UK Economic Growth Forecasts Updated: 1.5% y/y Now on the Cards

- Written by: Sam Coventry

Image © Adobe Images

The UK economy is forecasted by economists to maintain its positive momentum through the second half of the year.

This is after the ONS said the economy expanded 0.4% month-on-month in May, doubling the consensus expectation.

"The UK has now experienced a run of five consecutive months of non-negative GDP prints – an outcome last achieved in early 2021," says Nikesh Sawjani, an economist at Lloyds Bank.

The services sector remains the engine of growth, with economists saying the majority of the hit from the Bank of England's interest rate hiking cycle has now fed through; at the same time, inflation has fallen, resulting in strong real terms pay increases.

"The strong increase left the economy on track to register another solid quarter of growth in Q2, following the 0.7% q/q rise seen in Q1. For context, even if June GDP is flat or -0.1% m/m, that would still be enough to deliver growth of 0.6% q/q in the second quarter," says Sawjani.

For context, the Bank of England's second-quarter GDP forecast is for 0.5%.

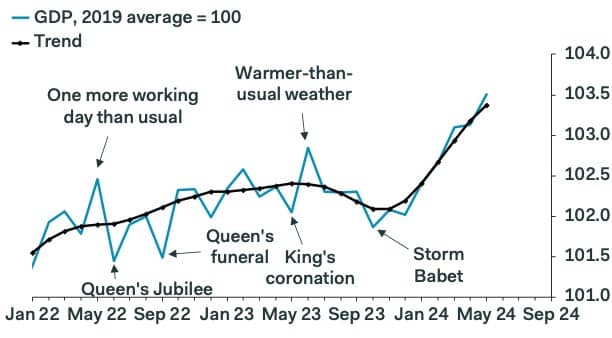

Image courtesy of Pantheon Macroeconomics.

"The question two months ago was whether growth would reach 1.0% this year. It is now possibly whether it will hit 1.5%. Indeed the recovery in the economy has now become more entrenched," says Philip Shaw, an economist at Investec.

Investec's base case is that the Bank of England cuts interest rates on August 01 but acknowledges the call is now more finely balanced in light of these strong growth data, which could 'tighten' the labour market.

Capital Economics thinks GDP in the second quarter is now on track to record a 0.7% q/q increase, matching that of the first quarter.

Berenberg Bank says UK GDP will likely "continue to rise nicely in H2".

"Consumer price inflation is back at the 2% target and consumers’ real disposable incomes are rising. And while inflation will likely drift up slightly again towards 2.5% yoy by the end of the year, in our view the Bank of England will loosen the monetary reins, starting with a first 25bp rate cut on 1 August," says Salomon Fiedler, an economist at Berenberg Bank.

Driving economic expansion is the real wage growth UK workers are experiencing as inflation falls back to 'normal' levels but wages remain at historically elevated levels.

This can support demand, particularly in the dominant services sector.

"The unavoidable conclusion after five month's data is that the economy is faring much better so far in 2024. Decent real wage growth is undoubtedly playing a role," says James Smith, Developed Markets Economist at ING.

ING says second-quarter GDP is on track to rise by 0.5-0.6 after 0.7% growth in the first quarter.

"We’re sceptical that these sort of growth figures can be sustained into the second half of the year, but we expect growth to remain reasonable nevertheless," says Smith.

ING thinks the Bank of England's preference will be to start cutting rates, and economists there expect three cuts in total this year.