Today's Best Euro Exchange Rates for Transfers, Holiday Money and Currency Cards

- Written by: Sam Coventry

Photo by: Sanziana Perju / ECB.

The Pound has fallen against both the Euro and Dollar during September, lowering purchasing power for those looking to send money or secure cash for their holidays.

The spot - or market exchange rate - is 1.1865, which means the rate offered to retail buyers will now be in a range of approximately 1.1810 to 1.1330.

Our price feeds show that the best euro exchange rate for those sending money is at approximately 1.1820 with providers such as Horizon Currency (zero fees) and Wise (note that although Wise offers the market price, it charges a fee that effectively lowers the exchange rate.

Rates on holiday cash buys are closer to 1.1652 at the most competitive providers (TravelFX), but a currency card can offer a rate close to 1.1820.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Although Sterling has lost some altitude, it remains 2024's best-performing major currency, having been spurred on by the expectation that the UK's interest rates would remain above those of other major economies for some time.

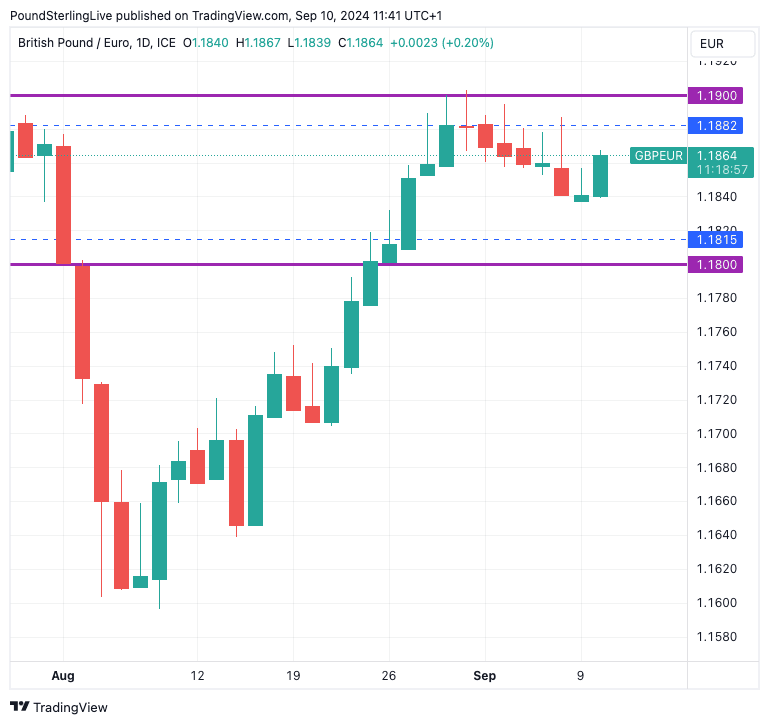

However, the rally higher has stalled as a technical resistance at 1.19 combines with weaker global stock markets to push GBP/EUR back below into the mid-1.18s.

"Our clients are asking if that's it," says Louisa Ballard, Director at Horizon Currency. "A Pound-Euro rate above 1.19 looks like a stretch for now, but we are still looking at great rates from a historical perspective: We last saw these levels in late July, and before that, we had to go back to 2022."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Despite a tough September for euro buyers, the British Pound rose against the Dollar, Euro and other G10 currencies following the release of UK job and wage data on Tuesday that showed no concerning deterioration in the labour market.

The Pound to Euro exchange rate rose to 1.1847 in the minutes after the ONS said the UK added 265K jobs in the three months to July, exceeding estimates for 123K, in what amounts to the biggest increase since May 2022. The unemployment rate fell to 4.1% from 4.2%.

Wages data met expectations at 5.1%, but when bonuses were included in the measure, the reading of 4.0% was a shave lower than the estimate for 4.1%.

"Another set of positive UK employment data has helped the pound gain a few pips against both the euro and the dollar," says Achilleas Georgolopoulos, Investment Analyst at XM.com. "Coupled with the recent positive PMI surveys and good news for the housing sector, the UK economy seems to be performing better than anticipated."

For those selling euros and buying pounds, Citibank's currency trading desk has some advice, telling its clients to lock in the recent gains in EUR/GBP and "anticipates a gradual move lower."

"Recent economic developments (UK robust performance vs German slowdown) should continue to indicate downside," says a note from Citi, released Thursday.

That said, traders at the bank acknowledge much of this negative outlook is already priced and for a more significant move lower, be on the lookout for a close below 0.8383.

The broader trend for the Pound still remains higher, and a break above 1.19 in GBP/EUR remains possible in Autumn. "A break below 0.8383 would open up further downside towards support in the 0.8200-0.8250 range," says Citi. For those watching Pound-Euro, this equates to a move higher to 1.21-1.22.

"The UK is rebounding from last year’s technical recession and services inflation remains sticky. The Bank of England could cut less than its peers and soon offer the highest rates in the G10," says David Alexander Meier, an analyst with private bank Julius Baer in Zurich.

As global investors tend to send their money where returns are higher, the Pound can benefit as inflows into UK interest rate-based assets stay elevated. This is particularly relevant for the Pound to Euro exchange rate, as the UK's interest rates are set to remain notably higher than those in the Eurozone.

"UK interest rates have peaked, but rate differentials with European peers will widen, benefiting the GBP," says Meier.

And it won't be until 2025 that the Pound comes under pressure, according to the Julius Baer analyst. "Longer term, structural issues and fiscal headwinds suggest that the best of the recovery is over."