Targets for Pound to Euro Exchange Rate

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling retains an upward bias favouring patience for those looking to buy euros, say technical analysts at leading investment banks.

However, Tanmay Purohit, technical analyst at Société Générale, says "a brief" dip is likely for the Pound to Euro exchange rate (GBP/EUR).

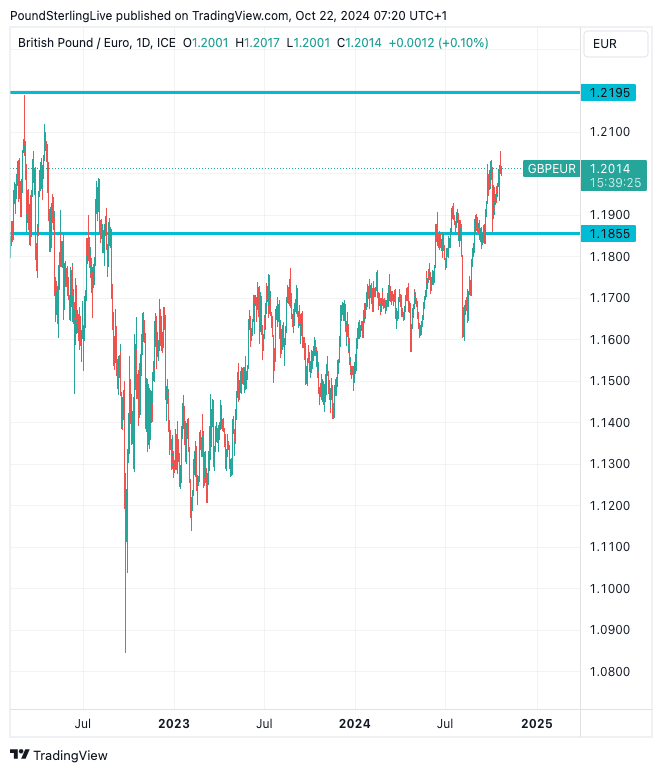

According to his latest technical analysis, a pullback is possible near current levels, but the exchange rate remains in an uptrend as long as the pullback remains above the pivot low of 1.1855.

Those watching the GBP/EUR should remember this level as the analysis says a breach below here suggests "a meaningful" down move would be underway for GBP vs. the EUR.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

That said, Purohit is constructive Pound Sterling, noting it has witnessed eight consecutive months of gains, indicating a robust upward trend against the Euro.

According to the Soc Gen analyst, a key resistance zone that some euro buyers might target resides in the 1.2128/1.2195 region.

He explains this is a "key" resistance zone.

Above: GBP/EUR at daily intervals with some key levels mentioned in the text.

Traders at Goldman Sachs are biased to play the EUR weakness via EUR/GBP shorts, which is trader parlance for saying they are sellers of the Euro and buyers of the Pound.

Analysts at the Wall Street bank note UK retail sales data from last week suggest that the growth backdrop in the UK remains firm.

"Given its pro-cyclical tendencies, and the fact the market has now all but shifted to price in 25bps at the Nov and Dec meetings, we continue to expect GBP to outperform on a relative basis," says a note from Goldman Sachs.

Traders at JP Morgan were looking for a bigger selloff in the Pound following last week's UK inflation report, as the notable 'long' positioning on the currency was at risk of unwinding.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

But, the strength of the Pound following the release caught them by surprise.

"In hindsight, one needed to be mindful that a very large proportion of the GBP length that dominates so many a conversation is against EUR - it certainly is in our franchise," says a note from the desk.

"We still like the currency and want a larger dip to re-engage in a more medium-term sense," it adds.

JP Morgan traders are watching for a EUR/GBP decline to 0.8280 and then 0.8245 ahead of eight-year lows at 0.8200/05.

This would equate to a rise in GBP/EUR to 1.2077 and then 1.22.