Pound to Euro Week Ahead Forecast: Unto the 1.19s

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling has wind in its sails and further gains against the Euro are possible in the coming five days.

The Pound to Euro exchange rate powered ahead in the Monday session and set itself up for another positive week, hitting a new high at 1.1960 after the UK reported a robust set of PMI data for September that compared favourably with that of the Eurozone.

The UK Composite PMI read at 52.9 in September, which is consistent with an expansion in economic output, although the figure was down on August's 53.8. By contrast, the Eurozone saw its Composite PMI fall to 48.9 from 51, signalling the single currency bloc is entering recessionary territory.

Looking ahead, S&P Global said September's data pointed to another month of robust new business gains in the UK, led by strengthening order books across the service economy.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Eurozone PMI data suggests that the recent Olympic games might have provided a temporary boost, but this is now behind us. The reduction in overall business activity was driven by a deepening downturn in the eurozone manufacturing sector, where production decreased for the eighteenth month running and at the fastest pace in the year-to-date.

Although services business activity continued to rise, the latest expansion was only marginal and the weakest since February. The Eurozone meanwhile reported easing cost pressures and a downturn in employment intentions, signalling the European Central Bank might have to consider a consecutive interest rate cut next month. Rising odds of another rate cut can weigh on European bond yields, and the Euro.

Fresh gains in GBP/EUR follow a 0.75% advance last week, making for the biggest weekly advance since November 2023. Sterling was buoyed by a 'hawkish' Bank of England decision, robust inflation and retail sales data, as well as rising global stock markets.

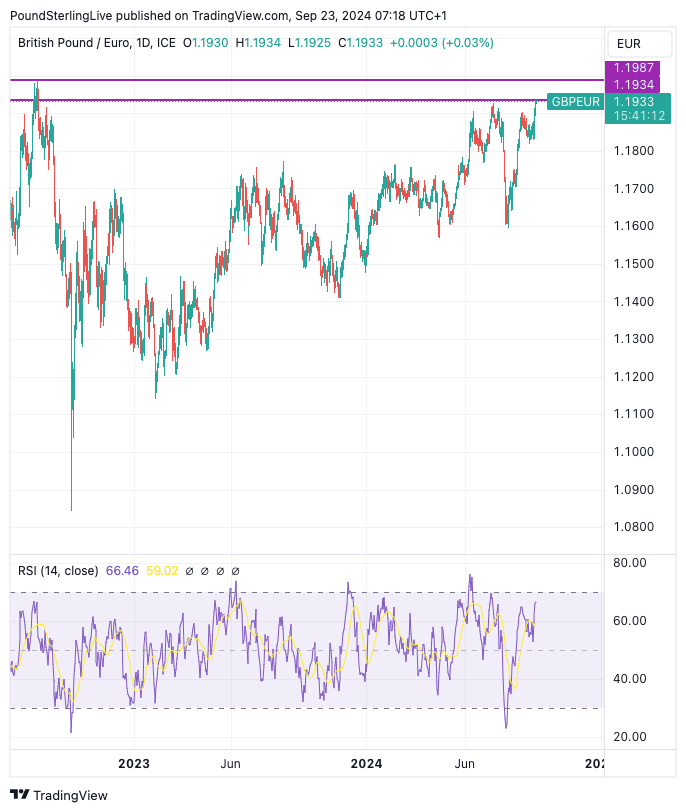

Above: GBP/EUR at daily intervals showing the 2024 high and the 2022 resistance line at 1.1987.

From a technical angle, this gives GBP/EUR upside momentum and we look for further gains now that the major calendar risks of the previous week have passed. That these risks fell in Sterling's favour will only underscore the bullish setup that we think can carry the market towards 1.20.

Bear in mind, however, that this pair can move slowly and is prone to long periods of consolidation, so we would not be surprised to see some near-term retracements of the recent strength. But for now, weakness is seen as being counter-trend in nature and will likely be bought.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

From a technical perspective, momentum is to the upside, with the RSI at 62 and pointing higher, while the pair remains above all its key moving averages. The significant resistance level of 1.1905 (EUR/GBP at 0.84) was also breached and held on a daily close basis last Friday.

If the market can consolidate above this level then we might just have entered a new and higher range than seen in recent years. The next upside target is set at 1.1987, which is the August 2022 high, where the summer's rally met resistance and failed.

The remainder of the week will be quieter with Germany's IFO business climate due on Tuesday. However, it will be the global picture that will be more consequential for GBP/EUR, we think.

This is because the exchange rate has shown itself to be sensitive to global investor sentiment, with pullbacks in stock markets tending to weigh. Should the current pro-risk bull run continue, GBP/EUR will remain supported, regardless of this week's eurocentric data outcomes.

The Federal Reserve's above-consensus 50 basis point rate cut provided markets with a fresh impetus last Wednesday, and expectations for further cuts in the coming months will likely be verified by a number of speeches from Fed decision-makers. This can keep the pro-risk / low-volatility setup in tact, which is ultimately supportive of Sterling against the likes of the Dollar, Euro and Franc.