Pound Sterling Boosted by the Bank of England's Cool Hand

- Written by: Gary Howes

File image of Bank of England Goveror Andrew Bailey. Image © Pound Sterling Live, Still Courtesy of Bloomberg TV.

The British Pound spiked after the Bank of England kept interest rates unchanged and said there was no rush to cut again.

The 8-1 vote to maintain Bank Rate at 5.0% signalled the Monetary Policy Committee was in agreement on the need to keep interest rates unchanged. Had more members voted for a cut, the Pound might have come under pressure, as this would have been a signal that the MPC was looking at providing further policy support.

"In the absence of material developments, a gradual approach to removing policy restraint remains appropriate," said the minutes to the meeting.

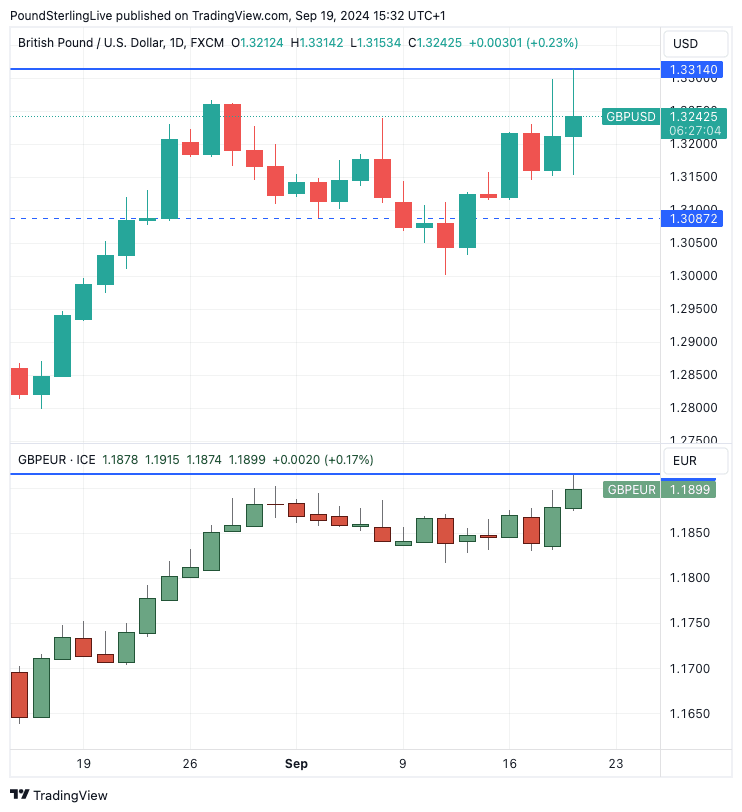

The Pound to Euro exchange rate jumped to 1.1915 in the wake of the decision and the Pound to Dollar exchange rate scaled a a new two-and-a-half-year high at 1.3314.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Although there was no official press conference following the decision, it has become something of a tradition for the Bank's Governor to deliver unscheduled comments to the press following these inter-MPR decisions.

Andrew Bailey said interest rates are on a "gradual path down," but the Bank needs more supportive economic evidence to make further cuts.

"I think we’re now on a gradual path down. That’s the good news. I think interest rates are going to come down. I’m optimistic on that front, but we do need to see some more evidence. We need to see that sort of residual element now fully taken out... to keep inflation sustainably at the 2% target," he said.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Bank of England's stance means the UK will likely command higher interest rates relative to the other major economies for some time, which is attractive to international investors seeking higher returns. The inflow of capital can boost the value of the Pound.

"The vote composition was slightly more hawkish than expected at 8:1, with the statement emphasising easing ‘gradually over time’. Service inflation is the biggest risk to the BoE, which could push CPI above 2.5% into the end of the year. This is a reason for the BoE to move slow, at an expected pace of one 25bps cut per quarter," says Jeremy Stretch at CIBC Capital Markets.

Money market pricing shows investors are positioned for an interest rate cut in November, at which point the Bank will also issue its latest forecasts.

Ahead of Thursday's suspicion market pricing for a Thursday cut had risen as investors reckoned the Bank might hasten the pace in light of the Federal Reserve's bumper 50bp cut, delivered on Wednesday.

Above: GBP/USD (top) and GBP/EUR.

But the guidance from the Bank dispels the notion the Bank will be tracking the Fed, which is another 'hawkish' outcome from today's decision. The Bank looks to be lazer-focussed on UK inflation, and until it is clearly returning to the 2.0% target sustainably, an accelerated pace of cuts is unlikely.

"Absent a material retreat in the data, we can expect one more cut this year, in November. Given relative BoE inertia we would expect GBP/USD to remain well supported although we be wary of chasing here in the short term. We would look for GBP appetite in crosses such as EUR/GBP," says Stretch.

Money market pricing shows investors are positioned for an interest rate cut in November, at which point the Bank will also issue its latest forecasts.

Ahead of Thursday's decision, market pricing for a Thursday cut had risen as investors reckoned the Bank might hasten the pace in light of the Federal Reserve's bumper 50bp cut, delivered on Wednesday.

But the guidance from the Bank dispels the notion the Bank will be tracking the Fed, which is another 'hawkish' outcome from today's decision. The Bank looks to be lazer-focussed on UK inflation, and until it is clearly returning to the 2.0% target sustainably, an accelerated pace of cuts is unlikely.

"Absent a material retreat in the data, we can expect one more cut this year, in November. Given relative BoE inertia we would expect GBP/USD to remain well supported although we be wary of chasing here in the short term. We would look for GBP appetite in crosses such as EUR/GBP," says Jeremy Stretch, a foreign exchange strategist at CIBC Capital Markets.

CIBC looks for look for a break of 0.8383 in EUR/GBP to open the way for an extension towards 0.8340. In GBP/EUR terms, this represents a break higher through 1.1930 to 1.1990.