the budget statement next week. We will get debt falling as a share of our economy during this parliament but the changes that we will make to the investment rule will free up money to invest in things that deliver a long-term return for our country and for our taxpayers," she said on Thursday.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"The next important event for UK markets will be the release of the budget, which will likely cause some jitters, but we expect nothing akin to LiZ Truss' mini budget two years ago," says Jens Nærvig Pedersen, Director of FX and Rates Strategy at Danske Bank.

However, FX market action suggests budget speculation might still not be top of mind for the Pound, at least for now.

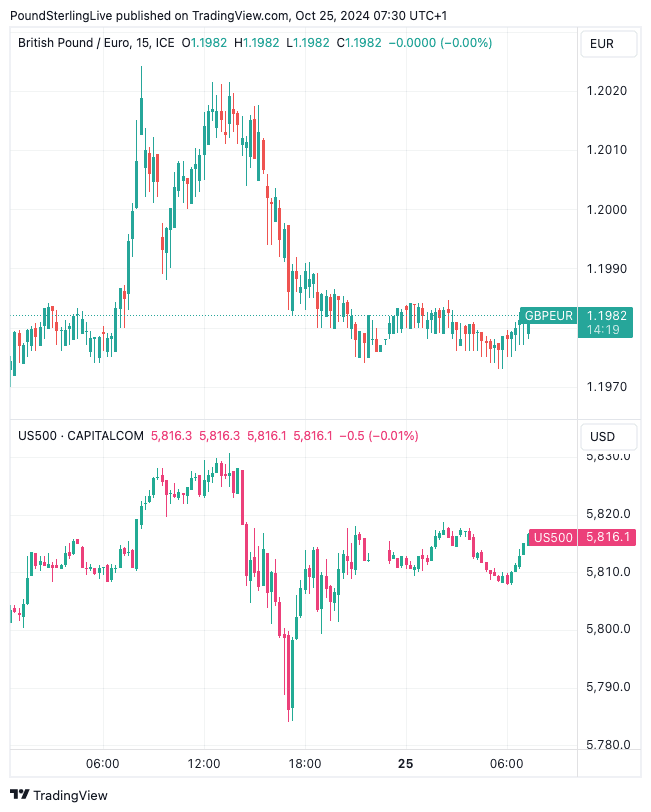

The Pound to Euro exchange rate (GBPEUR) gained to 1.2020 on Thursday, however, the pair soon retreated back to 1.1980, where we find it today.

Above: GBP/EUR (top) came off its highs as the U.S. S&P 500 fell in Thursday's trade.

A fall in U.S. equity markets might have played a part in the decline, confirming the global context remains incredibly important for GBP behaviour, as per the above chart.

Nevertheless, foreign exchange market participants looking for domestic explainers will fix their gaze on Reeves' budget, due Thursday.

The government is set to announce notable tax increases next week to plug a gap in day-to-day spending.

Expectations for tax hikes have weighed heavily on consumer and business sentiment over the course of September and October, confirmed by Thursday's PMI release and Friday's GfK consumer confidence data.

This is a clear headwind for the Pound and explains why there is a consensus that the Labour government's first budget is a significant headwind to the Pound.

£50BN Extra to Play With

However, we see signs that the budget won't be an outright negative for the UK economy and Pound, as any boost to investment spending should be welcomed in the longer term.

Reeves said the additional borrowing that would be freed up by a change to the fiscal rules would not be used to fund public sector pay deals or the day-to-day functioning of government.

"This investment is not to pay for day-to-day spending or on tax giveaways," Reeves said. "Day-to-day spending will be matched by revenues."

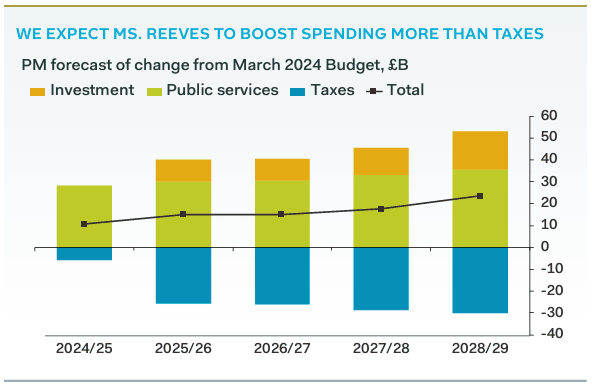

Image courtesy of Pantheon Macroeconomics.

