Pound to Canadian Dollar Week Ahead Forecast: Lost Momentum

- Written by: Gary Howes

Image © Adobe Images

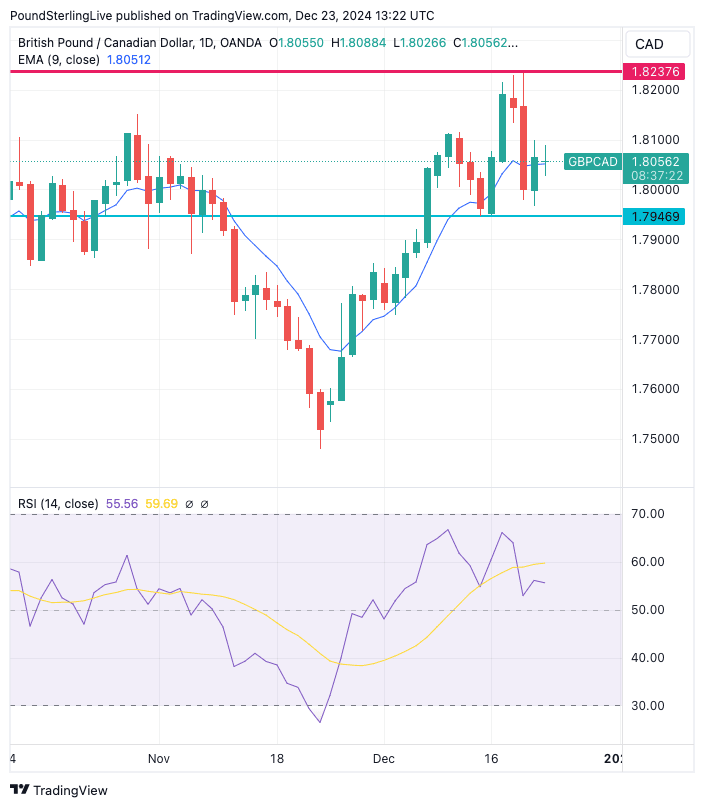

The Pound has lost steam against the Canadian Dollar and could be due a retreat to 1.7946. Bigger picture, however, is still constructive.

The Pound to Canadian Dollar (GBP/CAD) exchange rate hit a new six-year high last week at 1.8237 but has since pared some of that advance, which potentially sets the done for the next few days.

Last week's Bank of England policy decision took some steam out of the uptrend in GBP/CAD and we think this theme can play out over the remainder of the year.

GBP/CAD retains a bullish bias and could yet break to new multi-year highs early in 2025, but for now, a short-term retreat to 1.7946 can be anticipated.

Here, some support might be found that can limit any weakness.

FX enters thin market conditions with most traders on holiday, meaning that what would normally be a relatively contained move could be exaggerated.

Those watching GBP/CAD should be aware of this and seize any tactical advantages that might be forthcoming. As a rule, however, we don't see any major move being the start of a more consequential trend and mean-reverting patterns should be expected.

Keep in mind month- and year-end flows are also likely to be a feature of the coming days, which should generate random movements, but they should also be faded by traders.

"The final five trading days of 2024 are upon us and I would expect we'll start seeing year-end corporate and balance sheet related rebalancing flows start kicking in," says W. Brad Bechtel, Global Head of FX at Jefferies LLC. "There are large segments of the market that are shut down the next two weeks, and we all know that means liquidity will be thin and volumes will be low."

📈 Q2 Investment Bank Forecasts for GBP vs. CAD. See the Median, Highest and Lowest Targets for the Coming Months. Request your copy now.

So, the coming week could see some choppy action, but the important takeaway is that we will wait until 2025 before any assertive moves occur.

There is nothing of interest on the UK and Canadian data calendars over the next two weeks, although Canadian politics have become interesting and last week saw how they can impact Canadian financial markets.

"The political outlook is hardly any clearer as Friday’s cabinet reshuffle changes little for the government. The NDP said it will table a no-confidence motion when parliament resumes in late January. The Conservatives are urging an urgent recall of parliament to hold a vote before that," says Shaun Osborne, FX strategist at Scotiabank.

Prime Minister Trudeau could yet step down, allowing a Liberal party leadership contest to take place. However, Osborne notes this would likely entail the suspension of parliament "at a time when it should be all hands on deck to respond to Trump’s tariff threats."

The Canadian Dollar is meanwhile reapproaching 2020 and 2015 lows against the U.S. Dollar, and further weakness here can keep GBP/CAD on the move higher.

Bechtel says a looming change in government in Canada may not be the salve the currency needs as the fundamentals are challenging on the budget side and the Trump variability is a wild card impacting the price as well.

"The 2015 and 2020 highs were just below 1.4700 and will likely be tested in coming weeks," he says.