GDP Boosts Pound to Multi-month Highs against Euro and Dollar

- Written by: Gary Howes

The services sector continues to drive the UK economy. Image © Adobe Images

Pound Sterling rose after the UK's GDP rose more than expected in May, lessening the odds of an interest rate cut on August 1.

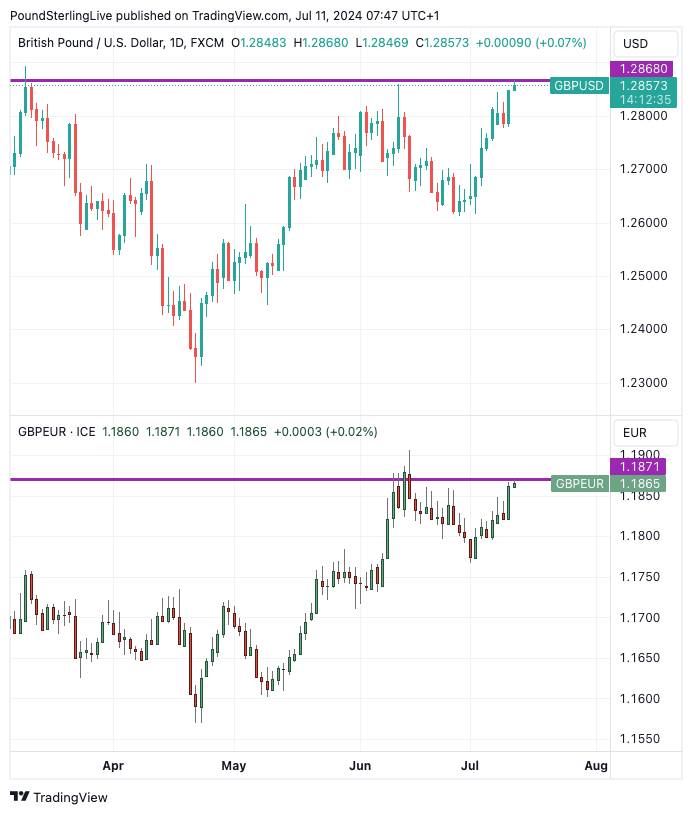

The Pound to Euro exchange rate rallied to a one-month high, and the Pound to Dollar exchange rate reached a four-month high after the ONS said UK GDP rose 0.4% month-on-month in May.

This more than doubled the consensus estimate for 0.2% growth while eclipsing April's flat 0% reading. The growth came from services, the largest sector of the UK economy, where output grew by 0.3% in May 2024.

"GDP numbers have given markets another reason to support GBP," says Thanim Islam, Head of FX Analysis at Equals Money. GBP/USD is quoted at 1.2863, taking it above the median forecast of over 30 investment bankers, and GBP/EUR is quoted at 1.1867, which is also above the median forecast.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

This means the UK economy grew by 0.9% in the three months to May 2024 compared with the three months to February 2024, driven by a growth of 1.1% in services output.

These data are consistent with an ongoing robust economic recovery in the UK, lessening the need for the Bank of England to step in and offer support via an interest rate cut.

"The question for the MPC is whether they can cut rates in August with growth perhaps registering two back-to-back quarter-to-quarter gains of 0.7%," says Rob Wood, Chief UK Economist at Pantheon Macroeconomics.

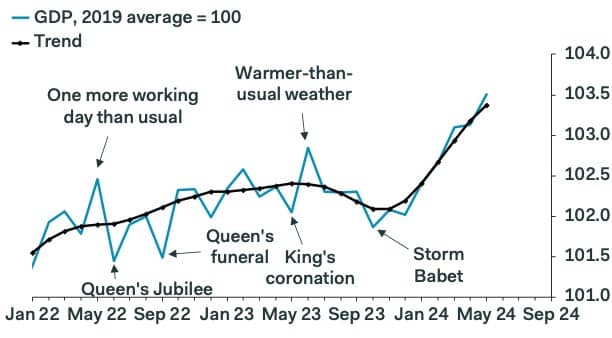

Image courtesy of Pantheon Macroeconomics.

The strong data and output in the services mean inflation in this sector will likely remain high. The Bank of England's Chief Economist, Huw Pill, said Wednesday that he remained watchful of services inflation.

Pill told an audience in London that interest rates would come down, but the timing remained uncertain.

The Pound rose following Pill's comments as investors lowered the odds of an August 01 rate cut at the Bank of England to less than 50%.

Above: GBP/USD (top) and GBP/EUR. Track GBP with your own alerts, find out more here.

"The pound was yesterday’s main gainer as remarks by BoE Chief Economist Huw Pill poured cold water on expectations of an August rate cut. Pill said that services and wage inflation remain uncomfortably high despite headline inflation hitting the BoE’s target of 2% in May, adding that June’s prints are unlikely to change the picture," says Charalampos Pissouros, Senior Investment Analyst at XM.com.

Thursday's GDP numbers will push back expectations even further, and this decline in expectations is helping Pound exchange rates rise.

"Rate-setters look desperate to ease policy and said in the minutes of their June meeting that they were unconcerned about stronger-than-expected growth. Even so, this latest upside growth surprise supports our call that the MPC will wait until September to reduce Bank Rate," says Wood.

The rise in GDP in May was the fourth increase in the past five months. Ashley Webb, UK Economist at Capital Economics, says this supports the idea that the dual drags on activity from higher interest rates and higher inflation are starting to fade.

Capital Economics thinks GDP in the second quarter is now on track to record a 0.7% q/q increase, matching that of the first quarter.

Importantly, this is above the Bank of England's forecast. "At the margin this may mean the Bank doesn’t need to rush to cut interest rates," says Webb.

Capital Economics thinks the Bank will still cut rates on August 01. However, "the timing of the first cut will be heavily influenced by June’s inflation and May’s labour market data releases next week," says Webb.