Jump in Employment Bolsters the Pound

- Written by: Gary Howes

Image © Adobe Images

The British Pound rose against the Dollar, Euro and other G10 currencies following the release of UK job and wage data that showed no concerning deterioration in the labour market.

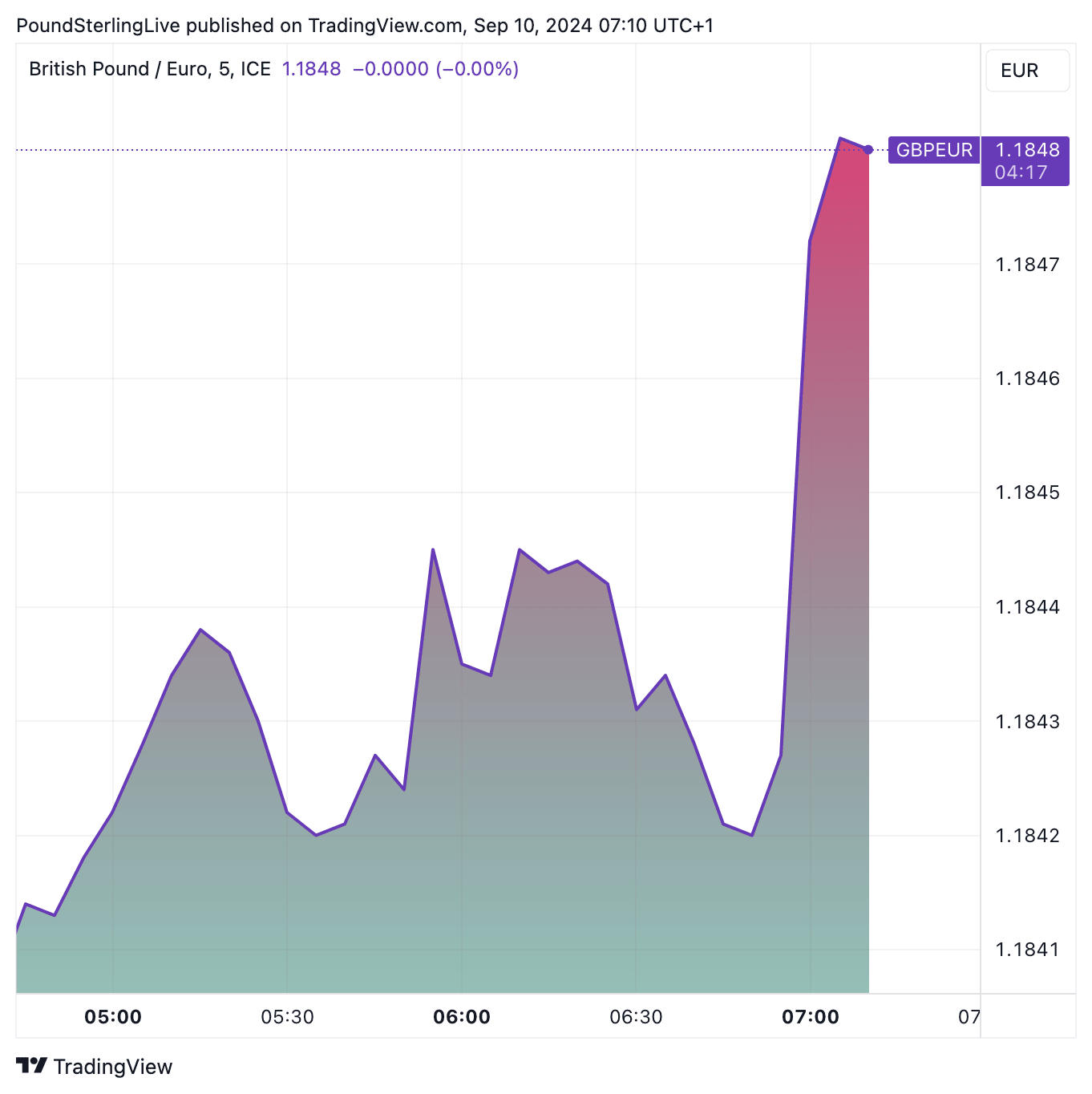

The Pound to Euro exchange rate rose to 1.1847 in the minutes after the ONS said the UK added 265K jobs in the three months to July, exceeding estimates for 123K, in what amounts to the biggest increase since May 2022. The unemployment rate fell to 4.1% from 4.2%.

Wages data met expectations at 5.1%, but when bonuses were included in the measure, the reading of 4.0% was a shave lower than the estimate for 4.1%.

"Another set of positive UK employment data has helped the pound gain a few pips against both the euro and the dollar," says Achilleas Georgolopoulos, Investment Analyst at XM.com. "Coupled with the recent positive PMI surveys and good news for the housing sector, the UK economy seems to be performing better than anticipated."

The Pound to Dollar exchange rate rose to 1.3082 but ultimately remains under pressure owing to the broader rally in the USD that has been underway this September.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The wage and employment report underscores the robust nature of the UK economy and verifies market expectations that the Bank of England will leave interest rates unchanged next week. "Labour market loosening? Employment has now risen for the last three months, the 3-month rolling average moving up from -157k in April to +127k in July, a change in trend that will give hawks on the BoE ammunition to oppose faster rate cuts," says Kenneth Broux, a strategist at Société Générale.

Economists expect the next rate cut to come in either October or November: bigger picture? the Bank will move slowly owing to the still elevated levels of wages that will help inflation rise over the coming months.

"Incoming data suggests stubbornly high underlying inflationary pressure, and sticky wage growth – which poses upside risks to medium-term inflation – is likely to keep rate cuts at a more gradual pace than for the ECB and Fed, even into next year," says Georgette Boele, Senior FX Strategist at ABN AMRO. As a result, "we expect sterling to outperform the dollar and the euro in our forecast horizon," she adds.

Above: GBP/EUR rose in the minutes following the UK job and wage report.

Michael Brown, Senior Research Strategist at Pepperstone, says a September Bank Rate cut remains off the cards following these days. He explains that quarterly 25bp cuts remain his base case, with said cuts likely delivered in conjunction with the Bank's updated economic forecasts, hence leaving the November meeting on the table for the next, and likely final, cut this year.

"Such an outlook, of course, is somewhat more hawkish than that foreseen from the ECB, and from the FOMC, where a 50bp September cut remains a possibility. Consequently, this divergence could help to underpin the GBP over the medium-term, against both the EUR and the USD," he explains.

Soc Gen's Broux points out that public sector pay is running at 5.7% and although private sector pay decelerated to 4.9% from 5.3%, it remains too high, "especially with the economy having a new spring in its step."

Market pricing shows investors see fewer than two interest rate cuts before year-end, which is validated by the nature of incoming days. Boroux says this "puts UK bond yields and the pound at an advantage relative to the USD and the Euro barring a correction in risk assets and another volatility shock."