GBP/EUR Rate Eyes Strongest Weekly Finish in Two Years, But a Risk-filled Week Looms

- Written by: Gary Howes

Image © Pound Sterling Live

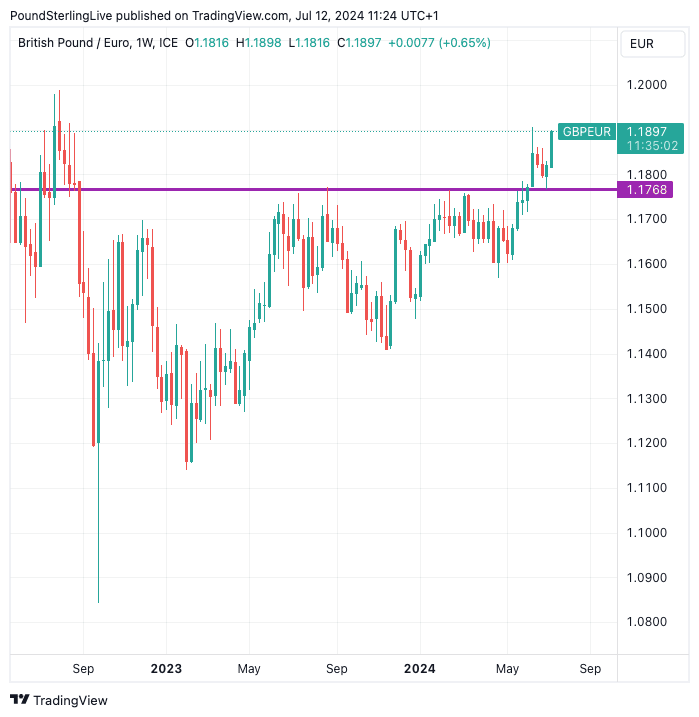

The Pound to Euro exchange rate (GBP/EUR) is looks set to record its highest weekly finish in two years, but recent gains would be reversed if next week's employment and inflation data undershoots.

GBP/EUR is quoting shy of 1.19 at present, and a close anywhere above 1.1855 would be the highest ending to any week since July 2022.

The gains signify the tailwinds behind Pound Sterling as we move into the early stages of the second half of 2024. In fact, Sterling is the top-performing G10 currency of 2024 thanks to the recent retracement in the U.S. Dollar amidst rising expectations for a September interest rate cut at the Federal Reserve.

Above: GBP/EUR at weekly intervals. Track GBP/EUR with your custom alerts; find out more here.

"The pound has outperformed all its major peers this year on expectations the BoE will have to keep interest rates at 16-year highs for longer due to the surprisingly robust economic recovery, and lingering concerns about stubborn services inflation and wage pressures," says George Vessey, Senior FX Strategist at Convera.

The UK economy expanded (0.4%) in June, doubling the rate expected by economist, meaning the second quarter is on course to register a solid 0.7% advance.

Some economists think that by the end of the year, the UK will have registered a 1.5% annual increase in G10, which would put it near the top of the G7 league.

The Pound's recent gains also reflect a paring back in expectations for a Bank of England rate cut on August 01. Bank of England Chief Economist Huw Pill said this week that the timing of a first rate cut was still in question owing to stubborn levels of service sector inflation.

Market-implied odds are now crystalising around a September start date.

"This bodes well for the pound’s outlook, which is also supported by optimism the newly-elected Labour government will bring a period of political calm and a steady approach to the nation’s finances," says Vessey.

We reported earlier this week that Barclays raised its forecasts for the Pound to Euro exchange rate, with analysts saying closer ties with the EU under Labour will yield further gains.

The Pound's 0.66% advance against the Euro over the past five days comes ahead of a risk-filled week, which means some recent gains could be reversed.

Wednesday is a big day for the UK as the latest set of inflation numbers are due. Inflation is expected to hover around 2.0%, but this is not what the market will be reacting to.

As mentioned by Pill, the inflation rate of the services sector matters. Because it is running closer to 6.0% there is only a prospect of a sustained easing in the headline rate to 2.0% if it comes down.

It is because of elevated services inflation that the Bank and institutional economists think inflation will steadily rise over the remainder of the year.

Therefore, a below-consensus service inflation print will reignite bets for an August rate cut and we anticipate a sharp retracement of the Pound's recent gains.

Further risks come on Thursday when the UK releases its latest labour market figures. Here, the headline wage rate counts. High wages are why services inflation is so high. Therefore, a softening in wages will signal that further disinflation is in the pipeline, which could also give the Bank of England reason to pull the trigger.