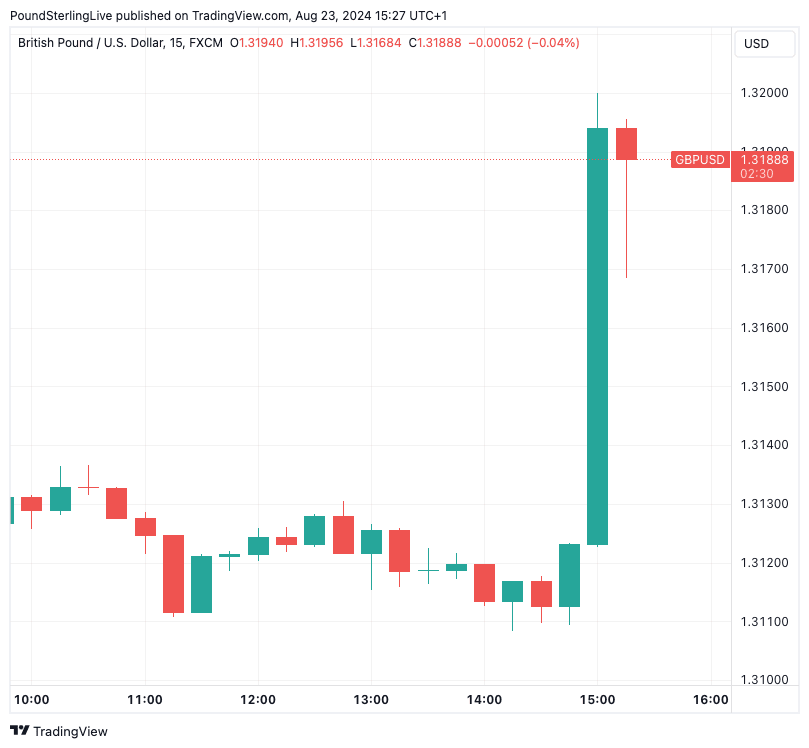

GBP/USD Rate Surges to Two-year High on Powell Rate Cut Call

- Written by: Gary Howes

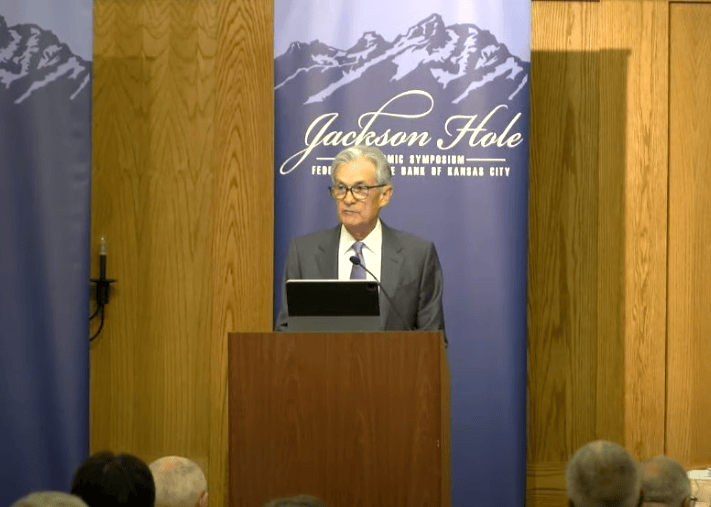

Image courtesy of the Kansas City Fed.

"The time has come for policy to adjust," said Federal Reserve Chair Jerome Powell, in a clear sign U.S. interest rates are about to fall.

The Dollar fell to a two-year low against Pound Sterling after Powell delivered these prepared remarks to delegates at the Jackson Hole Economic Symposium, which effectively rubber-stamped a rate cut next month.

But, a September cut is not new news; the new news is that markets got the inkling that the Fed was prepared to be more committed to further cuts in subsequent months.

“The cooling in labour market conditions is unmistakable," said Powell. “It seems unlikely that the labour market will be a source of elevated inflationary pressures anytime soon."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Pound to Dollar exchange rate (GBP/USD) powered to 1.32 - the highest level in two years- after markets digtested additional comments that, "we do not seek or welcome further cooling in labour market conditions."

This is a clear signal that the Fed is now willing to defend growth to ensure job losses are minimised in the coming quarters. This will involve policy easing, which can boost risk-on assets like stocks and the Pound.

“The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks," said Powell.

"We will do everything we can to support a strong labour market as we make further progress toward price stability," he adds.

Above: The reaction to Powell's comments was clear.

The comments raise the odds of a 50 basis point rate cut in September, which represents a step up from the 25bp move that was factored into the Dollar ahead of Powell's speech.

This ramp-up in expectations explains the USD's selloff.

"The Fed must deliver 50-point rate cut in September to avert recession," says Nigel Green, CEO of deVere Group. "Consumer confidence is wobbling, spending is slowing, and corporate earnings are under threat. The Fed cannot afford to tiptoe around these warning signs with a cautious 25-point cut. It’s simply not enough."

However, Rogier Quaedvlieg, an economist at ABN AMRO Bank says despite the relatively dovish tone, he continues to expect a 25bp cut as the overall picture continues to allow for a gradual easing cycle.

He says to expect ongoing volatility as markets flip between expectations for a 50bp or a more modest 25bp move, particularly given there is still another set of inflation and job data numbers to consider before the September decision.