Pound Sterling Welcome's Hunt's Giveaways

- Written by: Gary Howes

Above: Chancellor Jeremy Hunt prepares for the Autumn Statement 2023. Picture by Kirsty O'Connor/HM Treasury.

The British Pound can benefit as new tax cuts and increased spending on benefits by the government lean against market expectations for Bank of England interest rate cuts, according to analyses that follow the government's latest budget update.

UK Chancellor Jeremy Hunt announced a combination of increased spending and lower taxes, amounting to a net giveaway of £14.3BN in the coming fiscal year, driven primarily by a 2.0% cut to the National Insurance tax rate.

"We think some looser fiscal policy will be welcomed by sterling at this juncture," says Chris Turner, head of FX analysis at ING Bank.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Capital Economics says the smaller fiscal squeeze could boost GDP growth in 2024/25 relative to expectations by about 0.2%, which, at the margin, could mean inflation is a little higher than otherwise.

"There is a possibility that tax cuts will trigger some GBP gains, as it may lead some market participants to expect less BoE easing next year as a result," says George Vessey, Lead FX Strategist at Convera.

For the Pound, what matters is how these policy changes support inflation in the coming months, as this will have implications for the future of interest rate settings at the Bank of England.

Should interest rates be kept higher for longer, the Pound can be supported.

"A smaller fiscal squeeze may mean inflation is a bit higher than otherwise, which supports our view that the Bank of England won't cut interest rates until late in 2024 rather than in mid-2024 as widely expected," says Paul Dales, Chief UK Economist at Capital Economics.

Track GBP with your own custom rate alerts. Set Up Here.

Since August, the Pound had steadily declined against the Euro and other major currencies as markets lowered expectations for further Bank of England rate hikes and raised expectations for rate cuts in 2024, mainly in response to signs inflation was falling.

But this trend of declining rate expectations might have reached its limits, partly due to expectations that recently announced fiscal plans at the Treasury support inflation.

Weakness in the Pound could be limited from here if rate cut bets retreat.

"Markets could still try to assess how inflationary upcoming tax cuts could be for the UK economy and whether this could temper BoE easing prospects for next year. The GBP may welcome any eventual rebound in interest rates," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

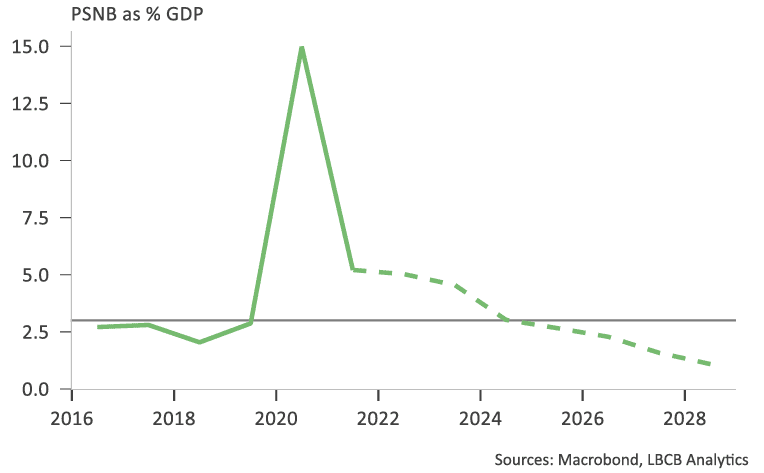

Above: Public sector net borrowing comfortably meets the fiscal target. Image courtesy of Lloyds Bank.

The Pound to Euro exchange rate was largely unchanged on the day of the Autumn Statement, suggesting there were few surprises. But the pair had risen by over half a per cent the day prior, thanks in part to news the government had accepted a recommendation to boost the minimum wage by an inflation-beating 9.8%.

Another key element of the Autumn Statement was the tax break afforded to businesses, whereby they can limit their taxable profits by deducting the value of investments.

"We think that a slightly more growth-oriented budget, which delivers larger-than-expected tax cuts and a focus on supporting households during the elevated cost of living, may actually be greeted positively by markets," says Matthew Ryan, Head of Market Strategy at global financial services firm Ebury.

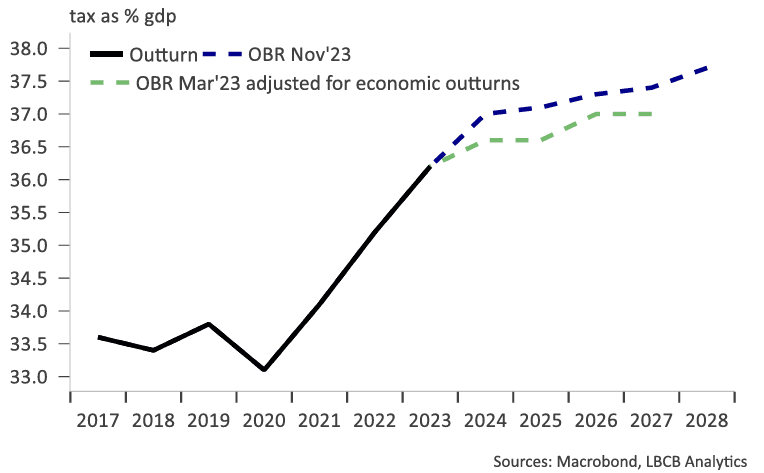

Above: Tax as a share of GDP is expected to continue to rise. Image courtesy of Lloyds Bank.

Chancellor Hunt was able to afford giveaways thanks to the Office for Budget Responsibility (OBR) lifting its growth forecasts, which boosts the expected income that will be earned via taxes.

The ONS recently revised higher its estimated size of the UK economy, allowing the OBR to forecast the economy will be about 5.5% bigger at the end of the forecast period than it previously thought.

This is even as the OBR revised down its forecast for real GDP growth in 2024 from 1.8% to 0.7%.

It is nevertheless important to emphasise that UK fiscal policy will continue to be squeezed over the coming years, even if by less than previously expected. Capital Economics estimates the squeeze amounts to £55.9bn, or 2.1% of GDP, in 2024/25.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes