Pound Sterling to Test Fresh Multi-week Lows vs. Euro and Dollar as Inflation is Set to Dip

- Written by: Gary Howes

Image © Adobe Images

The British Pound risks falling next week as inflation falls below the 2.0% target again.

Economists say UK headline CPI inflation will dip below the Bank of England's 2.0% target when September's figures are reported next week, thanks to the fall in global oil prices over the summer months.

However, for those requiring a stronger Pound Sterling, the development could deal another setback as it could prod the Bank of England to speed up the pace at which it lowers interest rates.

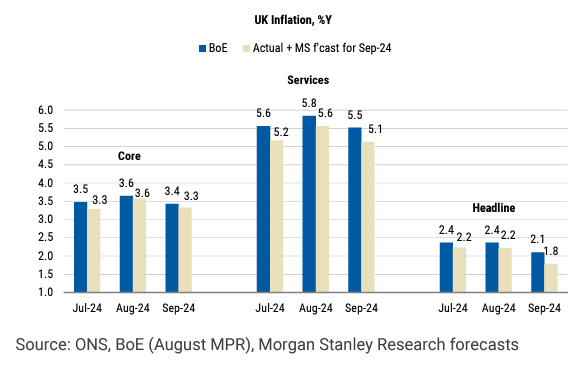

"Oil prices have swung sharply higher more recently, but an earlier drop in fuel prices likely pushed headline inflation to 1.8%Y in September," says Bruna Skarica, Chief UK Economist at Morgan Stanley.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The most recent forecasts from the Bank of England's Monetary Policy Committee (MPC), issued in August, show headline CPI inflation was expected at 2.10% in September.

"All of the undershoot relative to the MPC's call is accounted for by falling motor fuel prices," says Robert Wood, Chief UK Economist at Pantheon Macroeconomics.

Global oil prices fell to their lowest levels since 2021 in September but have since recovered, meaning the bottom for forecourt fuel prices will be in the rearview mirror.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

The Pound is 2024's best performing major currency thanks to the Bank of England's cautious approach to lowering interest rates, having only cut once, in August.

At 5.0%, Bank Rate is now the highest central bank policy rate in the G10. This ensures UK assets such as bonds yield superior returns for international investors than in other comparable nations.

This foreign demand for UK assets creates inflows and boosts the Sterling: the Pound to Euro exchange rate traded as high as 1.20 at the end of September, and the Pound to Dollar exchange rate tested 1.34.

Image courtesy of Morgan Stanley.

The Bank of England's Governor Andrew Bailey caused a tumble in the Pound on October 03 when he said the Bank could be more "activist" on cutting interest rates if the data allowed.

Could the data be about to allow the Bank to become more "activist"?

"Underlying price pressures should remain on a downward path for the foreseeable future. This will further alleviate concerns about inflation persistence and therefore lower the bar for the MPC to adopt a progressively more “activist” stance on rate cuts," says Konstantinos Venetis, an economist at TS Lombard.

To be sure, a fall in headline inflation owing to falling oil prices will be welcome, but it won't necessarily shift the dial on more stubborn aspects of the inflation basket.

The Bank could look through this development, particularly given that oil prices have since risen owing to the war in the Middle East.

However, analysts at Morgan Stanley think we will also see a solid decline in services inflation, which is a measure that the Bank of England is closely scrutinising when considering interest rates.

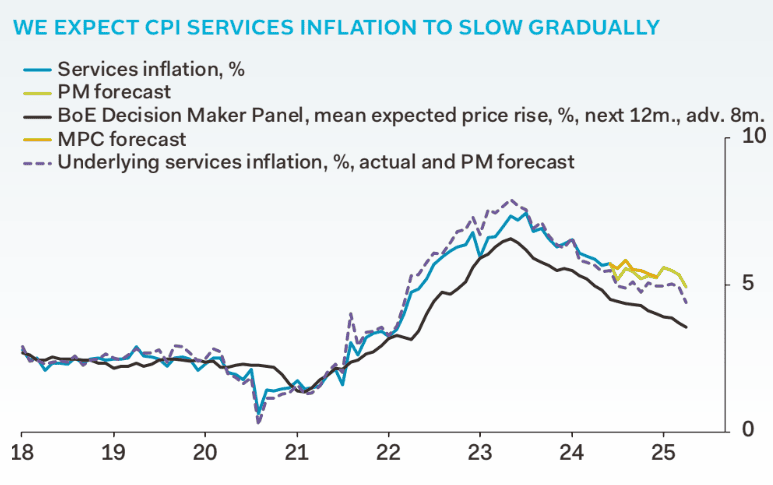

Image courtesy of Pantheon Macroeconomics.

This is because services inflation reflects domestic economic realities and unless it falls back notably, headline inflation will always tend to rise back above 2.0%.

A fall in services inflation would, therefore, be particularly welcome at the Bank of England and bolster expectations for a quickening in the tempo of Bank Rate reductions.

Economists say falling airfares and hotel costs would mainly drive the decline of September's services inflation.

"We expect core inflation to again come in below the BoE's forecasts," says Skarica.

The Bank of England forecasted core CPI inflation at 3.42% in September and services at 5.52%.

Pantheon Macroeconomics expects services inflation to slow to 5.4% year-over-year in September from 5.6% in August.

This undershoot will put the Pound under pressure and see it potentially print fresh multi-month lows against the Euro and Dollar.