Barnier Falls, But New Euro Lows Prove Elusive

- Written by: Gary Howes

File image of Michel Barnier. Source: EPP. Accessed and licensing: European People's Party on Flickr.

Euro exchange rates are proving resilient despite France entering unchartered waters following the eviction of its Prime Minister Michel Barnier.

Barnier lost a censure vote in France's National Assembly after opponents on his political right and left joined forces to vote his government down.

The right-wing RN party of Marine Le Pen voted with a bloc of leftist parties to vote Barnier out after he could not pass a finance bill that was required to put the country's finances on a stable footing.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

President Emmanuel Macron is expected to appoint a new Prime Minister at 8PM Paris time. However, the new incumbent will face the same political schims in the Assembly that his predecessor faced.

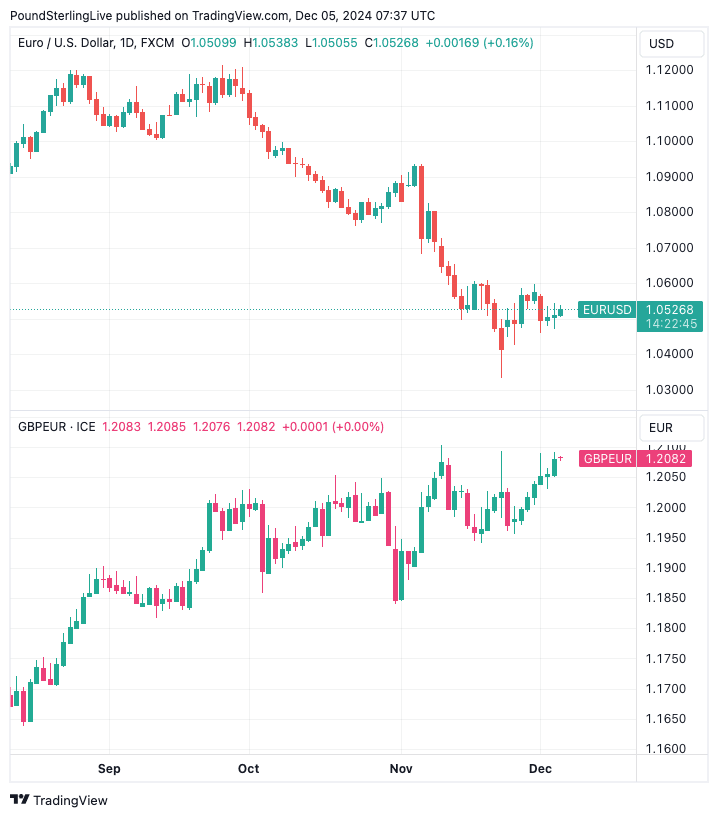

The Pound to Euro exchange rate on Wednesday recorded its highest daily close since March of 2022 at 1.2081.

However, the 2024 high of 1.21 is still proving elusive, even if it is close at hand.

In fact, the Euro is proving resilient in the face of French political intrigue, with the Euro-Dollar exchange rate trading a quarter of a per cent higher on Thursday at 1.0536.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

FX price action confirms Barnier's ouster was well anticipated and in the price of Euro exchange rates, and it will take fresh developments to trigger fresh lows.

"The result was broadly expected, so it’s little surprise that markets haven’t seen much of a reaction. Indeed, since Marine Le Pen’s announcement on Monday that her party would vote against the government, it was clear that the numbers were there to remove the government, so that was when the biggest market reaction took place," says Henry Allen, a strategist at Deutsche Bank.

A broader pullback in the Dollar followed a softer-than-forecast U.S. services PMI release on Wednesday, which is also flattering the Euro.

Euro weakness remains the path of least resistance.

France will nevertheless remain the focus for financial markets ahead of Friday's U.S. jobs report.

France's parliament remains deeply divided; the earliest Macron can call an election is in July. This means his next pick of Prime Minister will face the same parliamentary calculus as Barnier faced.

"Any new administration faces the same issues: a minority government that needs to find common ground to address unsustainable public finances in a heavily divided parliament," says Mathias Van der Jeugt at KBC Bank.

He explains that although the decision was widely expected and, as such, left little trace on the euro intraday. "But ongoing political uncertainty (including in Germany) obviously doesn’t help clear the cloudy skies circling over the currency."

Despite French uncertainty, France's debt costs have yet to rise to crisis levels. They can come down once Barnier is removed and the caretaker government settles into its role.

This is because Eurozone countries enjoy the privilege of having the mighty European Central Bank (ECB) acting as a backstop that will ultimately buy French government bonds in a crisis.

TS Lombard analyst Davide Oneglia says France extracts an "exorbitant privilege" from being a member of the Eurozone.

"The ECB has come a long way since the GFC: now it has the tools (TPI), the template (UK Gilt crisis) and the motive (protect repo markets) to stem a market rout," he says.

This means France will avoid an unruly deterioration in its debt dynamics.

It also means French politicians can continue playing their games and avoid having to take the necessary hard decisions to put the country's finances on a sustainable footing.

So although a full-blown debt crisis is unlikely, French uncertainty will limit the Euro's potential to advance, meaning the path of least resistance remains lower.