New Zealand Dollar at 6-week Low on "Recessionary" Business Survey

- Written by: Gary Howes

Image © Adobe Images

The New Zealand Dollar extended a soft run after a new business survey showed a continued deterioration in economic sentiment and raised the odds of an interest rate cut at the Reserve Bank of New Zealand in H2.

The Pound to New Zealand Dollar exchange rate rose to its highest level in over a month at 2.0877 after the latest NZIER Quarterly Survey of Business Opinion pointed to a further decline in business confidence in the second quarter.

New Zealand Dollar weakness was broad-based, with a daily loss of 0.63% against the U.S. Dollar (0.6053) and 0.80% against the Euro (1.7725).

NZIER said the knock to confidence was due to higher interest rates, which dampened demand across the New Zealand economy.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

A net 35% of firms expect a deterioration in the general economic outlook over the coming months on a seasonally adjusted basis.

"NZD/USD weakened to around 0.6050 after a downbeat New Zealand Quarterly Survey of Business Opinion (QSBO) for Q2 2024. The QSBO indicated weaker activity, easing capacity constraints and cooling price pressures," says Carol Kong, a strategist at Commonwealth Bank.

Economists at ASB say the results are "hugely encouraging for the RBNZ", and they raise the odds of a rate cut in the coming months.

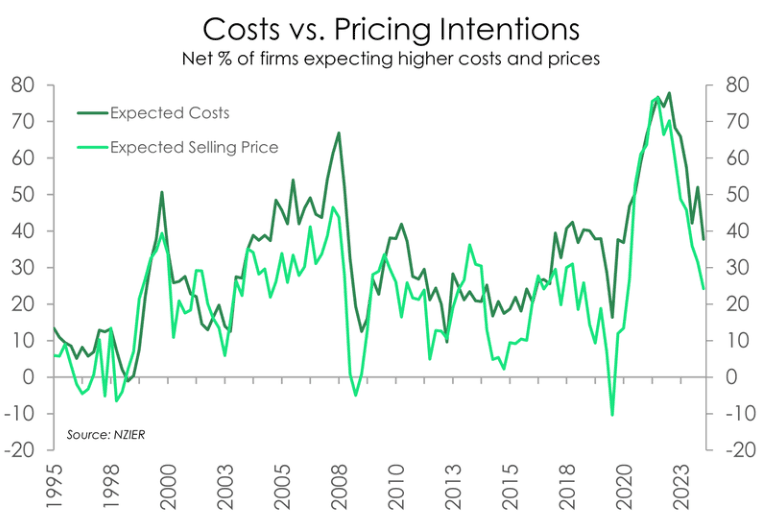

"The results suggest that the protracted downturn in NZ will continue for a while yet," says Mark Smith, Senior Economist at ASB. "Pricing and cost pressures are easing, with increasing spare capacity particularly evident in the labour market."

Image courtesy of Kiwibank.

A key driver of Kiwi inflation - the rate at which firms raise their prices - showed encouraging signs of slowing. A net 23% of firms increased selling prices over Q2 (+35% in Q1), with expected prices lower at +23% (from +33% in Q1).

"The most important read in the report involves pricing. And it was all-round good news. Cost expectations have eased, and pricing intentions have softened," says Jarrod Kerr, Chief Economist at Kiwibank.

ASB thinks this means pricing intentions are moving in the right direction and raises the odds that sub-3% inflation will be delivered by the end of the year.

"Today’s results are hugely encouraging for the RBNZ. OCR cuts before year end remain a distinct possibility," says Smith.

Image courtesy of Kiwibank.

Rising expectations for an earlier rate cut at the RBNZ appear to be weighing on the New Zealand Dollar.

"November 2024 looks to be the earliest date in which the RBNZ is likely to press the OCR rate cut trigger. Our OCR forecasts – we currently expect the first OCR cut in February 2025 - are under review," says Smith.

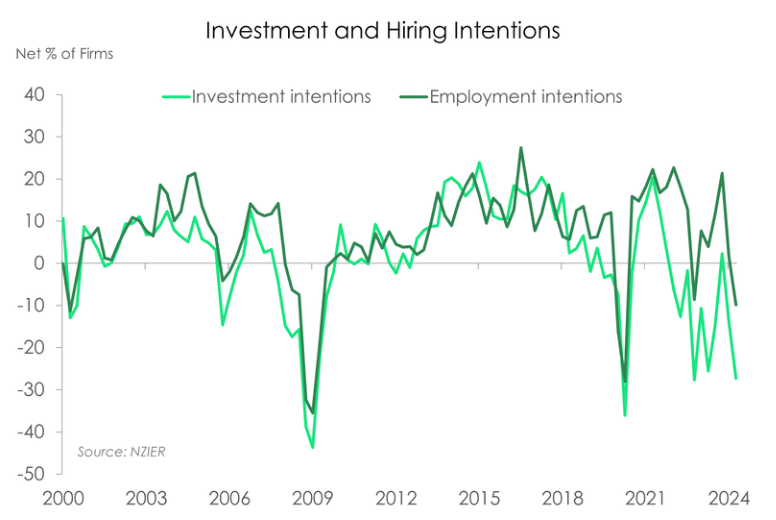

Businesses reported that employment intentions had fallen sharply, with the optimism of previous surveys giving way to pessimism.

Actual hiring slumped to -25 (from -11 in Q1), its weakest since 2009. Hiring intentions sharply cooled to -10 from +2, the weakest since mid-2020.

This will ease wage cost pressures facing firms, which can contribute to a weaker trend in inflation. "Activity gauges from the QSBO were weak, consistent with recessionary conditions," says Smith.

"The inflation dragon has been slain, we’re just waiting for it to hit the turf. This is good news for businesses, who have had to deal with rapid inflation in parts," says Kerr. "The QSBO adds further support for our call for RBNZ rate cuts sooner rather than later. We’re sticking to our call for cuts to begin in November."