Next Targets for Pound-to-New Zealand Dollar Rate as Market Breaks Lower

The Pound-to-New Zealand Dollar exchange rate is trending lower as Sterling sells off this morning amidst a clutch of news and data which showed the currency in a negative light; we look at the next chart levels to watch.

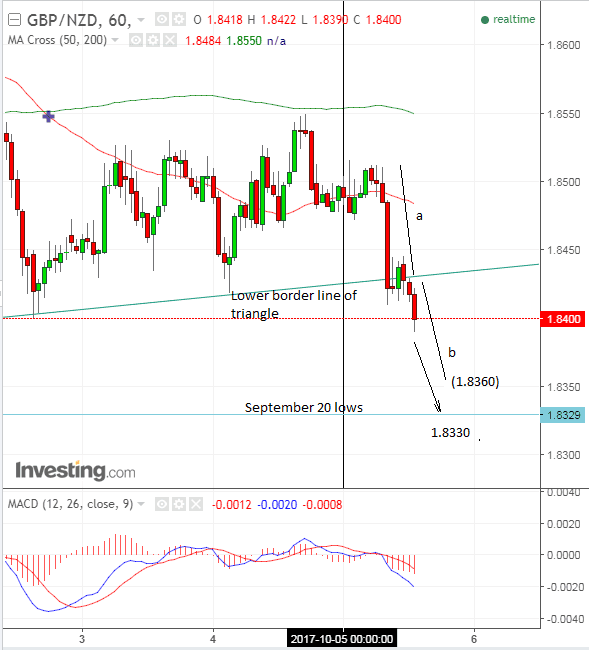

The pair has broken through several key levels such as the lower border line of a possible bullish triangle price pattern which had been forming on the daily chart and the key October 2 lows.

The question for many traders and analysts now is, how much further south is the pair likely to go?

The break below the lower border line of the triangle itself yields a downside target based on the height of the move prior to the break (a) - in this case about 80 points - which if extrapolated after the break tends to accurately predict a follow-through target (b).

This method of establishing a target after a trendline break yields a downside target of 1.8360, which is 80 points below the break point at 1.8440.

Another potential target for the downtrend lies at the septmber 20 lows of 1.8330, as these are key lows.

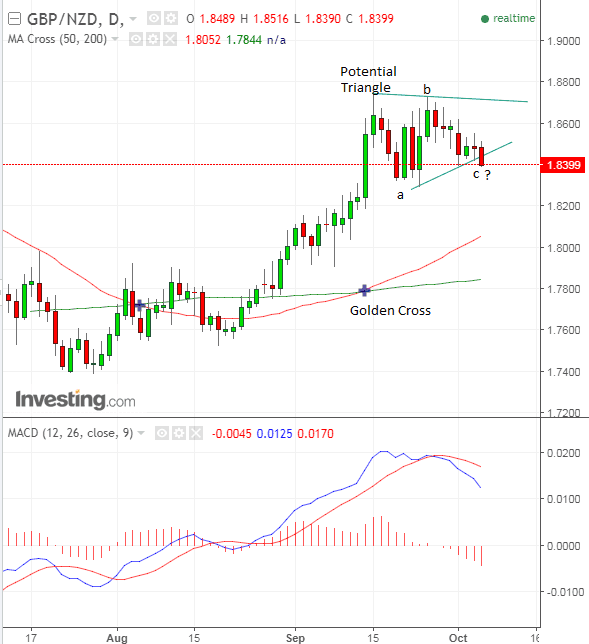

The breakout has brought into the doubt the validity of the trinagle price pattern we thought was forming on GBP/NZD in our last technical report.

We thought the narrowing range over the last 14 days was indicative of the formation of such a pattern with a bullish bias due to the more horizontal edge facing higher, and technical theory suggesting the breakout from a triangle tends to be throught the straighter line.

It is still too soon to fully dismiss our idea, as it is still porrible the pair could stall in its current intraday downtrend, rotate and start to rise back up to the triangle highs, however, a break below the September 20 lows would indeed negate the possibility such a pattern was forming.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.