Pound Sterling Holds Positive Momentum But Shallow Pullbacks Expected

- Written by: Gary Howes

Image © Pound Sterling Live

Pound Sterling holds onto positive momentum thanks to constructive market sentiment and Friday's contrasting speeches from Andrew Bailey and Jerome Powell. However, we think further outperformance will be more muted in the near term.

The Pound was helped by Bank of England Governor Andrew Bailey, who said it is "too early to declare victory" over inflation, verifying market bets the Bank would skip another rate cut in September.

Both the European Central Bank and Federal Reserve are expected to cut rates in September, with a potential further cut coming from both before year-end. By contrast, the Bank of England looks set to deliver just one more cut before year-end.

This suggests a slower path of cuts from the Bank of England, which provides a fundamental source of support for the Pound against both the Euro and Dollar.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Constructive global market sentiment remains the other key driver behind the Pound's recent outperformance, and Friday's jump in stocks propelled the UK currency to new highs against the Dollar while also bolstering the recovery against the Euro.

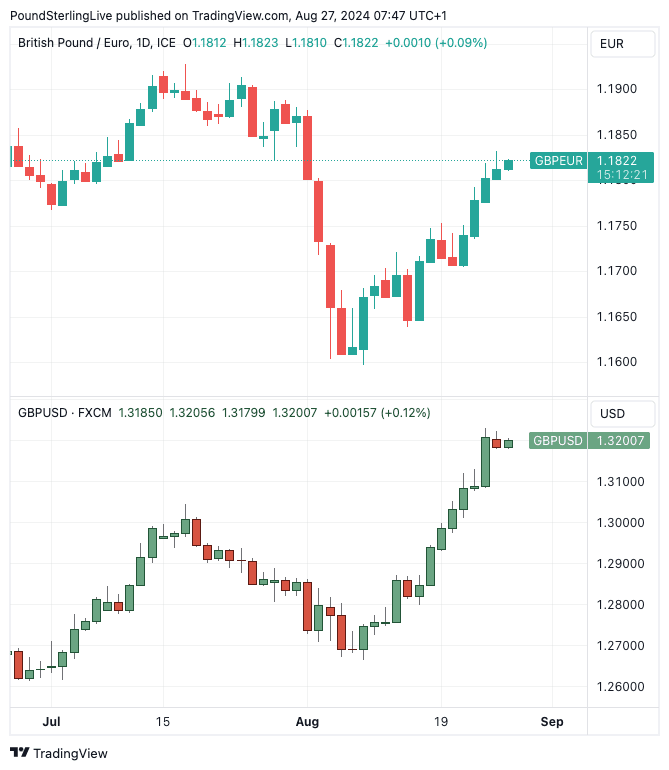

The Pound to Euro exchange rate rose above 1.18, while the Pound to Dollar pairing reached 1.32. When screened over a one-week period, the Pound is the best-performing G10 currency and remains 2024's best performer.

Above: GBP/EUR (top) and GBP/USD at daily intervals.

To be sure, Monday saw markets give back some recent gains, which blunted the Pound's advance, particularly against the U.S. Dollar. Losses were centred on the U.S. technology sector, which showed nerves ahead of Nvidia's midweek results announcement. A lot hinges on how the AI leader performs, and any disappointments could prompt a wider pullback in the tech sector.

Disappointment here can bolster the Dollar from recent levels, but we don't see this impacting Pound exchange rates in a major way. Pullbacks in GBP/USD are likely to be shallow as long as the market thinks the Federal Reserve is set to deliver several interest rate cuts in the coming months.

Fed Chair Jerome Powell said at a speech in Jackson Hole, "the time has come for policy to adjust... the downside risks to employment have increased... We do not seek or welcome further cooling in labour market conditions."

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

This showed that the Chair is now less concerned about inflation and that his focus is shifting to the job market, where he fears an economic slowdown will boost unemployment. This necessitates rate cuts and raised market expectations for a 50 basis point Fed rate hike in September, although the odds of this retreated somewhat on Monday, helping the Dollar recover somewhat.

"Powell kept the door open to larger 50bp cuts. For instance, he didn’t make any comments about the moves being gradual, which could have implied the Fed would stick to 50bp moves," says Jim Reid, a strategist at Deutsche Bank.

San Francisco Federal Reserve President Mary Daly reiterated the message on Monday, saying, "the time to adjust policy is upon us".

Looking ahead, we look for the Pound's outperformance to be more muted, with the GBP/USD potentially capped at 1.32 in the near-term. We note that the exchange rate has become overbought in the short-term and some unwind is necessary.

Monday's losses in GBP/USD linked to the U.S. tech sector selloff suggest a broader market pullback will temporarily weigh on the UK currency.

GBP/EUR is meanwhile now in a fifth daily advance, which is unusual for this exchange rate. GBP/EUR is a slow mover with a mean reverting tendency, and some softening is also possible here if global markets face a setback.

We will be watching inflation data from the Eurozone this week (Germany on Thursday and all-Eurozone on Friday). Any undershoot in these data could potentially boost expectations for ECB rate cuts, which would, in turn, weigh on the Euro.