When Liz Truss delivered her shock-and-awe budget in 2022, the market saw significant risks that the day-to-day deficit would explode, owing to unfunded tax cuts and a significant boost in spending as she sought to keep energy bills down.

The market was also wary that the plans were rapidly drawn up and bypassed scrutiny from the Budget for Office Responsibility.

Reeves needs to convince the market that day-to-day spending is in check, even if borrowing increases.

In addition, markets will need to be convinced that spending will genuinely grow the economy,

Incoming analysis shows the budget should prove to be a net 'giveaway' for the economy, with one economist saying it will boost economic growth by half a per cent in 2025.

Pantheon Macroeconomics says this means the Bank of England will have to maintain a cautious approach to cutting interest rates, ensuring rates stay higher for longer.

This is fundamentally supportive of Pound exchange rates.

How Reeves is Changing the Rules

The current debt rule requires the government to reduce public sector debt in the fifth year of forecasts produced by the Office for Budget Responsibility.

This means day-to-day spending and investment spending - two very different items on a government's budget agenda - would have to be austere.

The problem for the UK (and Europe) is that when governments are forced into cutting spending to meet debt rules, big capital projects usually get the chop first.

Can an IT system vote? Of course not. But those on benefits can.

This has created an entirely unsustainable tendency by successive governments to cut crucial projects that would genuinely boost UK productivity and give the country a shot at getting out of its low-investment bind.

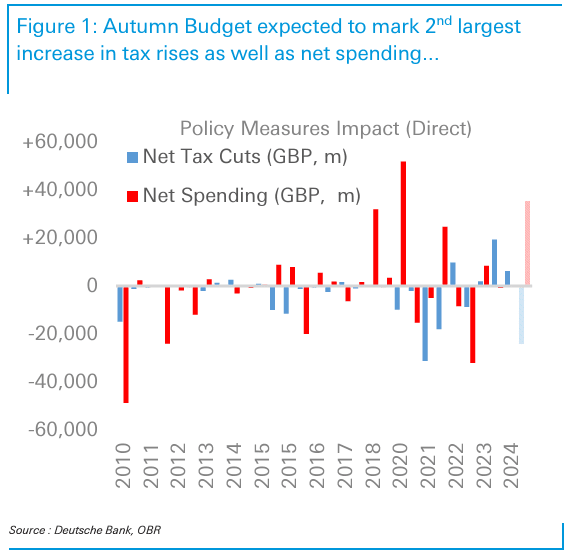

Image courtesy of Deutsche Bank.

Reeves wants to make the distinction between investment and day-to-day spending, arguing that investments will more than pay for themselves in the long run and shouldn't be a concern for markets.

To do this, it is expected the chancellor would target a measure of public sector net financial liabilities as a percentage of GDP as her new fiscal rule, a shift that would free up £53BN, according to estimates from the Institute for Fiscal Studies.

The gauge is a broader measure of the public balance sheet that includes financial assets such as student loans.

"I won’t cut capital budgets to make up for shortfalls in the day-to-day running costs of departments," said Reeves.

She explains that a new set of institutions will focus on ensuring value for money and a strategic plan to deliver infrastructure.

This includes the National Infrastructure and Service Transformation Authority, who will clear the way for the delivery of infrastructure, and the Office for Value for Money, which "will rigorously scrutinise spending," she says.

Market Reaction: GBP Capped Near-term, Bolstered Longer term

The UK will need to borrow more, even if the government wants to spend that borrowing on investments, which will push up the yield on UK government debt.

Markets will retain a sense of caution heading into the budget, as the memory of the Liz Truss bond market and currency selloff remain fresh.

This will cap GBP upside potential in the coming days.

However, if the rise in yields can be underpinned by expectations of greater economic output in the coming years, then there shouldn't be a problem for the currency.

After all, improving economic growth rates are a fundamental positive for any currency.

"Reeves' policy seems likely to improve supply rather than damage it, making a strong case for fading any yield movements based on a worries over fiscal premia," says Freya Beamish, an economist at TS Lombard.