Pound Falls After UK Wage and Jobs Report Hints a Turning Point has Been Reached

- Written by: Gary Howes

- Momentum in wages starting to slow

- As unemployment rate unexpectedly rises

- Markets lower Bank of England rate hike expectations

- This in turn is weighing on the Pound

Image © Adobe Images

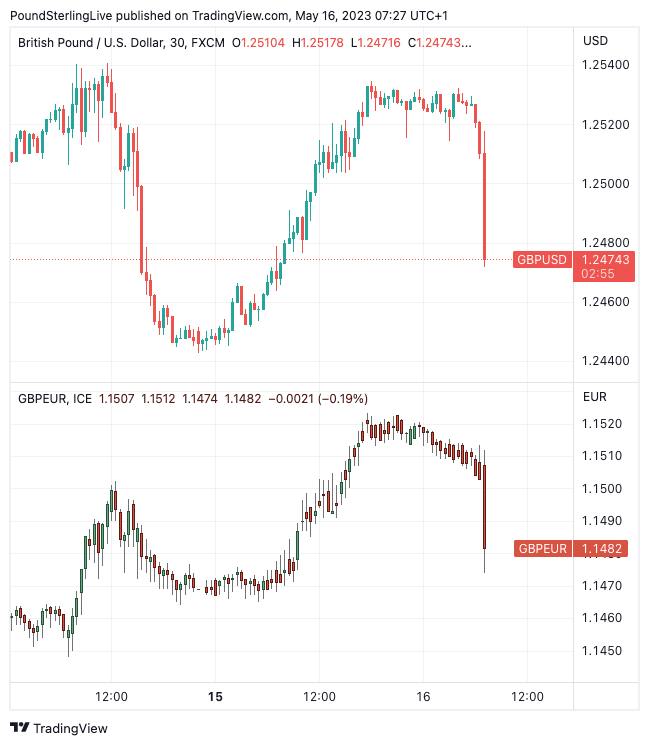

The British Pound returned recent gains against the Euro and Dollar following the release of UK wage and employment figures that suggest the UK labour market is at an inflexion point.

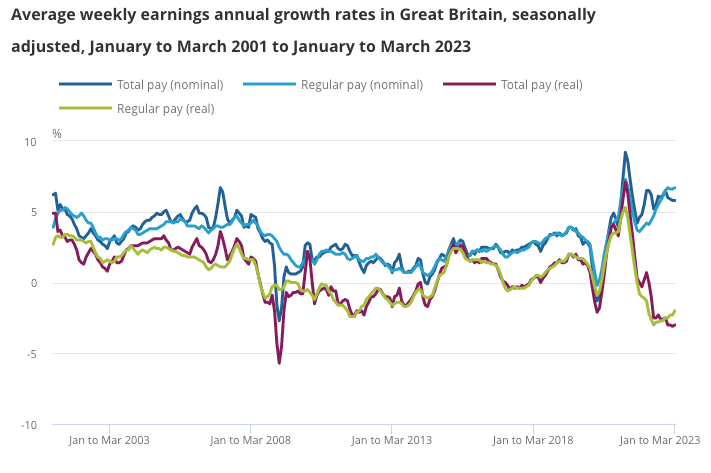

UK average earnings rose by 6.7% in March said the ONS, which was softer than the 6.8% figure the market was looking for, but nevertheless a shade higher than April's 6.6%.

When bonuses are included the figure stood at 5.8%, which was expected and unchanged on the previous month.

The Bank of England is particularly focused on wage figures as it looks for signs UK inflationary expectations are becoming embedded. While the figures are strong the Bank will note that a peak in wage increases is at hand, particularly if the unemployment rate continues to rise.

Indeed, the UK unemployment rate unexpectedly rose to 3.9% in March, whereas an unchanged reading of 3.8% was expected.

The figures could signal the UK labour market is finally starting to 'ease', potentially allowing the Bank of England to consider ending its interest rate hiking cycle.

Pound Sterling was understandably softer following the data: the Pound to Euro exchange rate fell 0.20% in the half-hour following the data release to 1.1480 and the Pound to Dollar exchange rate fell 0.30% in the half-hour following the release to 1.2475.

"Expectations for BoE hiking being notably trimmed. The OIS implied probability for a hike in June has fallen by 10% this morning to 73%, and the anticipated level for the peak in Bank Rate has also declined by around 7bp. This paring of rate expectations has, in turn, led cable lower, with the pair falling a third of a percentage point in response to this morning's data," says Nick Rees, FX Market Analyst at Monex Europe.

The UK labour market remains healthy and capable of generating inflation with 182K jobs being created in the three months to March, which was more than the 160K expected and a step up on the 169K jobs created in the three months to April.

The increase in jobs and rising unemployment rate shows more people are reentering the jobs market having been previously economically inactive.

Indeed, in an undoubtedly positive development for the economy and public finances, the ONS reports "there has been a record high net flow out of economic inactivity" between October to December 2022 and January to March 2023.

Source: ONS.

The rising employment rate also comes at a time of record net immigration levels with the ONS expected to reveal next week that UK net immigration was in the region of a million people in the past year.

The Pound has rallied through the course of 2023 as UK economic data releases have come ahead of expectations and defied market expectations for UK economic underperformance.

But May's labour market data represents a downside data miss and could signal the UK's data pulse is in the process of turning softer, a development that could be expected to weigh on the British Pound.

The figures will also give ammunition to those arguing the Bank of England can now afford to pause its interest rate hiking cycle as the number of hikes already delivered are yet to be fully felt by the economy.

"For a BoE that once again signalled its data dependence, this is strongly suggestive that a hold in rates will be the likely outcome of upcoming policy meetings," says Rees.

If the Bank decides to keep rates unchanged in June the Pound could come under pressure as UK bond yields adjust lower and investors start to raise bets for a year-end interest rate cut.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Signs of easing 'tightness' in the labour market could also be found in further declines in vacancies. The number of vacancies in the three months to April 2023 was 1,083,000, a decrease of 55,000 from the three months to January 2023.

"The clear downward trend in vacancies alongside modestly rising unemployment should take the heat out of wages soon – especially as inflation expectations continue to edge lower and headline inflation eases," says Kallum Pickering, Senior Economist at Berenberg.

"This tilts the case slightly against further hikes, in our view," he adds.

"Momentum in UK wage growth appears to have eased since 2022, and together with signs that the heat is coming out of the jobs market, there's nothing in the latest report that screams a need to keep hiking rates. But there's still plenty of data due before the next Bank of England meeting in June," says James Smith, Developed Markets Economist at ING Bank.

The next key data release in the interest rate debate is next week's inflation figures. A larger-than-expected undershoot in headline and core inflation would further bolster expectations for a no-change decision in June.

Of course, inflation might beat expectations, but for now investors are likely to be wary of pursuing the Pound beyond recent peaks against the Euro and Dollar.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes