Pound-Euro Shakes Off PMI Disappointment, Bailey's Words Offer Support

- Written by: Gary Howes

Image © Adobe Images

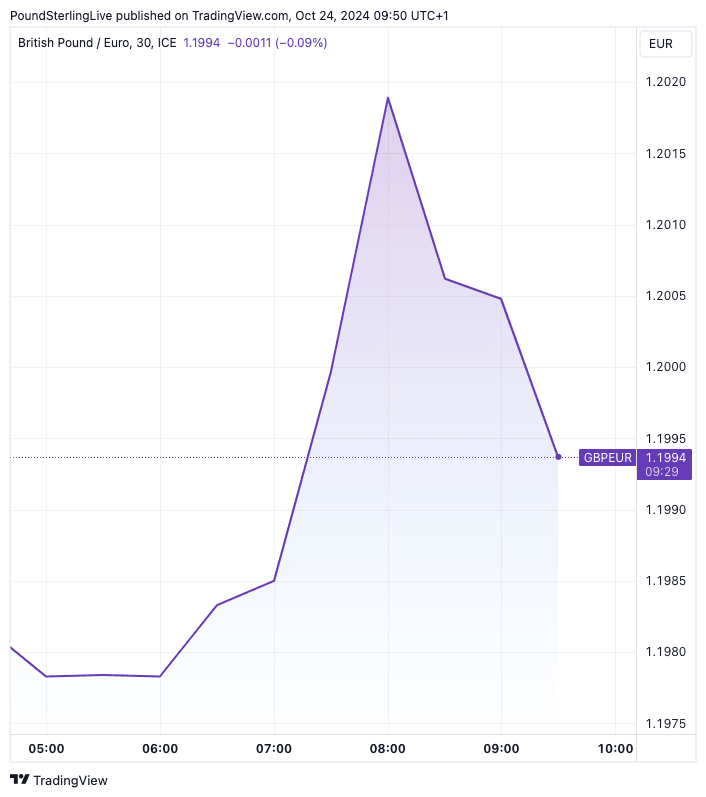

The pound-to-euro exchange rate fell after data showed the UK economy cooled in October, but weakness was short-lived, with the market instead focussing on new commentary from the Bank of England.

S&P Global's PMI survey showed the economic expansion continued across the services (51.8) and manufacturing sectors (50.3), however, momentum waned for a second consecutive month.

The Pound dropped noticeably in the wake of the release, and we think this is because the report contained some interesting developments regarding the labour market.

"Employment was a particularly weak spot, with overall staffing numbers decreasing for the first time in 2024 to date," said S&P Global.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Bank of England places great emphasis on UK employment dynamics, noting that a strong labour market is consistent with high wages, which can keep inflation elevated.

A deterioration in the labour market could, therefore, open the door to a quickening in the pace the Bank cuts interest rates.

The PMI survey hints at this possibility, which explains the weaker Pound.

"Business activity growth has slumped to its lowest for nearly a year in October as gloomy government rhetoric and uncertainty ahead of the Budget has dampened business confidence and spending. Companies await clarity on government policy," says Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

Above: GBP/EUR dipped back below 1.20 after the PMI release

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

"Worryingly, the deterioration in business confidence in the outlook has also prompted companies to reduce headcounts for the first time this year," he adds.

Despite the deterioration in confidence and employment intentions, there were other elements of the report that would urge some caution when considering whether or not to press the sell button on Pound Sterling.

Private sector firms indicated another robust rise in their average prices charged, a development that should serve as warning inflation will remain relatively stubborn.

Moreover, the rate of prices charged inflation edged up to a three-month high, helping Pound Sterling recover losses and return above the €1.20 marker.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

"The pound is also climbing, ignoring a steeper-than-forecast deceleration in purchasing manager indices," says Karl Schamotta, Chief Market Strategist at Corpay.

"Although flash PMI may have missed expectations, indeed services sentiment moderated to the slowest pace in 11 months Sterling continues to hold up as comments from BoE Governor Bailey encouraged a moderation in immediate rate cut expectations," says Jeremy Stretch, Chief International Strategist at CIBC.

Bailey said in an appearance in Washington that "disinflation is happening, I think, faster than we expected," but he qualified this 'dovish' comment with "we still have genuine questions about whether there have been structural changes in the economy."

He warned that services inflation (4.9% y/y in September) is still higher than consistent with the target, and the labour market was "probably loosening but still tight."

This latest guidance reflects ongoing caution, which can buffer Sterling.