Bailey Paves the Way for Bank of England to Pause the Interest Rate Hiking Cycle

- Written by: Gary Howes

Above: File image of Governor Andrew Bailey. Photo by Zara Farrar / HM Treasury.

Bank of England Governor Bailey has delivered an upbeat speech in which he says inflation will fall sharply by year-end and that the economy is performing better than expected.

In a speech to the British Chamber of Commerce Annual Conference, he also warned that the impact of past interest rate rises is yet to be felt.

Putting these two points of emphasis together suggests the thrust of the speech could be interpreted as laying the groundwork for the Bank to pause its interest rate hiking cycle.

"Things are looking a bit brighter than they did a couple of months ago," said Bailey. "In the latest MPR, published last week, we are now forecasting modest, but positive growth, and a much smaller increase in unemployment."

Previously, the Bank had expected a shallow but long recession in the UK economy.

Bailey is also optimistic the negative impact on living standards inflicted by double-digit inflation will start to ease as inflation drops sharply.

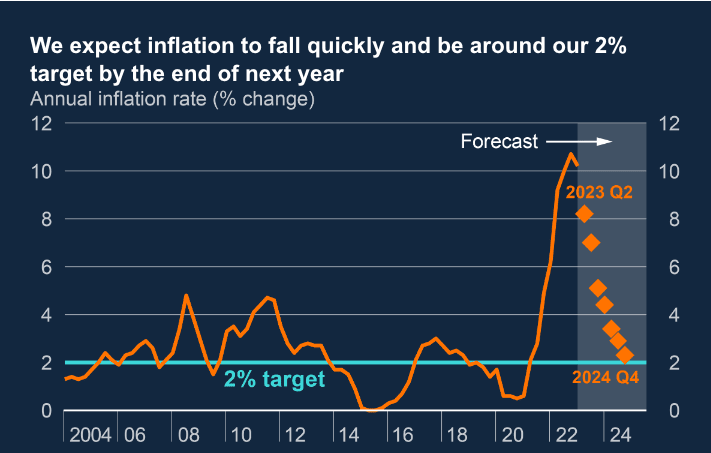

"We do, however, have good reasons to expect inflation to fall sharply over the coming months, beginning with the April number to be released on 24 May," says Bailey.

Image: Bank of England May 2023 MPR.

He added falling gas prices could mean that by year-end the impact of energy is outright deflationary:

"Looking ahead to the end of the year, if energy prices evolve as financial market prices now suggest, the contribution from energy will fall further. Towards the end of the year, energy prices should begin to pull overall inflation down rather than push it up as they have done over the past two years."

The other area of emphasis in the speech fell on the Bank's calculation that the 440 basis points of rate hikes delivered since 2021 are still yet to be felt via slower economic activity.

"These changes in interest rates are still working their way through the economy. While we have seen higher rates quoted on new mortgages, and while the effective rates on new mortgage lending have been increasing, the effective rate on the whole stock of mortgages is still in the process of adjusting towards higher reference rates," says Bailey.

This lagged delay is because of the increasing share of fixed-rate mortgages in the UK mortgage market, he added, saying as this process plays out, the rises in Bank Rate since December 2021 will weigh more on the economy in the coming quarters.

"The MPC factors these lags in the transmission of monetary policy into its policy decisions," he added.

The emphasis on an impending slump in inflation and the need to prepare for an interest-rate-induced slowdown will be interpreted by some as a sign the Bank is readying to pause its hiking cycle.

This view was bolstered by May 16's labour market statistics that revealed an unexpected rise in the unemployment rate in March, as well as an undershoot in headline wages.

But ultimately, Bailey gave the Bank some room for manoeuvre in the event next week's inflation data comes in higher than expected by dropping the caveat that the Monetary Policy Committee (MPC) remains data dependent.

"The MPC is continuing to address the risk of more persistent strength in domestic price and wage setting, as represented by the upward skew in the projected distribution for CPI inflation, and the Committee will continue to monitor closely the indicators of persistence in inflationary pressures," he said.

"I can assure you that the MPC will adjust Bank Rate as necessary to return inflation to target sustainably in the medium term, in line with its remit. If there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required," he added.