GBP/EUR Week Ahead Forecast: At Risk of Deflation if Inflation Disinflates

- Written by: Gary Howes

Image © Adobe Images

The Pound to Euro exchange rate hit a new two-year high at 1.1920 on Monday, but inflation, wage and retail sales data will determine whether this hot streak extends.

Pound Sterling outperformance means it stands at the top of the G10 currency basket for 2024 thanks to a trifecta of developments: 1) improving domestic data, 2) a retreat in Bank of England rate cut expectations and, 3) improved political sentiment.

"The GBP currently has the strongest upward momentum amongst G10 currencies. The UK election result has created a more favourable backdrop for the GBP. The large majority for Labour should ensure a period of much needed political stability in the UK," says Lee Hardman, an analyst at MUFG Bank Ltd.

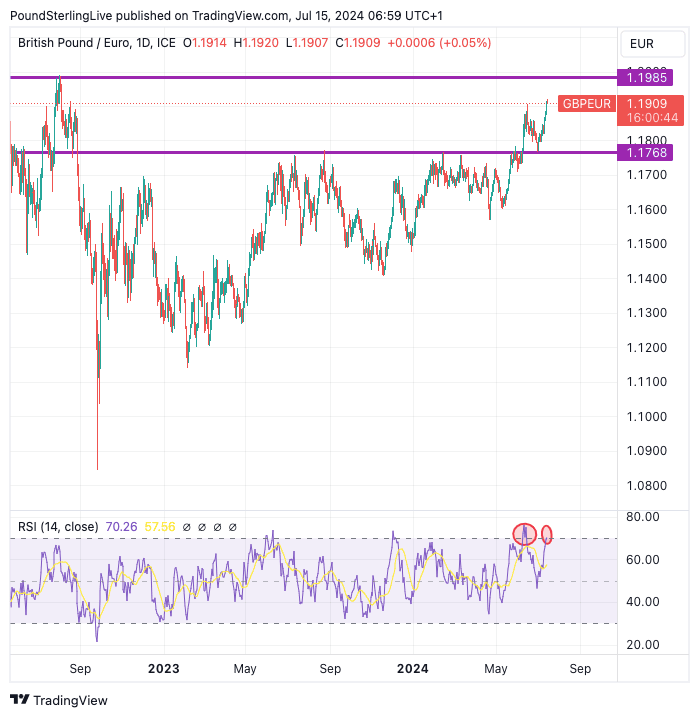

If this week's inflation and wage figures are supportive, we forecast Pound-Euro to hit a target of 1.1985 in the coming days. If data undershoot, a pullback to our downside forecast target at 1.1768 is possible (more on this below).

A note of caution to those buying euros: last week's strong run means the daily RSI reading has kissed 70, which means it is now overbought. We should expect a pullback and consolidation to emerge soon, as this would allow the RSI to recalibrate below 70.

Above: GBP/EUR at daily intervals with potential upside and downside targets. The RSI in the lower panel is now at overbought (circled in red) and this could mean a pullback is warranted in the near future. Track GBP/EUR with your custom alerts; find out more here.

Overbought conditions could mean Pound Sterling is particularly exposed to disappointing data. "UK CPI and labour data could shift market sentiment and extend or dent GBP rally," says Jeavon Lolay, Head of Markets Insight at Lloyds Bank.

Wednesday's inflation print will be followed by Thursday's wage figures, which will settle the question of whether the Bank of England will cut interest rates on August 01.

"We are still holding on to our call for an August rate cut, but another upside surprise for services inflation and/or wages would challenge our view and encourage a further strengthening of the GBP in the week ahead," says Lee Hardman, an analyst at MUFG Bank Ltd.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Services inflation is expected to read at 5.6% and headline CPI inflation is forecast to read at 2.0%. Any undershoot would raise the odds of an August 01 rate cut and send an overbought Pound-Euro sharply lower.

Analysts at Oxford Economics reckon the headline CPI inflation print will land at 1.8%, an outcome that would represent a decent undershoot and prompt a selloff in the Pound.

"Considering the GBP has been the best performing G-10 currency QTD, we think it remains prone to a larger correction if CPI print comes in lower than expectations," says Daragh Maher, Head of FX Strategy at HSBC.

However, the sell-off in the Pound would be limited because the Bank of England will find it difficult to cut aggressively if the economy continues to perform robustly, something a number of economists said was likely following last week's GDP release.

Regarding the wage numbers on Thursday, the expectation is for average weekly earnings to have increased 5.8% over the year to June. Anything below here would result in GBP selling.

For both key data releases, we forecast Pound-Euro weakness to be limited to 1.1768.

Charu Chanana, Head of FX Strategy at Saxo Bank, says GBP could be vulnerable if data suggested further possibility of a rate cut. However, he thinks medium-term dynamics are still ultimately supportive of the Pound:

"It is also worth noting that any rate cut in the UK is likely to come from inflation dynamics cooling, rather than any demand-side concerns. This continues to bode well for Sterling, despite near-term risks. As such, sterling could remain one of the cyclical beneficiaries of US dollar weakness in the next few weeks."

The Euro will be in focus on Thursday at midday when the European Central Bank makes its latest policy decision.

No change to interest rates will be made, but markets will want to know whether the Bank will cut again in September. Should the ECB signal such a move, the Euro can come under pressure.

However, the Bank is expected to maintain a data-dependent approach, which means it will keep its guidance as noncommittal as possible.

"We would not expect any explicit guidance of a September rate cut. Rather, a soft guidance, signally that September is a possibility. At the time of writing, markets are pricing in an 80% chance of a rate reduction in September, so guidance hinting at such a step should not make much of a splash," says Nick Kounis, an economist at ABN AMRO Bank.