Pound Sterling Chases New 2024 Highs Following Strong Retail Sales Print

- Written by: Gary Howes

Image © Pound Sterling Live

The British Pound was bid on Friday morning after UK retail sales beat expectations. However, a disappointing consumer survey signals the government's downbeat tone on the economy and nation's finances is having a chilling effect.

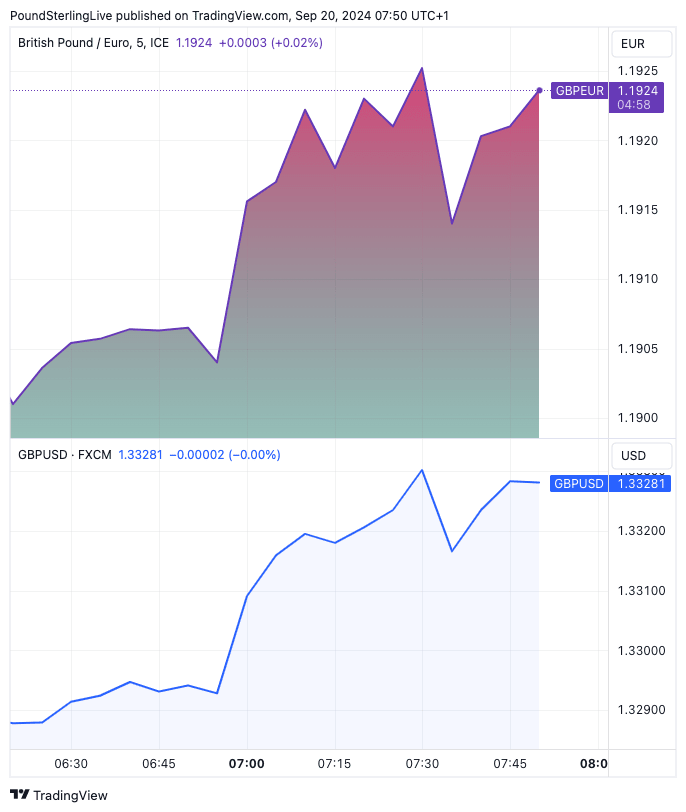

The GBP to EUR exchange rate rose to 1.1925, putting it just three pips away from the 2024 high, after the ONS said UK retail sales volumes surged 1.0% month-on-month in August, doubling July's figure and easily surpassing expectations for 0.4% growth.

The annual rate of growth rose to 2.5% from 1.5% and beat expectations for 1.4%. The strong reading justified the Bank of England's decision on Thursday to adopt a cautious approach to cutting interest rates any further and helped the Pound to Dollar exchange rate extend its run higher to 1.3330.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"Shoppers continued to loosen the purse strings in August. Warmer weather, summer sales and growing consumer optimism combined to help boost spending," says Tom Youldon, a partner at McKinsey & Company. "Stronger performance in textile, clothing and footwear stores reflect back to school and end of season sales and may contribute to some greater positivity in retailer revenue forecasts."

"Stronger sales growth in August likely reflects the improving fundamentals too. Year-over-year retail sales growth has been gradually trending up all year—with the official ONS data broadly matching a deflated version of the BRC Retail Sales survey as our chart below shows—and all sectors apart from ‘other non-food stores' saw sales volumes rise in August," says Robert Wood, Chief UK Economist at Pantheon Macroeconomics.

Above: GBP/EUR (top) and GBP/USD at five-minute intervals.

Risks Ahead as Consumer Confidence Slides

The GfK Consumer Confidence survey - the country's longest-running and most important survey of consumer sentiment - was also released on Friday. It reported a big fall in confidence right across the board in September, with the headline index down seven points.

Consumer confidence will be important in determining whether the uplift in retail sales can continue. Headwinds include the Autumn budget, which could be a dreary affair with the Government warning it will need to raise taxes to improve its financial position. Neil Bellamy, Consumer Insights Director at GfK says strong consumer confidence matters because it underpins economic growth and is a significant driver of shoppers' willingness to spend.

The new government has been preparing the nation for a tough budget in October that will see tax rises and spending cuts. The messaging from Prime Minister Keir Starmer and Chancellor Rachel Reeves has been downbeat and econonomists have warned the government risks talking the economy down.

"Words matter, and the new government’s persistent downbeat tone around the economy and the upcoming budget could become a self-fulfilling prophecy," says Matt Britzman, senior equity analyst at Hargreaves Lansdown.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

The Bank of England's decision to hold interest rates on Thursday will also disappoint consumers hoping for lower interest rates, however, money markets show investors are fully expectant of the next rate cut to fall in November.

"The next few months are pivotal. If inflation continues to hover close to the 2% mark, consumers may start to experience a modest increase in purchasing power over the crucial golden quarter. But with higher energy bills on the horizon from October, many will be mindful of making discretionary purchases and continue to look for opportunities to trade down," says Youldon.

The Pound is nevertheless making hay from the Bank of England's decision to keep interest rates unchanged and the strong retail sales figures are offering a fresh injection of buying interest ahead of the weekend. However, the strong performance could be challenged by a consumer-lead slowdown in the economy.

"Looking ahead, we see scope that GBP can continue its slow burning recovery," says Jane Foley, Senior FX Strategist at Rabobank. "That said, the budget may complicate this outlook. Not only may it sour investor sentiment, but a hefty round of tax hikes could impact market expectations regarding the pace of BoE easing."