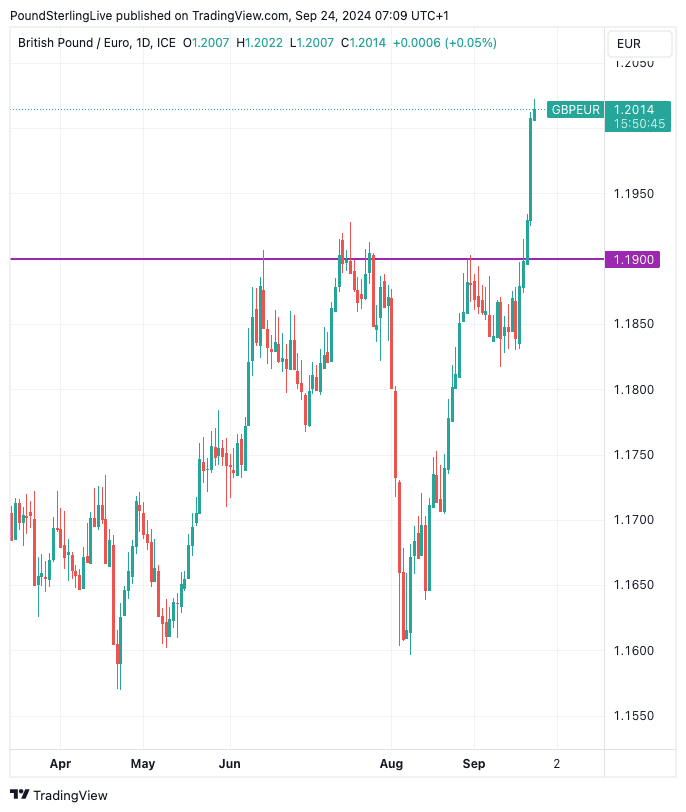

Pound to Euro Breaks 1.20

- Written by: Gary Howes

Image © Adobe Images

The British Pound has rallied to its highest level against the Euro in more than two years.

The Pound to Euro exchange rate is trading at 1.2014 at the time of writing Tuesday, having held a sizeable 0.65% the day prior, meaning it is at its highest since March 2022.

The advance comes after the exchange rate broke above the key technical level of 1.1907 (equating to the round number of 0.84 in EUR/GBP). Crucially, it closed the day above here on Friday, which is an important signal as previous forays above 1.19 have tended to fade.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Like a dam bursting, the breakthrough cleared away market orders laid by traders looking to benefit from another rebound in the euro. This forces them to sell their positions, thereby accelerating the Pound's advance.

The 0.65% leap witnessed on Monday is exactly the kind of price action you would expect following a genuine technical breakout and the market will now be eyeing potential resistance at 1.2119 (April '22 high) and 1.2188 (March '22 high).

Above: GBP/EUR breakout.

"Sterling continues to perform well. The majority of yesterday's drop in EUR/GBP was down to the miserable eurozone PMI data for September," says Chris Turner, an FX analyst at ING Bank.

Euro exchange rates came under pressure after PMI data showed the Eurozone economy entered contractionary conditions in September, with sharp slowdowns in activity being recorded in France and Germany.

The data also showed firms are becoming nervous about hiring staff, which could signal higher unemployment ahead.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

"The labour market also looks to be responding more meaningfully to weakness in demand, with the German composite employment index falling to 45.4 – outside of the pandemic, this is the lowest since 2009," says Bill Diviney, an economist at ABN AMRO Bank.

Money market pricing shows investors now see 10 basis points of European Central Bank (ECB) cuts priced for the October meeting, up from 6-7bp last week.

This realignment in expectations shows investors think the ECB will need to steup up support for the region's economy.

Rising expectations for rate cuts weigh on Eurozone bond yields, which in turn pressures the Euro.

By contrast, the UK's PMIs showed the economy remained in expansion mode in September with ongoing signs of inflationary pressures. This will keep the Bank of England on hold until November and support UK bond yields.

UK economic outperformance relative to the Eurozone is proving a powerful narrative for currency traders and explains the jump in the Pound to Euro exchange rate underway.

"This divergence in the economic prospects of the UK and the eurozone has taken GBP/EUR sharply higher," says Kyle Chapman, FX Markets Analyst at Ballinger Group.

"EUR/GBP has impressed by taking out support at 0.8340/45. Next stop, 0.8300," says ING's Turner. This target equates to a GBP/EUR rate of 1.2050.