Pound Drops After Core Inflation Sees Biggest Monthly Fall in 25 Years

- Written by: Gary Howes

Image © Adobe Images

UK inflation fell to 1.7% year-on-year in September, prompting a selloff in the British Pound.

Regular readers of Pound Sterling Live would have been prepared for today's decline in pound exchange rates, having read our warnings (here and here) that the market would press the sell button on the undershoot.

The prediction has played out, with the ONS reporting the headline figure of 1.7% was well below the consensus expectation of 1.9%, thanks to a fall in global oil prices into the September measurement period.

But there was more: core inflation - which the Bank of England concerns itself with - fell to 3.2% y/y from 3.6%, undershooting the 3.4% expected by consensus. This suggests a broader pullback in underlyinh price pressures.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"It's not just that UK CPI missed big. This was one of the weakest September MoM prints for core over the last 25yrs," says Viraj Patel, a strategist at Vanda Research.

This represents a significant decline in core price rises that will open the door to two more Bank of England interest rate cuts in 2024.

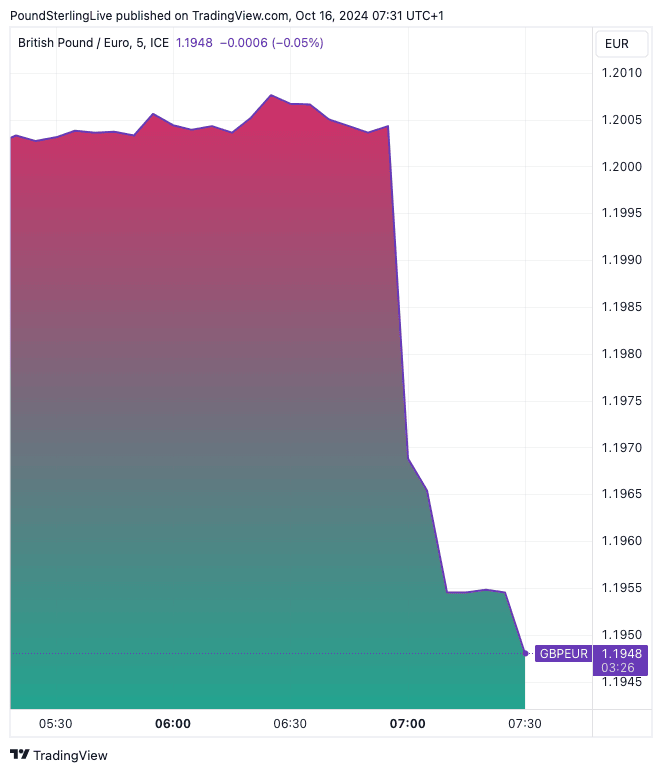

The repricing in market expectations is reflected in a decline in the Pound to Euro exchange rate to 1.1969 from 1.20 earlier in the day. The Pound to Dollar exchange rate has fallen from 1.3072 to 1.3022.

Above: GBP/EUR drops after the inflation release.

The clincher for the Bank of England will be the massive fall in services inflation from 5.6% to 4.9%, as this is the one corner in the price basket that has proven resolutely stubborn, thanks to rising prices in services-based industries (think hotels, restaurants, cinemas, lawyers, or any aspect of the economy where a person provides a service).

"Services inflation momentum in the UK is now weaker than in the US and euro area," says George Moran, an economist at Nomura.

The Bank has said time and again that it wants service inflation to fall comfortably before cutting interest rates further. Today it got what it wanted, and Governor Andrew Bailey will press the case to be more "activist" in approaching rate cuts now that inflation has gone the right way.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Vanda Research's Patel says the undershoot in UK inflation opens the door to a 50 basis point interest rate cut at the Bank of England in November, which he says would be a recognition that they were too cautious in opting to leave rates unchanged in September.

A rise in expectations for the quantum of Bank of England interest rate cuts will put pressure on the Pound.

"We expect sterling to weaken by ~4% against the euro and ~1% against the dollar by end-2025. We expect yield gaps to move against sterling, particularly vis-à-vis the euro, over the next year. We think the Bank of England will lower interest rates by much more than what is currently discounted in money markets," says Joe Maher, Assistant Economist at Capital Economics.

Economists at Nomura meanwhile maintain an existing call that the Bank will cut rates in November and then proceed cautiously at a quarterly pace of 25bp until a terminal rate of 3.50% is reached in early 2026.

This is largely because the weakness in services inflation in September was driven in large part by airfares, which are a component that the BoE often looks through.

"However, today’s services inflation print and yesterday’s wage number puts increasing pressure on the BoE to cut at a faster pace," says Moran.