Pound Sterling Retreats from Highs

- Written by: Gary Howes

Image © Adobe Images

The British Pound hands back recent advances made against the Euro and Dollar, and we suspect technical considerations, softer equity markets, and quarter-end flows are all playing a role.

The Pound to Euro exchange rate is now well below Tuesday's high of 1.2024 and is marked 0.33% down on the day at 1.1959. The Pound to Dollar exchange rate went as high as 1.3429 yesterday but is down 0.26% on the day at 1.3379.

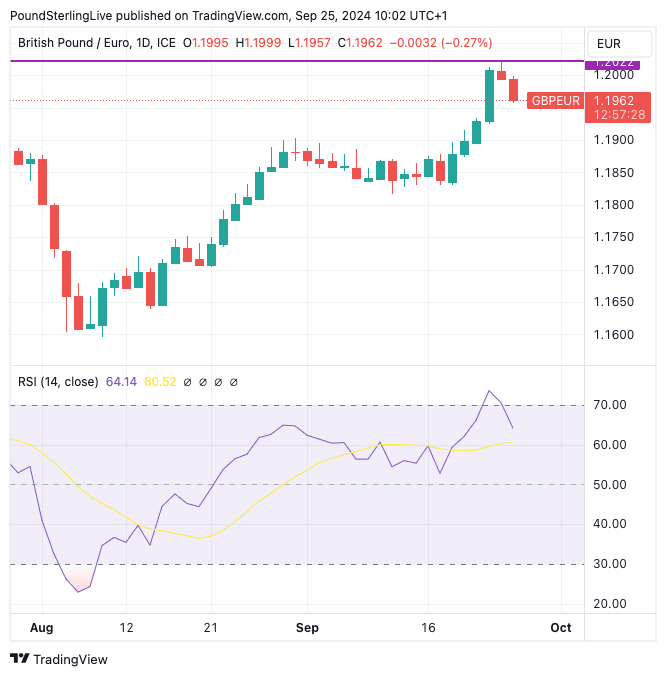

Its recent rally meant the Pound had reached overbought conditions against both the Euro and Dollar, with the Relative Strength Index (RSI) readings on the daily charts cresting above 70.

The RSI rarely spends time above 70 (a level that signals overbought) or below 30 (a level that represents oversold) and a mean reversion by the RSI is typically expected once these extremese are attained.

A period of consolidation or decline in the exchange rate would bring the RSI back into the equilibrium band, and we are seeing this in midweek trade.

Above: GBP/EUR is correcting from overbought.

There are no news triggers behind the pullback in the Pound and analyst Brad W. Becthel at investment bank Jefferies says Wednesday should see month- and quarter-end flows trigger volatility on FX markets.

"We have quarter end this week and that will likely start to drive FX in a bigger way [today] in the London morning and NY mornings," he says.

The end of the quarter and month are approaching, which will require global portfolio managers to make adjustments for recent FX market developments. The rebalancing can trigger significant short-term volatility.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"A turbulent Q3 for asset prices opens the door for significant rebalancing at quarter-end," says Robert Fullem, a Reuters market analyst.

Bechtel thinks the end of September and the third quarter of 2024 could be characterised by U.S. Dollar strength given the weakness seen over recent weeks.

"I would be surprised if we end up with enough USD selling for quarter-end to push us through 100 support in DXY, generally the quarter ends have been USD positive, so if anything, we are likely to grind back above 101 towards 102."

A recovery in the U.S. Dollar index (DXY) - a measure of overall USD performance - would imply Pound-Dollar is back under pressure and potentially extend the current six-day trend of appreciation.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Stock markets are also softer on Wednesday, which will typically weigh the high-beta pairs of GBP/USD and GBP/CHF, and to an extent GBP/EUR.

The combination of overbought conditions, quarter-end flows and softer markets are all, therefore, conspiring against the Pound.

However, in the medium term, the same drivers that took the Pound to recent highs remain in place, namely a Bank of England that will only cut interest rates cautiously owing to the UK's sticky services inflation amidst ongoing economic growth.

"While the GBP trades softer this morning, with cable easing back below the 1.34 figure, the near-term balance of risks continues to point towards further GBP upside," says Michael Brown, Senior Research Strategist at Pepperstone.

In its latest outlook on the world economy, the Organisation for Economic Cooperation and Development (OECD) said the UK economy was on course to expand by 1.1% this year, an upgrade of 0.7 percentage points from its last forecast in May.

It said the UK was among a group of countries recording "robust" growth rates this year, having bounced back strongly after a mild recession at the end of 2023.

There are also no major concerns for global equity markets, and weakness should prove short-lived now the Federal Reserve has started its easing cycle, which can aid the Pound.