The New Zealand Dollar is Tipped to Remain Under Pressure vs. Pound

The New Zealand Dollar has been weighed down by a fall in milk prices which lends support to a bullish technical outlook on the GBP/NZD chart.

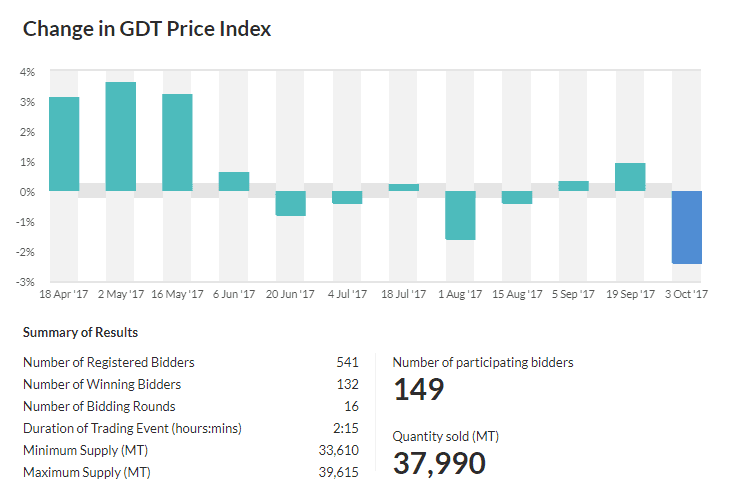

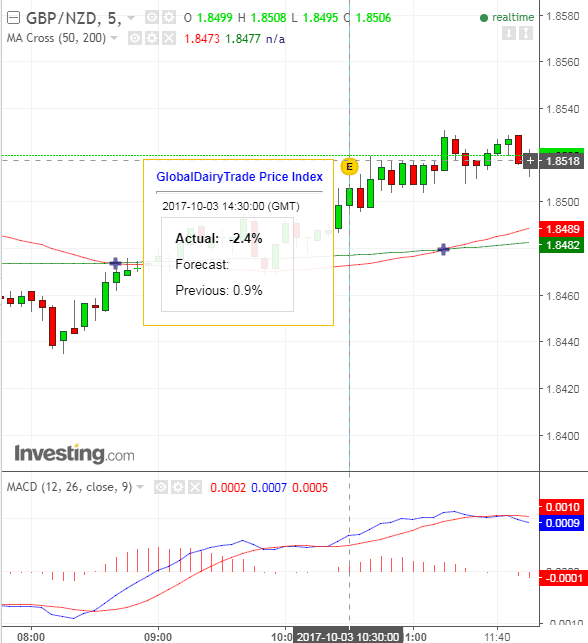

The New Zealand Dollar lost ground against the Pound following the release of Global Dairy Trade prices which fixed dairy prices -2.4% lower at a global auction of dairy goods, of which New Zealand is a primary exporter.

A fall in the price of the country's main export reduces the aggregate demand for the Kiwi from foreign buyers, thus reducing its value, and this explains why GBP/NZD rose from 1.8500 to roughly 1.8515, however, in the great scheme of things the move was pretty minor.

Bullish Pattern Forming on GBP/NZD

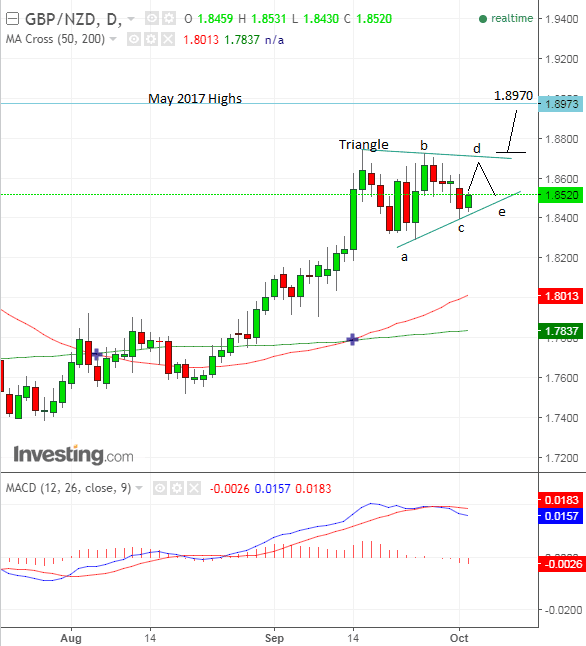

Of more import, arguably is the price pattern forming on GBP/NZD's daily chart.

