Schnabel Puts ECB Cuts on the Table

- Written by: Gary Howes

Above: File image of ECB Board Member Isabel Schnabel Image © European Central Bank

A prominent member of the European Central Bank's rate-setting committee won't rule out an interest rate cut occurring in the first half of 2024.

Isabel Schnabel, Member of the Executive Board of the ECB, said the most recent inflation data from the Eurozone "was a very pleasant surprise" and that any further interest rate hikes were "rather unlikely."

But for financial markets, the end of the ECB interest rate hiking cycle is well known and the more pertinent question is when will the first cuts fall. On this topic, Schnabel did not rule anything out.

"Am I reading it correctly that you're not ruling out a rate cut before mid-year then?" An interviewer asked Schnabel. Her response didn't rule cuts out, as the ECB remains "data dependent."

"Can we talk about cuts now? Judging from today’s interview to Isabel Schnabel, the most influential hawkish ECB policymaker, the answer is yes," says Davide Oneglia, an analyst at TS Lombard.

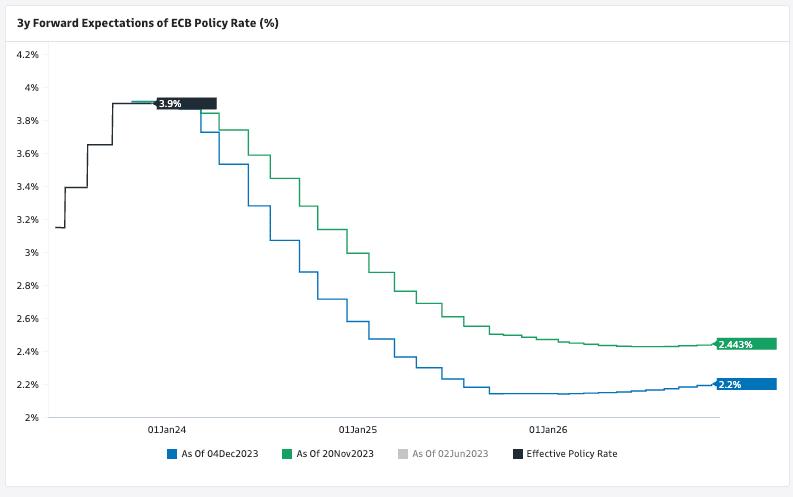

Above: Market-implied expectations for the future of ECB interest rates, relative to Nov. 20.

Schnabel was talking to an in-house ECB reporter, ensuring these were not unguarded comments but an official line of communication from the ECB.

"A remarkable interview touching on all the hot topics," says Frederik Ducrozet, Head of Macroeconomic Research at Pictet Wealth Management. "The ECB pivot is in".

A central bank pivot is a financial parlance for when a central bank reverses its policy stance.

"There is now 140bp of easing priced in for 2024, with 7bp of cuts added overnight. The main catalyst for the rates move was rhetoric from the ECB’s Isabel Schnabel. Ordinarily hawkish, she said further rate hikes are unlikely and, rather than ruling out rate cuts in H1 24, she said policymakers should be cautious about signalling policy that far out," says Daragh Maher, Head of FX Strategy at HSBC in New York.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Euro exchange rates fell last week after money market pricing showed investors had brought forward their expectations for the timing of the first ECB rate cut to spring 2024. This was after all components of Eurozone inflation fell further than investors and the ECB had expected.

The expectation shift was reflected in a widening in bond yield differentials in favour of the Pound, Dollar, and other major currencies.

Schnabel had a chance to push back against evolving expectations for rate cuts, but her circumspect answers won't do anything to shift the market's dials.

"Markets are pricing an early spring rate cut but the ECB has guided for steady rates for several quarters. How do you view this discrepancy?" Schnabel was asked.

She responded that markets are confident that inflation will come down rapidly, pricing early and "very large rate cuts next year".

"Central banks are more cautious, and I would argue they have to be more cautious. After more than two years of above-target inflation, we need to err on the side of caution," said Schnabel.

The ECB's official line is that key policy rates must remain sufficiently restrictive for as long as necessary to bring inflation back to its 2% target sustainably.

Schnabel says this should happen no later than 2025.

According to ECB staff projections, the current level of restriction is sufficient to bring inflation back to target within that time frame.

"Transmission is working – lending growth is slowing, the economy is weakening and inflationary pressures are easing. We are right on track," says Schnabel.

She warns the Eurozone has witnessed "very strong wage growth and weak or even falling productivity, leading to a sharp increase in the growth of unit labour costs."

"This is why we look very closely at services inflation in particular, which gives us a good indication of whether this disinflationary process is sustained. We’re going to watch upcoming wage agreements very closely. This will certainly also matter for our monetary policy decisions," explains Schnabel.

Economists at HSBC are at odds with markets, saying the first rate cut will only come in 2025 because wage growth pressures over the coming months will be entirely inconsistent with a sustainable fall in inflation back to 2%.

Although the ECB will be watching wage growth, Schnabel's comments suggest any downside prints in the data could be enough to trigger a pivot.