New Zealand Dollar Trades Higher on Non-tradeables Inflation Surprise

- Written by: Sam Coventry

Image © Adobe Images

The New Zealand dollar strengthened after the release of inflation figures, which showed that the Reserve Bank of New Zealand (RBNZ) still has more work to do if it wants to achieve the 2.0% target.

New Zealand's headline inflation rate fell to 3.3% year-on-year in the second quarter from 4.0% in the first quarter, according to Statistics New Zealand.

This outturn will be welcomed by the RBNZ, where forecasts showed an expectation for inflation to slow to 3.6%. So far, so good: such an outcome would typically be consistent with a weaker New Zealand Dollar as markets would typically bet that it opens the door to imminent interest rate cuts.

However, as we are seeing with the Pound's reaction to its own inflation release, the finer details of the report matter. The domestic element of New Zealand inflation - the non-tradeables basket - increased by 0.9% q/q, lifting the annual rate to 5.4% in Q2. The RBNZ expected it to slow by more, to 5.3%.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

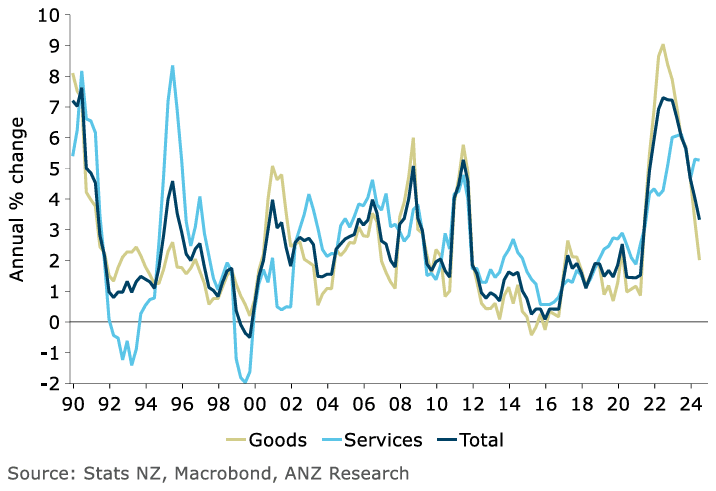

Non-tradeables includes inflation in consumer-facing businesses, such as restaurants and hotels. As is the case in the UK, inflation in the services sector is proving difficult to quell. Its ongoing strength signals the RBNZ might have to keep interest rates higher for longer.

The New Zealand Dollar is higher against the majority of its G10 peers as investors think the country will continue to command the highest interest rates for longer. Even the strengthening Pound is at a loss on the day, with GBP/NZD down a quarter of a per cent at 2.1384. "The New Zealand Dollar has strengthened following the release of the release of the latest CPI report from New Zealand," says Lee Hardman, FX analyst at MUFG Bank Ltd.

Above: Inflation in the services sector is proving stubborn. Image courtesy of ANZ.

NZD/USD is higher by three-quarters of a per cent at 0.6092, the EUR/NZD is down 0.30% at 1.7963.

"New Zealand rate market participants are less confident over how quickly the RBNZ will begin to cut rates as they believe that the RBNZ will place more weight on domestic price pressures which appear to be slowing less quickly than expected," says Hardman.

Markets show investors are now poised at 50/50 odds that the RBNZ cuts interest rates in August.

Yet, the RBNZ might have to look through the non-tradeables inflation component as the Kiwi economy continues to struggle under the weight of high interest rates and incoming survey data shows it risks falling back into recession.

Governor Orr and his team might opt to take the positives from the ongoing progress in headline inflation towards the 2.0% target and proceed with a cut as soon as next month, judging that the risks of scarring to the economy from elevated rates are growing.

If this is the case, the NZ Dollar will find its post-inflation bump short-lived.