The pair is probably in the process of forming a bullish triangle continuation pattern on the daily price chart.

It has already moved sideways over the last 14 days within a tapering range, which seems to suggest the possibility that the pair is consolidating in a triangle formation.

Triangles are normally continuation patterns and they usually breakout in the direction of their 'straighter' - that is more horizontal- edge, which in this case is the upper edge and therefore reinforces our view that the pair may be about to break higher.

Triangles normally occur near the end of uptrends and are often said to precede the last motive move higher.

They are usually composed of five internal wave’s a-b-c-d-e. This triangle has formed three waves, with 'd' and 'e' outstanding, so some more sideways is likely before the exchange rate breaks out higher.

Ideally we would want to see a break above the top of wave 'b' at 1.8730 for confirmation of a breakout higher towards a target at 1.8970, at the level of the May 2017 highs.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Coalition Dreams

The recent election was big news for the New Zealand Dollar as many of the parties had policies are expected to impact on the exchange rate either via proposed reforms of the Reserve Bank or economic policies.

No party won an outright majority so the next government will probably be a coalition or composed of a major party with a loose agreement with other parties.

Coalition negotiations are still ongoing, but the third largest party, New Zealand First (NZF) is the party holding the balance of power.

It is now up to NZF to choose whether to partner with the National party or Labour.

The leader of the Greens has said he will only team up with Labour, but even with the help of the Green party Labour will not have enough seats for a working majority so they also need NZF.

The NZF leader has said he will not announce who he plans to form a coalition with until after October 7 when the 'special vote count' is finished.

The special vote count is a the count of all votes taken by New Zealand citizens living outside of New Zealand; it tends to skew left, according to Westpac Economic Research, and this year it accounts for 15% of the vote, the largest ever.

"Special votes include late enrolments and people voting outside their electorates (including university students). These votes tend to skew left; in the last few elections, National have lost a seat and the Greens have gained a seat once the special votes are incorporated. The high number of special votes this time (about 15% of the total) means that National may even lose a second seat to Labour or the Greens. Such an outcome would not change the balance of power, but it might make a Labour/Green/NZ First agreement less vulnerable, as it would give them more than the one-seat majority that the current voting results suggest," said Westpac.

Westpac think the National/NZF is most likely and workable coalition, since a 2 party government is likely to be more workable than a 3 party coalition as would be the case with Labour, NZF and the Greens.

A government composed of NZF and the Nationals would probably result in a fall in immigration to 10k - it is already falling from 70k but it would speed the decline and impact negatively on GDP.

"If some policy change prompted us to forecast a steeper decline in net immigration, we would also consider reducing our GDP growth forecast."

A reduction in GDP would weaken the Kiwi.

A National/NZF coalition would probably lead to a rise in house prices because of a relief rally due to Labour not getting in who have pledged to tax homes. This would probably initially eclipse the fallout from less immigration-related demand.

A National/NZF coalition is unlikely to see major changes at the Reserve Bank of New Zealand (RBNZ) except that the single decision-maker rule will probably change to a committee.

NZ First's fiscal policies are expensive:

"Fiscal policy: NZ First’s policies are expensive, and it has not signed up to any budget responsibility agreement. In the first instance we would expect that policy concessions to NZ First, such as its various regional development priorities, could be managed within the Government’s existing budget. However, the direction of risk on fiscal policy is that this Government will hew towards smaller surpluses and more debt than otherwise."

This could lead to slightly higher interest rates, and a stronger Kiwi.

Reserve Bank Downgrades Growth Outlook

Last week's RBNZ meeting statement was something of a "control C, control V," affair as Canadian investment bank TD Securities described it in their week in review/ahead analysis.

The bottom line is that the Bank is in no hurry to change interest rates - or the "OCR" (Official Cash rate) as they call it.

"The OCR was left unchanged at 1.75%, and the press release retained much of the language of previous statements, including the bottom line: "Monetary policy will remain accommodative for a considerable period. Numerous uncertainties remain and policy may need to adjust accordingly," said Westpac.

They did however change some details - for example, they downgraded the growth outlook and construction activity.

These suggest that the hard economic forecasts could be downgraded in the November meeting, and the Kiwi could come under pressure.

"Weaker growth could be offset to some degree by a lower exchange rate, which has been lower than was assumed in the August MPS. If the decline in the currency persists, the RBNZ would be able to leave its OCR guidance unchanged. But if the exchange rate fails to fall by enough, the RBNZ may have to downgrade its OCR outlook."