Recession Fears are Rising Again

- Written by: Sam Coventry

Image: Doug Turetsky. Sourced: Flikr, licensing: CC 2.0.

US growth expectations have dramatically decreased, raising concerns about an impending recession, says Albert Edwards, Société Générale SA's chief global strategist.

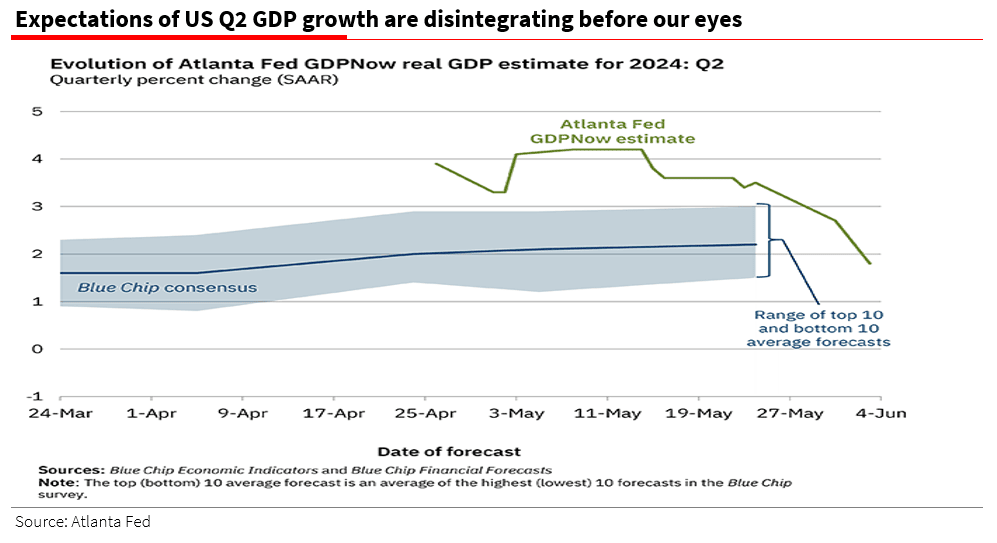

The call comes amidst a downturn in U.S. data that saw the Atlanta Fed's closely watched GDPNow projection for Q2 2024 nearly halve from 3.4% to 1.8% within just one week, following downward revisions to Q1 GDP to 1.3%.

“What’s going on? Surely that recession which almost everyone has given up on isn’t about to hit?” Edwards questions, pointing to the unexpected weakness in May’s manufacturing ISM index, which fell to 48.7 from 49.2 in April.

Image courtesy of Societe Generale.

While some dismissed this data as an anomaly, Edwards underscores that it coincides with weak consumption and trade deficit figures, each shaving 0.5% off Q2 GDP growth estimates.

The market’s reaction to these developments is crucial. "Markets do not move on outcomes alone, but on how they differ from expectations as signalled in market pricing," Edwards explains.

In early 2023, almost every economist predicted a US recession, but to widespread embarrassment, this did not materialise. By early 2024, he notes few economists remained committed to their recession forecasts as macroeconomic data painted a more optimistic picture, suggesting a ‘No Landing’ scenario where the Fed might even resume rate hikes.

This shift in sentiment, combined with rising analyst optimism on earnings and inflation trends, pushed major equity indices to all-time highs. However, Edwards warns that equity bear markets, defined by declines of 30% or more, typically occur during recessions. "Proper equity bear markets only really occur in recessions and so that is what equity investors fear most," he notes, emphasising the potential risks as expectations of continued economic recovery persist.

Edwards says US authorities have been adept at avoiding typical macro-triggered recessions since the 2008 Global Financial Crisis through easy monetary policies and extreme fiscal expansion. Yet, Edwards cautions that investors’ luck might be running out. “Even if Armageddon looms, I guarantee the investment air will be filled with the sound of the bulls singing their soft-landing siren songs,” he warns, sceptical that Fed rate cuts will prevent significant market downturns.

The upcoming US election and geopolitical risks add further uncertainty. Both political campaigns are focusing on tariffs rather than a weak dollar policy, making the dollar a strong hedge against geopolitical deterioration. Despite potential Fed easing, Edwards argues that as long as the dollar remains a high yielder, the dollar’s strength will be resilient.