Dollar Rises on Biggest PMI Rise Since January 2023

- Written by: Sam Coventry

Image © Adobe Images

Dollar exchange rates rose across the board after the U.S. services PMI beat expectations and eased fears that the economy was sliding into recession.

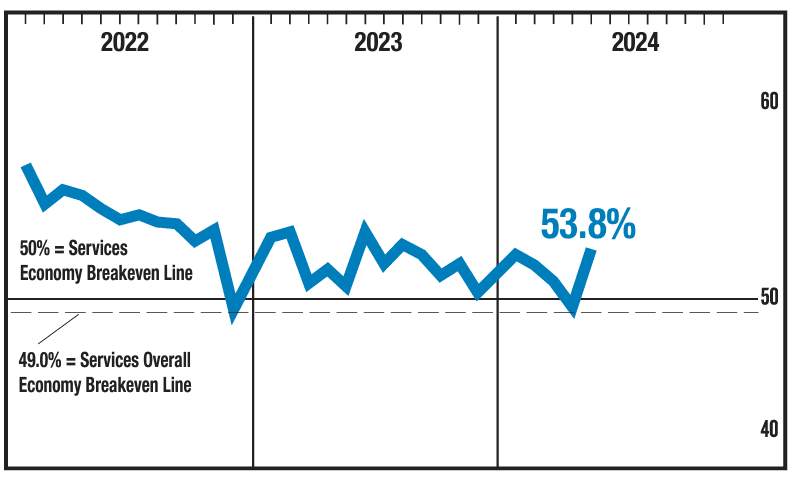

The Pound to Dollar exchange rate saw a notable drop to 1.2763 - from 1.2790 prior - after the ISM reported its services PMI read at 53.8% in May, ahead of expectations for 50.8% and notably higher than April's 49.4%.

The Dollar fell on Monday when ISM's manufacturing PMI disappointed and raised fears the U.S. economy was falling into recession. The services sector is far larger than that of manufacturing, meaning fears that the U.S. economy is experiencing a rapid slowdown are overblown.

We have heard from noted economists over recent days of signs the U.S. economy is finally slowing down under the weight of higher Federal Reserve interest rates, potentially paving the way for rate cuts in the coming months. But the ISM says the May Services PMI indicates the overall economy is growing for the 17th consecutive month.

A particular area of concern in the disappointing manufacturing PMI from earlier in the week was a sharp fall in the new orders index, which suggested further weakness ahead. But the same index in the service PMI showed no such concerns expanding in May for the 17th consecutive month: the New Orders Index read at 54.1%, which is 1.9 percentage points higher than the April reading of 52.2%.

"The leap in the headline ISM services index was much better than we expected; it’s the biggest month-on-month move since January 2023," says Oliver Allen, Senior US Economist at Pantheon Macroeconomics.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The services PMI print will shore up the Dollar ahead of Friday's all-important labour market report that should help give a more decisive steer on the economic outlook.

"The labour market data will provide new signals about interest rate expectations. It is justified to say that the labour market in the United States is starting to return to normal," says Rania Gule, Market Analyst at XS.com.

Futures pricing data for Federal Reserve rate hike expectations show markets hold a 65% chance of an interest rate cut in September from current levels. If Friday's labour market data comes in below expectations, expect this to rise.

Such an outcome would reboot the Pound's rally against the Dollar.