Dollar Sold After Manufacturing PMI Raises Slowdown Fears

Image © Adobe Images

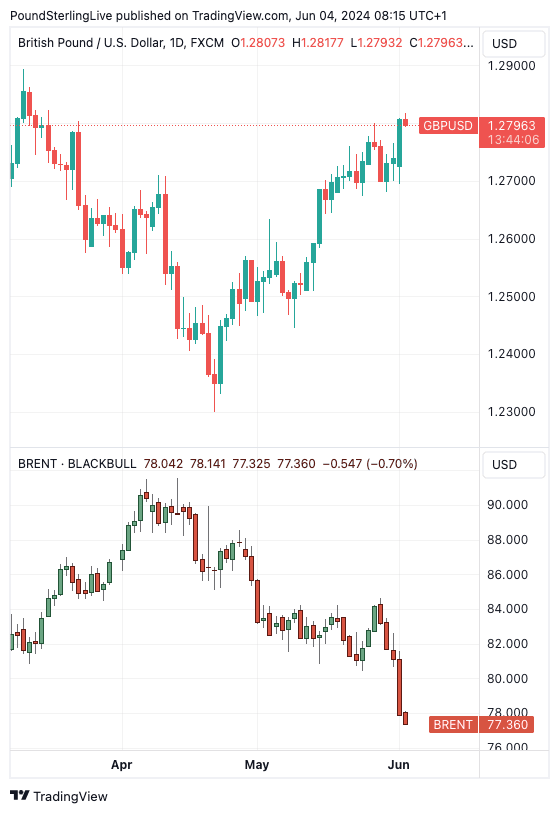

The Pound to Dollar exchange rate hit its highest level in 12 weeks on Tuesday amidst renewed USD weakness and analysts see potential for further advances if upcoming U.S. job figures disappoint.

The Dollar was sold following a soft domestic data print while a sharp decline in oil prices also weighed.

"News that the ISM manufacturing survey fell below the 49 handle in May increased pressure on the greenback across the board, driving the US Dollar Index (DXY) back to 104. Thus, EUR-USD and GBP-USD accelerated their rebound back above 1.09 and 1.28, respectively," says Roberto Mialich, FX Strategist at UniCredit Bank.

The ISM Manufacturing PMI fell to 48.7 in May from 49.2, undershooting expectations for 49.6. The Prices Paid component of the report read at 57, down from 60.9 and below estimates for 60. "The US ISM manufacturing report came in generally weak, echoing the message pencilled in by last week’s soft US PCE report and Chicago PMI and offsetting the picture from the May manufacturing PMI," says Evelyne Gomez-Liechti, Rates Strategist at Mizuho.

"The dollar is starting to show signs of weakness," says Chris Turner, head of FX research at ING Bank.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Oil prices meanwhile dipped by nearly 4% as investors reacted to news OPEC would begin raising oil production from October. Falling oil prices are disinflationary and will bolster views the Federal Reserve can cut intrest rates later in the year. Furthermore, because commodities are priced in dollars, any significant selloffs can weigh on the currency.

Elsewhere, the Atlanta Federal Reserve's GDPNow estimate for GDP growth in Q2 dropped sharply from 2.7% to 1.8%, which suggests below-trend growth has continued through the 1H of this year.

Above: GBP/USD at daily intervals and oil prices (lower panel). Track GBP/USD with your own custom rate alerts. Set Up Here

"The latest developments have provided further evidence that the U.S. economy has lost upward momentum at the start of this year which is beginning to put a dampener on U.S. dollar strength," says Lee Hardman, FX strategist at MUFG Bank.

The U.S. labour market is front and centre this week, with eyes now turning to the JOLTS report, which will give a sense as to how new job openings are faring.

ING's Turner points out that the Federal Reserve places emphasis on this report and a soft print could send the Dollar to new lows.

"Today's U.S. JOLTS job openings data could determine whether recent dollar losses are just idle range-trading or the start of an important new trend. We certainly see downside risks to the dollar today," says Turner.

Consensus looks for a fall to 8400k in April, down from 8488k in March. The quit rate is expected to fall to 2% from a peak of 3% over previous years. "That should signal a further easing of wage pressures," says Turner.