UK Economy Outperforming Bank of England's Expectations: Panmure Gordon

- Written by: Gary Howes

Image © Adobe Images

Incoming data shows the UK economy is outperforming the Bank of England's most recent round of forecasts, according to a leading economist.

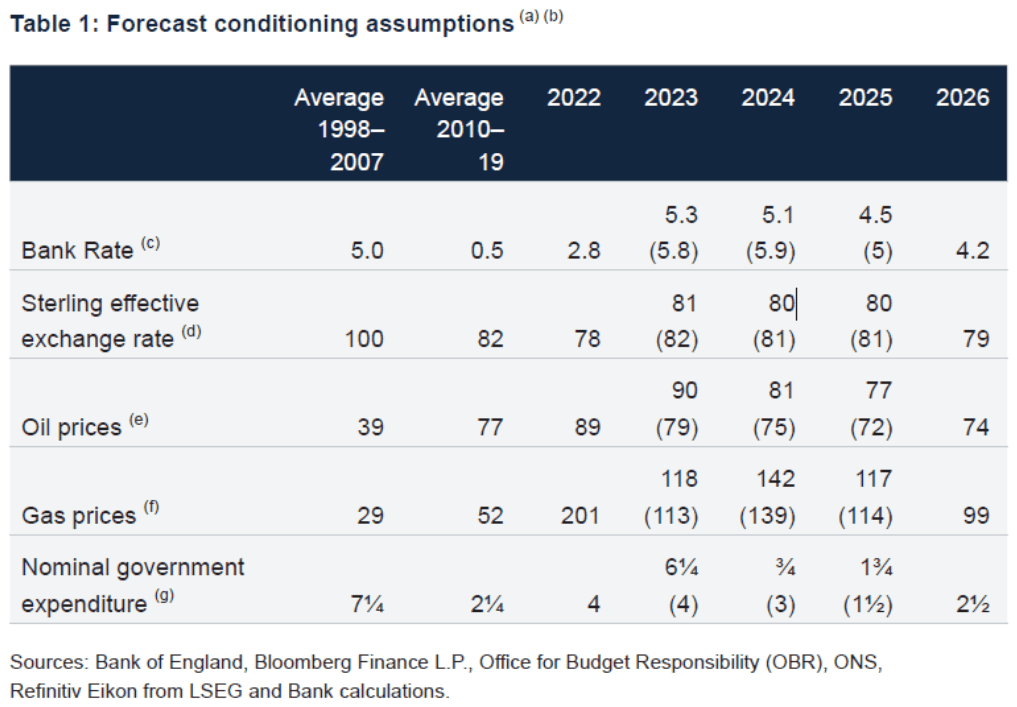

Simon French, Chief Economist at Panmure Gordon, says just one month on from the release of the Bank of England's most recent set of forecasts, "already ALL conditioning assumptions used in the Nov forecast (that saw no GDP growth in 2024) are, mark-to-market, too pessimistic."

The developments point to the Bank of England keeping interest rates at elevated levels for longer than the market - and the Bank itself - might have anticipated as recently as November.

French says if the economy continues on its current path, "there will be more criticism heading the Bank's way".

The Bank of England's conditioning assumptions, referred to by French, "are a big part of the CPI & GDP forecasts, and these have moved a lot in one month," he explains.

Above image courtesy of the Bank of England, Panmure Gordon.

French says Bank Rate was seen averaging 5.1% in 2024 in the Bank's November Monetary Policy Report, but he says financial markets are calling bluff (for all major central banks), and they now see 4.8% for the year.

Global markets have increased bets for interest rate cuts at the Bank of England and the other major central banks over recent weeks (some more than others, as per the fall in the Euro in response to an aggressive rise in bets for ECB rate cuts).

French says the easing in money market pricing loosens financial conditions in the UK (and elsewhere) in real-time, which is reflected in how forward swaps are pricing UK debt products.

French notes the Pound is stronger, with the trade-weighted Sterling Exchange rate now more than 2% higher at 82, which will mute the imported inflation impact into next year as less favourable currency hedges from the fourth quarter of 2022 roll off.

Another deflationary pillar supporting the UK economic outlook is the ongoing fall in oil prices.

"Oil prices have moved sharply lower to average ~$70/bbl across the 2024 curve - having been at $81/bbl at the Nov MPR. This has clear passthrough benefits to expected transport CPI, but also the GDP deflator, which is the big suppressant on the Bank's real GDP estimates," says French.

On energy, he notes UK gas prices are now (for the 2024 curve) at their lowest in 22 months at 106p/therm. This is down from 142p/therm in late October.

"This will have a big downward impact on Energy Price Cap estimates from Q2 24 onwards," says French.

The government is also helping, with the Panmure Gordon economist saying the recent Autumn Statement was stimulative for consumers and businesses.

"Overall this is encouraging and suggests if you were to run a real-time update to the Bank's economic model (on today's assumptions), you would get materially more growth in 2024 than output in the November 2023 forecast. We tick with our view the UK economy will grow by 1.25%," says French.

The Bank of England, by contrast, says GDP will be "broadly flat," with zero growth projected in 2024, down from the 0.5% expansion previously expected.