British Pound in Sudden Drop vs. Euro and US Dollar, Various Explanations on Offer

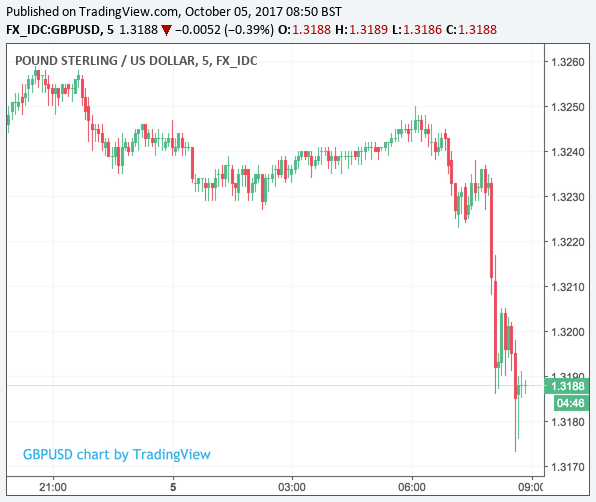

We are seeing a sudden drop in the value of the Pound at the time of writing with Sterling breaking below key levels against both the Dollar and Euro.

There is no immediate reasons for the decline but we are pinging our sources to find out whether something of note has occurred. One initial data point that might be behind the move is a shock 9% fall in UK car sales in September. Car sales are not exactly a major driver of UK economic growth but importantly tell us something about consumer sentiment.

Could this be a warning of a major drop in sentiment is underway? We doubt this to be the case though noting car demand has its own peculiar set of drivers to consider; the latest being shifts in demand due to the diesel scrapage scheme.

Another explanation doing the rounds is that the Pound is down on newspaper reports that Conservative Party parliamentarians are considering whether or not May should stay - i.e. a fresh rebellion is brewing. However, the reports are speculative - and broke many hours prior to the slump seen on Thursday morning.

Our hunch on Sterling's decline is that those analysts who labelled the September rebound in the currency as 1) mere “herd behaviour” by wayward traders and 2) a technical, positioning rally, are correct.

Therefore, the decline below the key 1.32 in GBP/USD and 1.1239 in GBP/EUR will be notable technical developments that bode for further weakness.

Indeed, we wrote yesterday that a break higher in the Euro vs. the Pound was looking imminent. At present this is playing out but we caution that the day is long and Sterling could yet pull the market back to key support levels.

What matters is where the various GBP exchange rates close tonight.

At the time of writing the Pound-to-Euro exchange rate is quoted at 1.1194, down 0.53%.

Analyst Robin Wilkin at Lloyds Bank Commercial Banking says he gas been looking for the cross to push back towards 1.1173-1.1050, with this morning’s break of 1.1246 “triggering a strong move lower already”.

The Pound-to-Dollar exchange rate is at 1.3179, down 0.4%.

"We remain biased for a move to 1.30-1.28 support, which may define the lower boundary of a medium-term range," says Wilkin.

Those analysts that are sceptical about the Pound's September rally argue the Pound will be unable to find any enduring support from the Bank of England's decision to potentially raise interest rates in November - recall it was this move that triggered the bounce in the Pound.

And politics might be an enduring problem for the currency.

"Politics will come into clearer focus as time marches towards March 2019, when only one Brexit outcome will be possible," says Dominic Bunning, FX Strategist with HSBC Bank. "We believe the market is under-pricing the risk of a “no deal” Brexit and we see GBP-USD falling to 1.26."

Analysts at the high-street lender forecast the Pound-to-Euro exchange rate at 1.12 by end-2017, up from 1.0 previously.

1.11 is seen by the end of the first-quarter 2018, 1.09 by mid-2018 and 1.05 by year-end 2018 which suggests the bulk of declines are for next year.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.