Bank of England Faces 3.0%+ Inflation in 2025: Deutsche Bank

- Written by: Sam Coventry

Image © Adobe Images

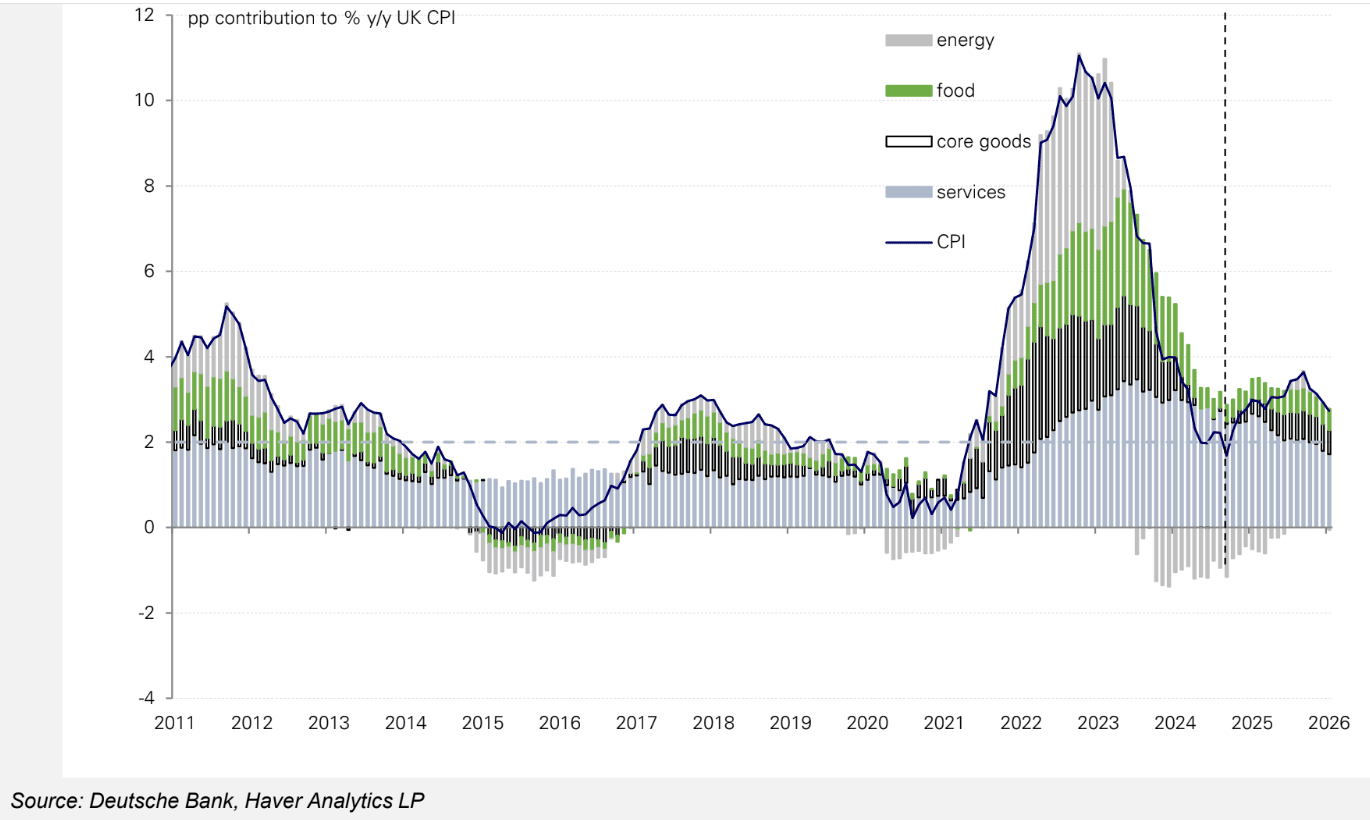

Deutsche Bank has raised its inflation forecast for the UK, projecting that headline Consumer Price Index (CPI) inflation will rise to 3.1% in 2025, up from 2.6% in 2024.

This upward revision reflects continued pressures from core goods and services despite signs of easing in some sectors.

Core CPI, which excludes volatile items such as energy and food, is expected to decelerate only marginally, dropping from 3.75% in 2024 to 3.5% in 2025. Meanwhile, services inflation is forecast to decline from 5.5% in 2024 to 4.5% in 2025, reflecting slower growth in key labour-intensive sectors.

This development follows the release of November inflation numbers, which showed an increase to 2.6% year over year, with the all-important service inflation measure coming in at 5.0%.

The December edition of Deutsche Bank’s UK Inflation Chartbook highlights several factors driving the persistent inflationary pressures through 2025.

Key contributors include strong wage growth from National Living Wage increases, higher private rents, and administrative tax adjustments.

"The biggest upward driver for CPI remains services through our forecast, with energy and core goods price pressures becoming less of a drag, too." - Deutsche Bank.

While energy prices are expected to exert less of a drag on the CPI in 2025, services inflation - particularly within the housing, transport, and labour-intensive sectors - remains a dominant force.

Inflation Drivers and Forecast Adjustments

Deutsche Bank’s revised outlook incorporates updated energy price projections and assumptions surrounding Ofgem’s price cap. The bank expects a modest reduction in energy bills in early 2025, followed by small increases in subsequent quarters. Adjustments have also been made to forecasts for core goods and services, with particular attention to rent inflation, which has been on an upward trajectory.

The bank’s analysts remain cautiously optimistic about a return to the Bank of England’s 2% inflation target in 2026. This is contingent on a significant demand-driven slowdown in the second half of 2025, as higher unemployment and reduced disposable income begin to exert downward pressure on prices.

Anticipated Bank of England Response

Despite the revised inflation forecasts, Deutsche Bank believes that the Bank of England (BoE) will proceed cautiously in adjusting monetary policy. The bank expects one rate cut in the first half of 2025, likely in February, as policymakers weigh the risks of persistent inflation against concerns over slowing economic growth.

"The Bank of England’s Monetary Policy Committee is unlikely to pivot aggressively, given the current inflationary backdrop," the report notes. "However, as the economy weakens and wage and price momentum ease, we anticipate three additional rate cuts in the latter half of 2025."

By early 2026, Deutsche Bank projects the BoE’s Bank Rate will decline to 3.25%, marking a gradual retreat from the current restrictive monetary stance. This outlook aligns with expectations of a broad-based normalisation in inflationary pressures, particularly in services and domestically generated inflation components.

Global and Domestic Context

Deutsche Bank’s forecasts arrive amid a challenging economic environment characterised by ongoing global supply chain pressures, rising food and housing costs, and fluctuating energy prices. While the UK’s inflation trajectory remains elevated compared to most G7 economies, it trails the United States in terms of headline CPI.

The bank’s economists emphasise the importance of vigilance in monitoring underlying inflation trends. “The balance between policy normalisation and managing inflation expectations will be crucial for the Bank of England," the report concludes.

As the UK navigates the twin challenges of inflation and growth, the Bank of England’s measured approach will remain pivotal in shaping the economic outlook for 2025 and beyond.