A Critical Moment for Pound-to-Euro Exchange Rate Outlook as Key Support Level is Tested Today

Pound Sterling approaches a key support level vs. the Euro that must hold if the lion's share of the gains made in September are to hold.

The British Pound is at risk of cracking below a key support level and falling back towards 2017 lows as selling pressures on the UK currency ramp up once more.

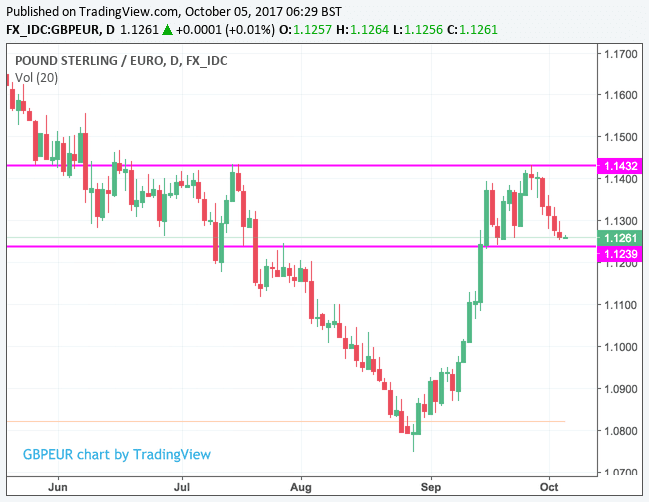

Technicals are of heightened importance in the near-term with the Pound-to-Euro exchange rate approaching a key support level which we identify as being at 1.1239. The exchange rate has fallen from a multi-week best at 1.1432 in late September to the 1.1261 we are seeing today.

Charts show the market is still within a region of relative familiarity for the Pound and Euro - earlier in the year we saw the exchange rate bounce around current levels for an extended period:

The Pound is therefore now a few pips away from a key test of support where buyers would be expected to step into the market and push it up back into the consolidation range, broadly identified by the purple parallels in the above.

This is where the Pound has shown it will not go below on previous occasions and the same is expected to be likely this time around. Of course this is not an exact science so the ultimate level of support in this impulse might kick in earlier or later but this is not important.

The point we are putting across is that this is a key moment for the GBP/EUR exchange rate - a failure to remain in the broad consolidative zone risks a steeper fall. Technical analyst Richard Perry at Hantec Markets reckons a break below 1.1363 opens up the prospect of a race lower to 1.11; a region he identifies as a the first level of support.However we prefer to look for broader regions of consolidation and see little such support for the Pound until the multi-year lows sub-1.08 that were reached in August.

A move back up into the consolidative region allows for the stage to be set for further recovery.

Before the Pound falls further. Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

The Support Line is Breaking

We are seeing a sudden drop in the value of the Pound at the time of writing with Sterling breaking below key levels against both the Dollar and Euro.

There is no immediate reasons for the decline but we are pinging our sources to find out whether something of note has occurred. One initial data point that might be behind the move is a shock 9% fall in UK car sales in September. Car sales are not exactly a major driver of UK economic growth but importantly tell us something about consumer sentiment.

Could this be a warning of a major drop in sentiment is underway? We doubt this to be the case though noting car demand has its own peculiar set of drivers to consider; the latest being shifts in demand due to the diesel scrapage scheme.

Another explanation doing the rounds is that the Pound is down because of unconfirmed reports of Conservative Party parliamentarians are considering whether or not May should stay - i.e. a fresh rebellion is brewing. However, the reports are just that speculation - and broke many hours prior to the slump seen on Thursday morning.

Our immediate suspicion is that those analysts who labelled the September rebound in the Pound as mere “herd behaviour” and a technical, positioning rally, are correct.

Therefore, the decline below the key 1.32 in GBP/USD and 1.1239 in GBP/EUR will be notable technical developments that bode for further weakness.

Indeed, we wrote yesterday that a break higher in the Euro vs. the Pound was looking imminent. At present this is playing out but we caution that the day is long and Sterling could yet pull the market back to key support levels.

What matters is where the various GBP exchange rates close tonight.

At the time of writing the Pound-to-Euro exchange rate is quoted at 1.1194, down 0.53%.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.