GBP/USD Rate Rights Capsized Ship and Lives to Die Another Day

- Written by: James Skinner

“Going forward, our bias is that the pound is likely to follow a W-shaped recovery. Our technical indicators suggest cable is ripe for a pullback" - BCA Research.

Image © Adobe Images

The Pound to Dollar exchange rate righted a capsizing position in midweek trade after falling into a cluster of technical support levels on the charts but a growing collection of risks and uncertainties looms on the horizon and might yet invite fresh losses in the days or weeks ahead.

Dollars were bought widely on Wednesday with few exceptions though the Pound held up comparatively after its fall was frustrated near a Fibonacci level on the charts, though in the G10 bucket the Norwegian Krone outperformed Sterling alongside the Australian and Canadian Dollars.

“GBP continues to be more resistant to these USD upswings,” says Brad Bechtel, global head of FX at Jefferies.

“I would only sell the GBP/USD on a break and close below the 50dma but there is a lot of support in that region,” he adds.

Meanwhile, in the G20 grouping the Hong Kong Dollar, Brazilian Real, Indonesian Rupiah and Russian Rouble were all seen at the top of the board carrying gains over the Pound and Dollar, though employment figures released on Tuesday were indicative of an uncertain outlook for Sterling.

Above: GBP/USD at 15-minute intervals with Fibonacci retracements of November rally indicating possible support for Sterling.

Above: GBP/USD at 15-minute intervals with Fibonacci retracements of November rally indicating possible support for Sterling.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Tuesday’s Office for National Statistics figures showed unemployment ticking higher in April following a rise in unemployment welfare claims and a fall in the number of payrolled employees, taking economists by surprise and potentially offsetting the significance of an April uptick in pay growth.

It’s the pay growth part of that equation the Bank of England (BoE) cares about most, however, so the data has uncertain implications for the interest rate outlook going into the release of the next week’s inflation number.

“The latest figure of 10.1% for March was 0.8 percentage higher than we expected,” says Governor Andrew Bailey, in a Wednesday speech.

“We do, however, have good reasons to expect inflation to fall sharply over the coming months, beginning with the April number to be released on 24 May,” he told a British Chambers of Commerce conference.

Most central banks generally agree that changes in workforce pay can be a prominent driver of inflation due to their effect on corporate pricing intentions, but that this can be managed in the context of an inflation target, and by using adjustments to interest rates.

Above: GBP/USD at daily intervals with 50-day moving average and Fibonacci retracements of November rally indicating possible support for Sterling. Shown alongside other pairs.

Above: GBP/USD at daily intervals with 50-day moving average and Fibonacci retracements of November rally indicating possible support for Sterling. Shown alongside other pairs.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The BoE lifted its forecasts for inflation last week along with projections for economic growth, which no longer envisage a recession but do foresee the inflation rate following a sligthly more bumpy path back to the 2% target.

Next week’s inflation report is likely to be an important determinant of the outlook for the Pound, though its correlation with inflation has been inconsistent in recent years, and particularly since the return of meaningful inflation.

Inflation had spent the best part of a decade below the two percent target but rose sharply and remained higher during the latter stage of the pandemic and following the full-scale invasion of Ukraine last year.

“The bottom line is that while the UK has historically had much higher inflation than other G10 countries, the headline print could fall much faster from the current level of 10.1%, but settle at a higher level, than the BoE expects,” says Chester Ntonifor, the foreign exchange strategist at BCA Research.

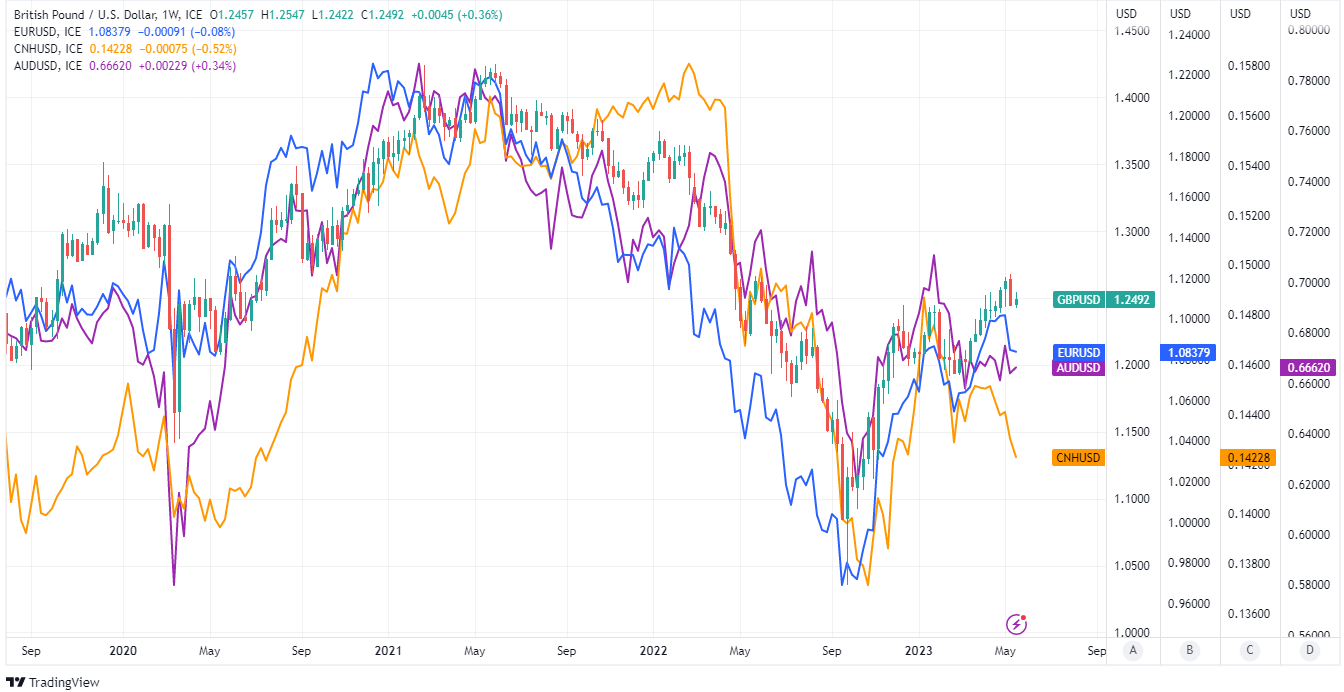

“Going forward, our bias is that the pound is likely to follow a W-shaped recovery. Our technical indicators suggest cable is ripe for a pullback, after a 20% rally from 1.04 to 1.25 (Chart 5, panel 1). We expect this pullback to take cable to around 1.20,” Ntonifor adds in a Friday research briefing.

Above: GBP/USD at weekly intervals with other pairs. Click image for closer inspection.

Above: GBP/USD at weekly intervals with other pairs. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks