GBP/EUR Rate: Levels To Watch on Budget Day

- Written by: Gary Howes

Above: A photograph of the Spring Budget 2024 in No 11 Downing Street. Picture by Kirsty O'Connor/HM Treasury.

The Pound to Euro exchange rate has edged above 1.17 in the run-up to the budget announcement and could remain well supported if any meaningful stimulus is announced.

Joe Tuckey, Head of FX Analysis at Argentex, says it is normal for the Budget not to induce any real currency volatility, but the 'muscle memory' of the Truss / Kwarteng horror show could still create a 'twitch'.

"If the Gilt market gets a sniff of any tax cut pledge being unworkable, we could see sterling trade nervously, even to the extent of a 200-pip knee-jerk move," he says.

Pound Sterling and UK bonds cratered in September 2022 when newly installed Prime Minister Liz Truss attempted to push through sweeping tax cuts and spending commitments without regard to the outlook for UK finances.

"This time is different, and things ought to remain much calmer this year," says Shreyas Gopal, Strategist at Deutsche Bank. "Not only is the current account in a better position, but the Bank of England are no longer seen as a dovish outlier, providing the pound with adequate yield support."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

According to the Resolution Foundation, falling interest rates (linked to falling bond yields) are likely to increase the room for fiscal manoeuvre by around £13BN. Reports say about £10BN of this will be spent on a 2p cut to the National Insurance contribution rate employees pay every month.

Such a stimulus could increase expenditure, which would boost the economy but risks creating the demand that keeps inflation higher for longer.

As such, it could give the Bank of England reason to maintain interest rates at 5.25% for an extended period. All else equal, this is supportive of the Pound, according to analysts.

Above image courtesy of Deutsche Bank. Track GBP/EUR with your own custom rate alerts. Set Up Here

"On the sterling positive side of the ledger, the announcement of looser fiscal policy is pro-growth and could be a sterling positive, partly in that it would be reinflationary (thus helping to delay rate cuts)."

Tuckey says positive risk sentiment and the possibility of new stimulus measures from China could also act as further tailwinds to sterling and the euro.

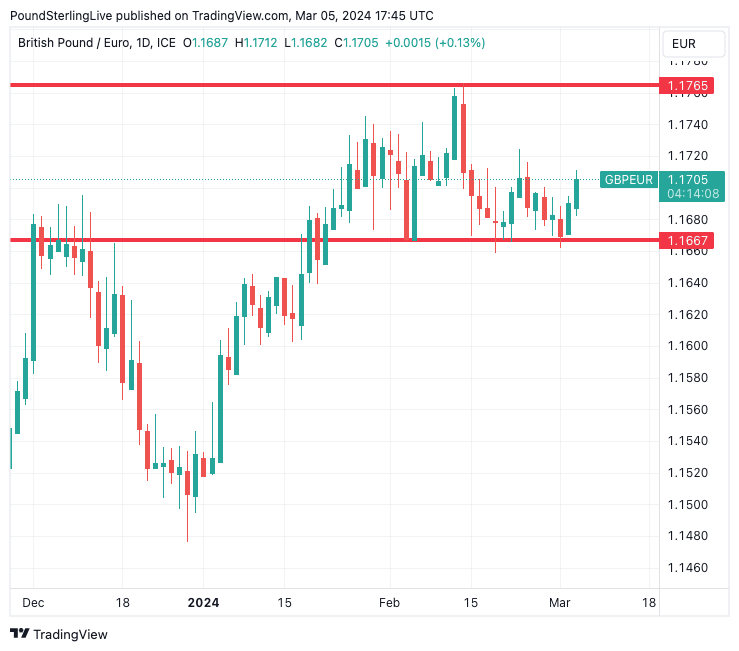

Regarding the Pound to Euro exchange rate's potential targets, Tuckey looks for price action to remain within the bounds of the pair's longer-term consolidation.

"There is major resistance at 1.1740 and 1.1770 to the upside, which is likely to remain for the foreseeable future, in our view. In the near term, there is support at 1.1667, a level from December 2023 which was used by the market in recent declines as seen several times of late. It held once again last week. If price action breaks through this level, a test of 1.1640 is likely, with long-term support at 1.1580 still in play," he says.

Above: Key levels to watch in GBP/EUR.

The next event risk for the Pound-Euro exchange rate comes just 24 hours later when the March European Central Bank (ECB) meeting lands.

Tuckey is not looking for major market moving developments as the ECB looks set to keep rates on hold and continue to guide that it is too soon to expect interest rate cuts.

"While the interest rate shall remain unchanged, Lagarde is very likely to suggest that a few more months of inbound data are required before a rate cut can be executed – with June or later now the expectation. New economic projections will make tweaks, such as lower inflation forecasts or a downward revision to growth, but they are unlikely to ignite any sizeable FX movements," says Tuckey.

These developments would keep Pound-Euro strength capped in the mid-1.17's.